- Taiwan

- /

- Entertainment

- /

- TPEX:3293

3 Asian Dividend Stocks Yielding Up To 7.4%

Reviewed by Simply Wall St

As Asian markets navigate the complexities of global economic trends, including inflationary pressures and monetary policy shifts, investors are increasingly turning their attention to dividend stocks as a source of steady income. In this environment, identifying stocks with strong fundamentals and attractive yields becomes crucial for those seeking reliable returns amidst market volatility.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.98% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.72% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.81% | ★★★★★★ |

| NCD (TSE:4783) | 4.24% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.94% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.97% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.45% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.26% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.52% | ★★★★★★ |

Click here to see the full list of 1003 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

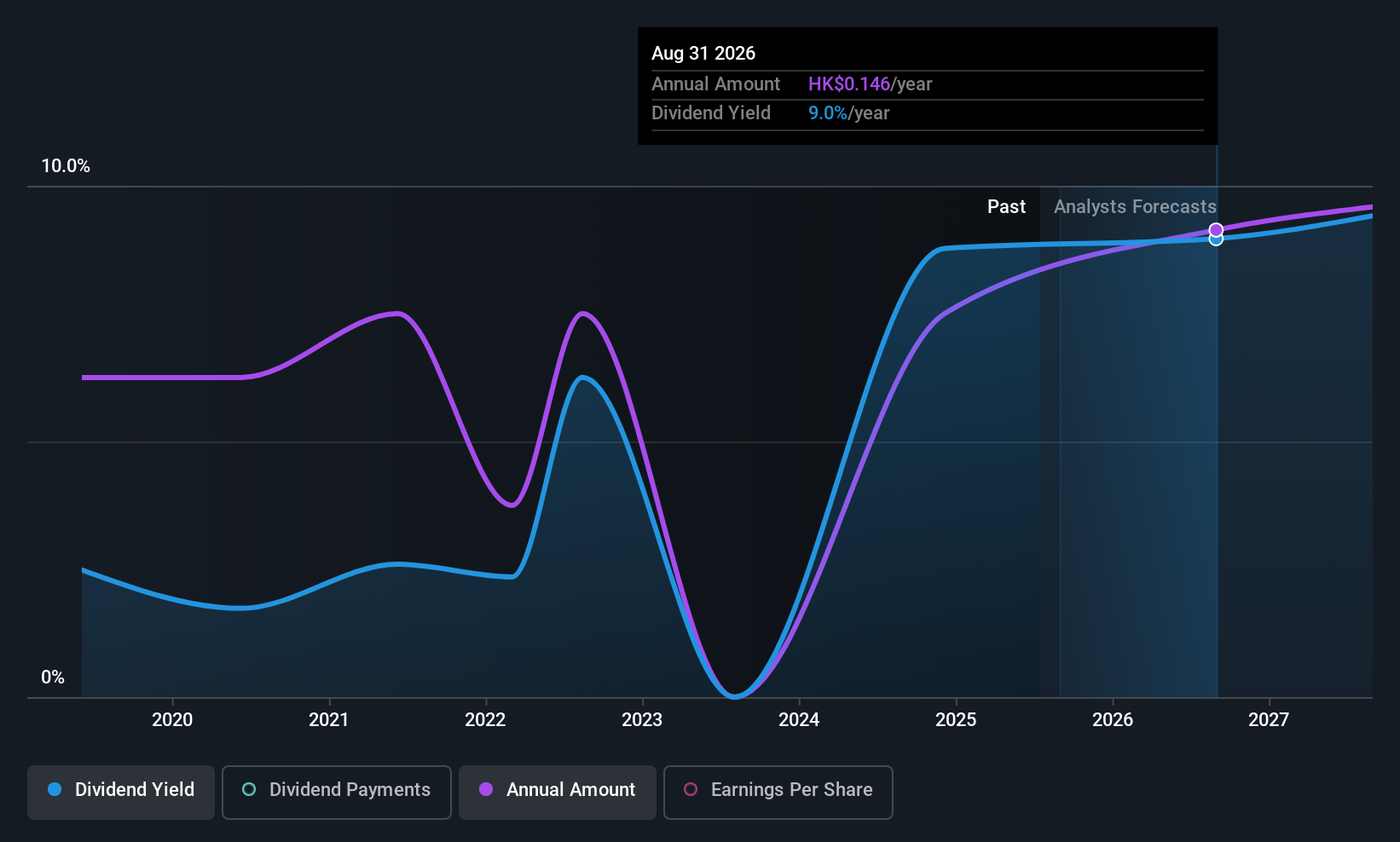

China Kepei Education Group (SEHK:1890)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Kepei Education Group Limited is an investment holding company that offers private vocational education services with a focus on profession-oriented and vocational training in the People’s Republic of China, with a market cap of HK$3.55 billion.

Operations: China Kepei Education Group Limited generates revenue of CN¥1.74 billion from its private vocational education services in the People’s Republic of China.

Dividend Yield: 7.4%

China Kepei Education Group's dividend payments are well-covered by both earnings and cash flows, with payout ratios of 30% and 39.3%, respectively. Despite a high dividend yield of 7.35%, the company has an unstable dividend history, characterized by volatility and unreliability over its six-year payment period. Recent board changes in response to corporate governance amendments may impact future strategic decisions, but the stock remains undervalued at 64.1% below its estimated fair value.

- Click here and access our complete dividend analysis report to understand the dynamics of China Kepei Education Group.

- In light of our recent valuation report, it seems possible that China Kepei Education Group is trading behind its estimated value.

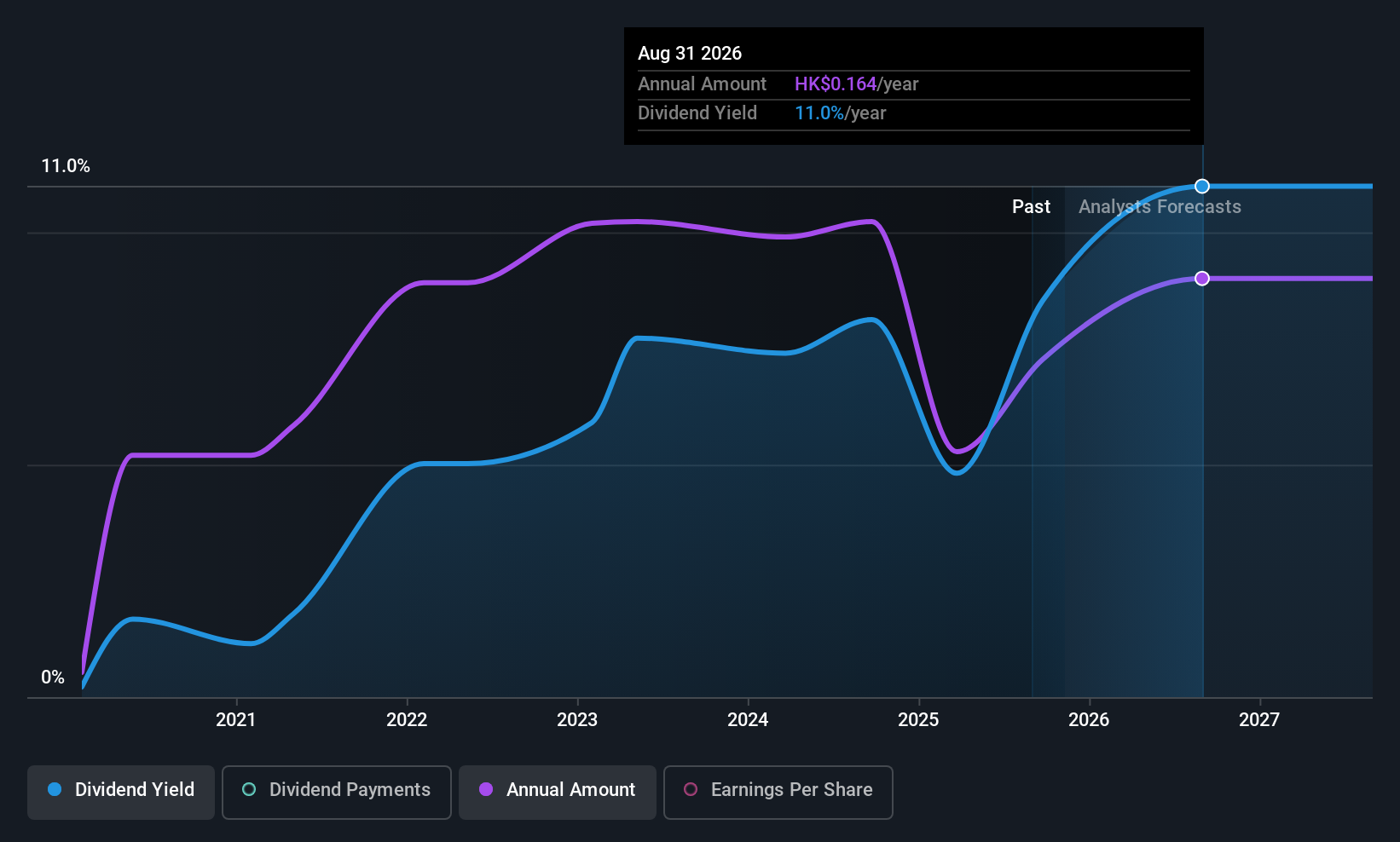

Edvantage Group Holdings (SEHK:382)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Edvantage Group Holdings Limited is an investment holding company that operates private higher and vocational education institutions in China, Australia, and Singapore, with a market cap of HK$2.09 billion.

Operations: Edvantage Group Holdings Limited generates revenue from its private higher and vocational education institutions, with CN¥2.36 billion coming from operations in the People’s Republic of China and CN¥39.90 million from its overseas activities in Australia and Singapore.

Dividend Yield: 7.4%

Edvantage Group Holdings offers a high dividend yield of 7.42%, placing it in the top 25% of Hong Kong's dividend payers, with dividends well-covered by earnings and cash flows due to low payout ratios of 11.3% and 23.1%, respectively. However, its six-year dividend history is marked by volatility and unreliability. Recent collaboration with PurerAir for air quality solutions at Guangzhou Huashang College highlights strategic partnerships but doesn't directly impact its dividend profile.

- Dive into the specifics of Edvantage Group Holdings here with our thorough dividend report.

- The valuation report we've compiled suggests that Edvantage Group Holdings' current price could be quite moderate.

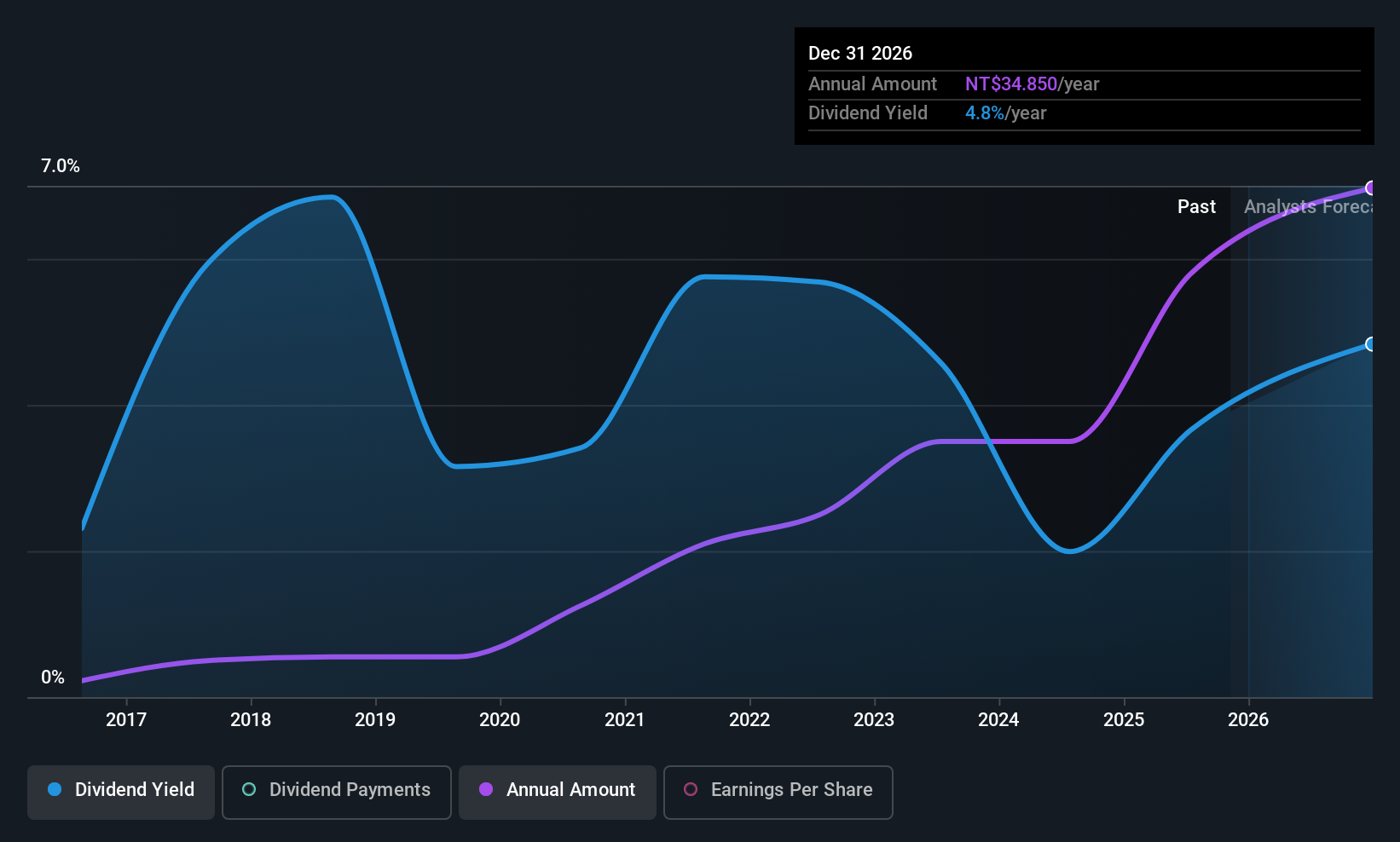

International Games SystemLtd (TPEX:3293)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: International Games System Co., Ltd. engages in the planning, design, research, development, manufacturing, marketing, servicing, and licensing of arcade, online, and mobile games across Taiwan, the United Kingdom, Curacao, and Malta with a market cap of NT$237.56 billion.

Operations: International Games System Ltd generates revenue primarily from its Online Games Division, contributing NT$14.23 billion, and its Business Game Division, which accounts for NT$6.48 billion.

Dividend Yield: 3.4%

International Games System Co., Ltd. has shown consistent earnings growth, with a recent increase in net income and sales. However, its dividend yield of 3.44% is lower than the top tier in Taiwan, and dividends are not well-covered by free cash flows despite being stable over the past decade. The company's recent lease agreement with Prime World International Holdings Ltd. may provide additional revenue streams but does not directly enhance dividend sustainability or yield coverage.

- Delve into the full analysis dividend report here for a deeper understanding of International Games SystemLtd.

- Our comprehensive valuation report raises the possibility that International Games SystemLtd is priced lower than what may be justified by its financials.

Key Takeaways

- Reveal the 1003 hidden gems among our Top Asian Dividend Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3293

International Games SystemLtd

Plans, designs, researches, develops, manufactures, markets, services, and licenses arcade, online, and mobile games in Taiwan, the United Kingdom, Curacao, and Malta.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives