- China

- /

- Auto Components

- /

- SZSE:301535

Unveiling Undiscovered Gems in Asia for May 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing trade tensions and mixed economic signals, small-cap indexes have shown resilience, advancing for the fourth consecutive week. In this environment, discerning investors may find opportunities in Asia's lesser-known companies that demonstrate strong fundamentals and adaptability to shifting market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wuxi Double Elephant Micro Fibre MaterialLtd | 6.32% | 9.86% | 52.64% | ★★★★★★ |

| Hangzhou Fortune Gas Cryogenic Group | 0.01% | 22.78% | 17.11% | ★★★★★★ |

| AOKI Holdings | 27.05% | 3.74% | 52.54% | ★★★★★★ |

| Ampire | NA | -2.21% | 8.00% | ★★★★★★ |

| Yibin City Commercial Bank | 136.61% | 11.29% | 20.39% | ★★★★★★ |

| Praise Victor Industrial | 85.87% | 1.77% | 44.52% | ★★★★★☆ |

| Iljin DiamondLtd | 2.66% | -2.57% | -7.00% | ★★★★☆☆ |

| Kwong Lung Enterprise | 38.83% | -3.82% | 12.53% | ★★★★☆☆ |

| Zhejiang Risun Intelligent TechnologyLtd | 27.20% | 20.33% | -22.82% | ★★★★☆☆ |

| Changzhou Nrb | 54.33% | 10.13% | -28.75% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Cafe24 (KOSDAQ:A042000)

Simply Wall St Value Rating: ★★★★★★

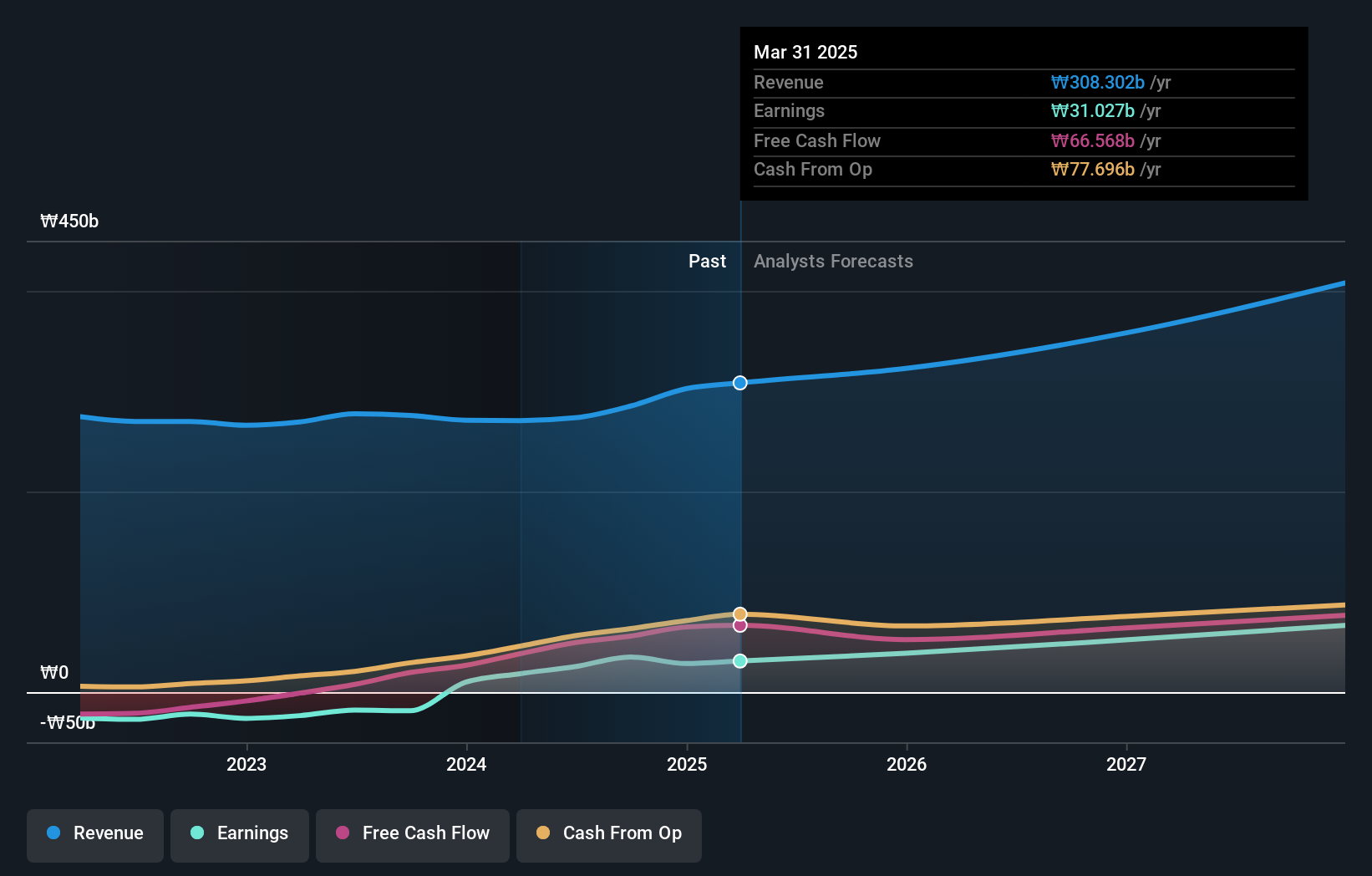

Overview: Cafe24 Corp. operates a global e-commerce platform with a market capitalization of approximately ₩1.61 trillion.

Operations: Cafe24 Corp.'s primary revenue streams include its Internet Business Solution, generating ₩241.14 billion, followed by Transit and Clothing segments contributing ₩44.58 billion and ₩26.24 billion respectively. The company's financial structure also includes consolidated adjustments amounting to -₩9.48 billion, impacting overall revenue figures.

Cafe24, a burgeoning player in the IT sector, has captured attention with an impressive earnings growth of 188.5% over the past year, outpacing the industry average of 8.8%. The company appears financially robust with more cash than total debt and a reduced debt-to-equity ratio from 10% to 1.7% over five years. Despite recent share price volatility, its high-quality earnings and positive free cash flow position it well for future growth, with forecasts indicating a potential annual earnings increase of 36.39%. This mix of strong financial health and promising growth prospects makes Cafe24 noteworthy in its field.

- Click to explore a detailed breakdown of our findings in Cafe24's health report.

Assess Cafe24's past performance with our detailed historical performance reports.

Zhejiang Huayuan Auto Technology (SZSE:301535)

Simply Wall St Value Rating: ★★★★★☆

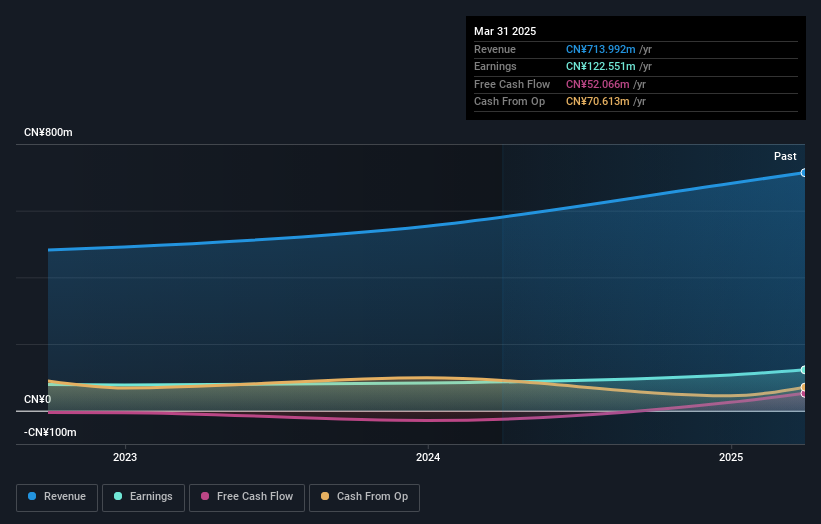

Overview: Zhejiang Huayuan Auto Technology Co., Ltd. specializes in the production of automotive parts and has a market capitalization of CN¥8.66 billion.

Operations: The primary revenue stream for Zhejiang Huayuan Auto Technology comes from its automotive parts segment, generating approximately CN¥714 million.

Zhejiang Huayuan Auto Technology, a small player in the auto components sector, is showing promising growth. Over the past year, its earnings surged by 38%, outpacing the industry's 6.5% rise. The company has more cash than total debt, reflecting strong financial health despite a slight increase in its debt-to-equity ratio from 15.3 to 16.4 over five years. Recent IPO raised CNY 313 million and it was added to key indices like Shenzhen Stock Exchange Composite Index, indicating growing market recognition. First-quarter revenue jumped to CNY 167 million from CNY 136 million last year, with net income rising to CNY 39 million from CNY 23 million previously.

Ton Yi Industrial (TWSE:9907)

Simply Wall St Value Rating: ★★★★★★

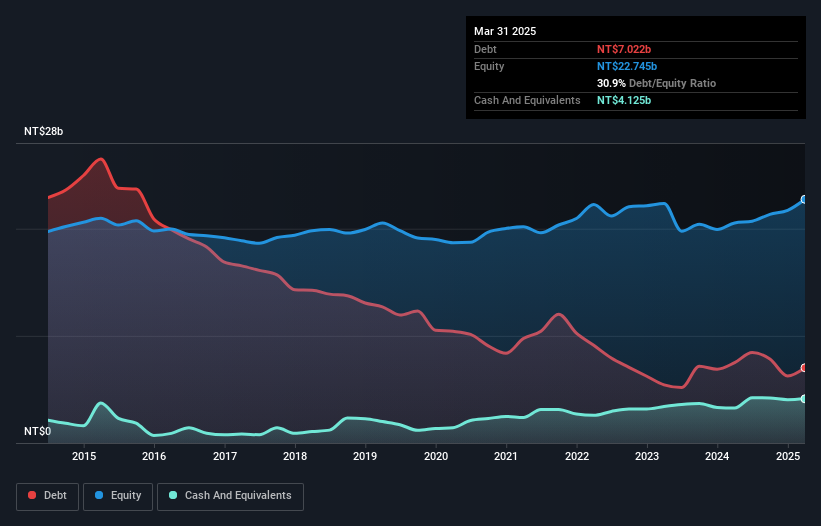

Overview: Ton Yi Industrial Corp. manufactures and sells tin plate packaging materials in Taiwan, Mainland China, and internationally, with a market cap of NT$31.98 billion.

Operations: Ton Yi Industrial generates revenue primarily from the sale of tin plate packaging materials across Taiwan, Mainland China, and international markets. The company's financial performance includes a focus on managing its cost structure to support profitability.

Ton Yi Industrial shines with its robust performance, posting a remarkable earnings growth of 283% over the past year, outpacing the Packaging industry’s 14.5%. The company’s debt to equity ratio has improved significantly from 55.7% to 30.9% over five years, indicating effective financial management. With a price-to-earnings ratio at 15.6x below the Taiwan market average of 18.1x, it presents a compelling value proposition. Recent results show sales climbing to TWD 11,455 million in Q1 2025 from TWD 9,370 million last year and net income rising to TWD 668 million from TWD 153 million previously, reflecting strong operational efficiency and profitability improvements.

- Get an in-depth perspective on Ton Yi Industrial's performance by reading our health report here.

Gain insights into Ton Yi Industrial's past trends and performance with our Past report.

Seize The Opportunity

- Gain an insight into the universe of 2680 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Huayuan Auto Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301535

Zhejiang Huayuan Auto Technology

Zhejiang Huayuan Auto Technology Co., Ltd.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives