In the wake of a "red sweep" in the U.S. elections, major stock indices have rallied, with small-cap stocks like those in the Russell 2000 Index leading gains despite not yet reaching record highs. As investors navigate this dynamic landscape marked by policy shifts and economic indicators such as a strengthening dollar and easing inflationary pressures, identifying promising small-cap stocks can offer unique opportunities for growth. In this context, uncovering undiscovered gems involves looking for companies with strong fundamentals that are well-positioned to benefit from favorable market conditions and potential regulatory changes.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Citra Tubindo | NA | 9.17% | 14.32% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Focus Lighting and Fixtures | 12.21% | 36.42% | 77.11% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Ghitha Holding P.J.S.C (ADX:GHITHA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ghitha Holding P.J.S.C is an investment holding company that provides management and investment services across diversified projects and businesses in the United Arab Emirates, with a market capitalization of AED5.59 billion.

Operations: Ghitha Holding P.J.S.C generates revenue through its management and investment services in diversified projects, with a segment adjustment of AED5.27 billion.

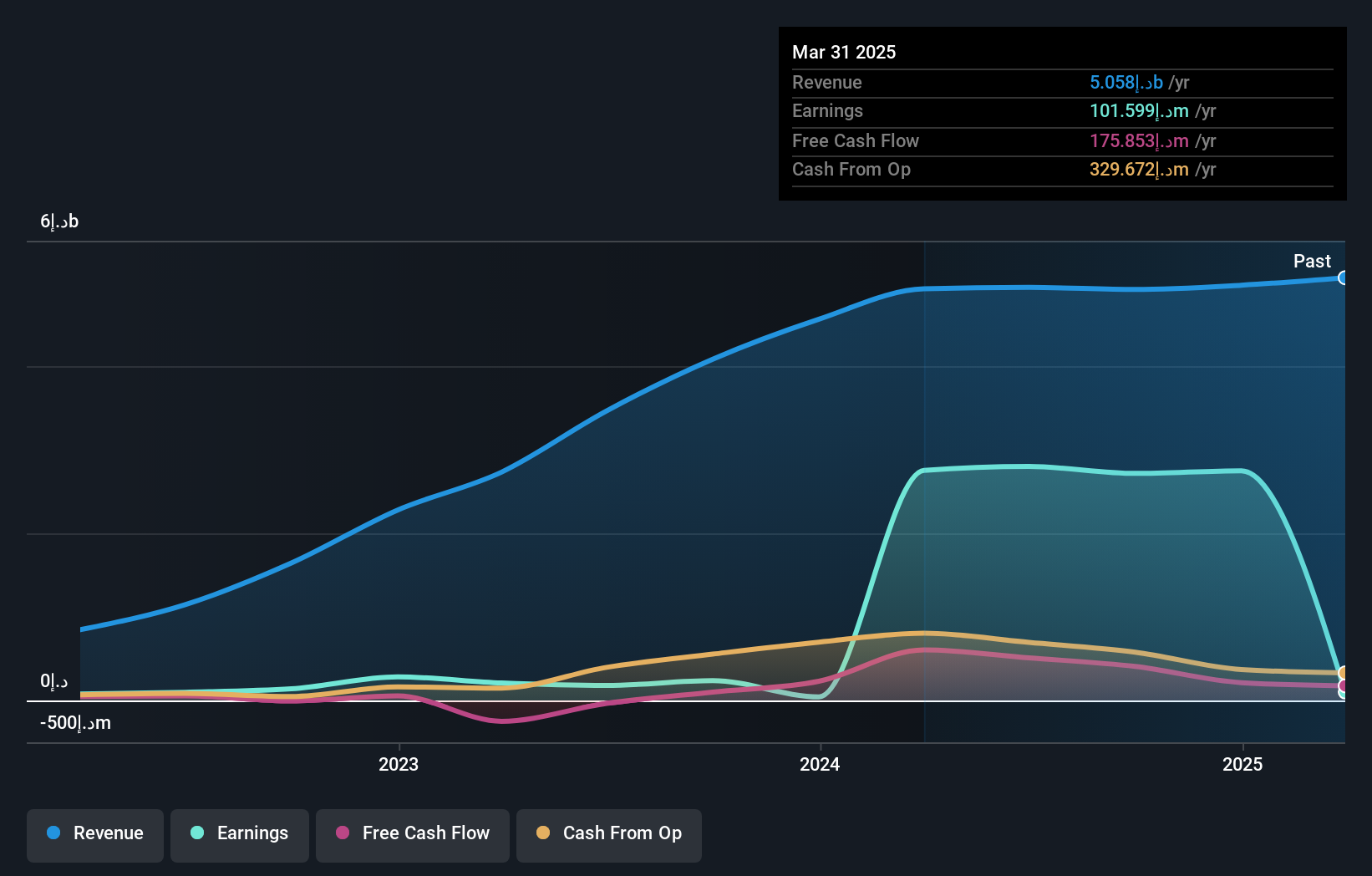

Ghitha Holding P.J.S.C shows a compelling profile with its earnings skyrocketing by 1039% over the past year, significantly outpacing the Consumer Retailing industry's 12.7% growth. Despite this, recent quarterly results reveal a dip in net income to AED 26.07 million from AED 109.14 million last year, hinting at potential volatility reflected in its share price movements over the past three months. The debt-to-equity ratio has risen to 16.5% from 4.1% over five years; however, interest payments are well covered by EBIT at a coverage of 3.8x and it maintains a satisfactory net debt-to-equity ratio of 6.2%. Additionally, Ghitha's price-to-earnings ratio stands attractively low at just 2.2x compared to the AE market's average of 13.4x, suggesting potential undervaluation amidst its high level of non-cash earnings and positive free cash flow status.

- Unlock comprehensive insights into our analysis of Ghitha Holding P.J.S.C stock in this health report.

Evaluate Ghitha Holding P.J.S.C's historical performance by accessing our past performance report.

Noritsu Koki (TSE:7744)

Simply Wall St Value Rating: ★★★★★★

Overview: Noritsu Koki Co., Ltd. is a Japanese company that manufactures and sells audio equipment and peripheral products, with a market capitalization of ¥140.48 billion.

Operations: Noritsu Koki generates revenue primarily from the sale of audio equipment and peripheral products. The company's financial performance includes a focus on managing its cost structure to optimize profitability.

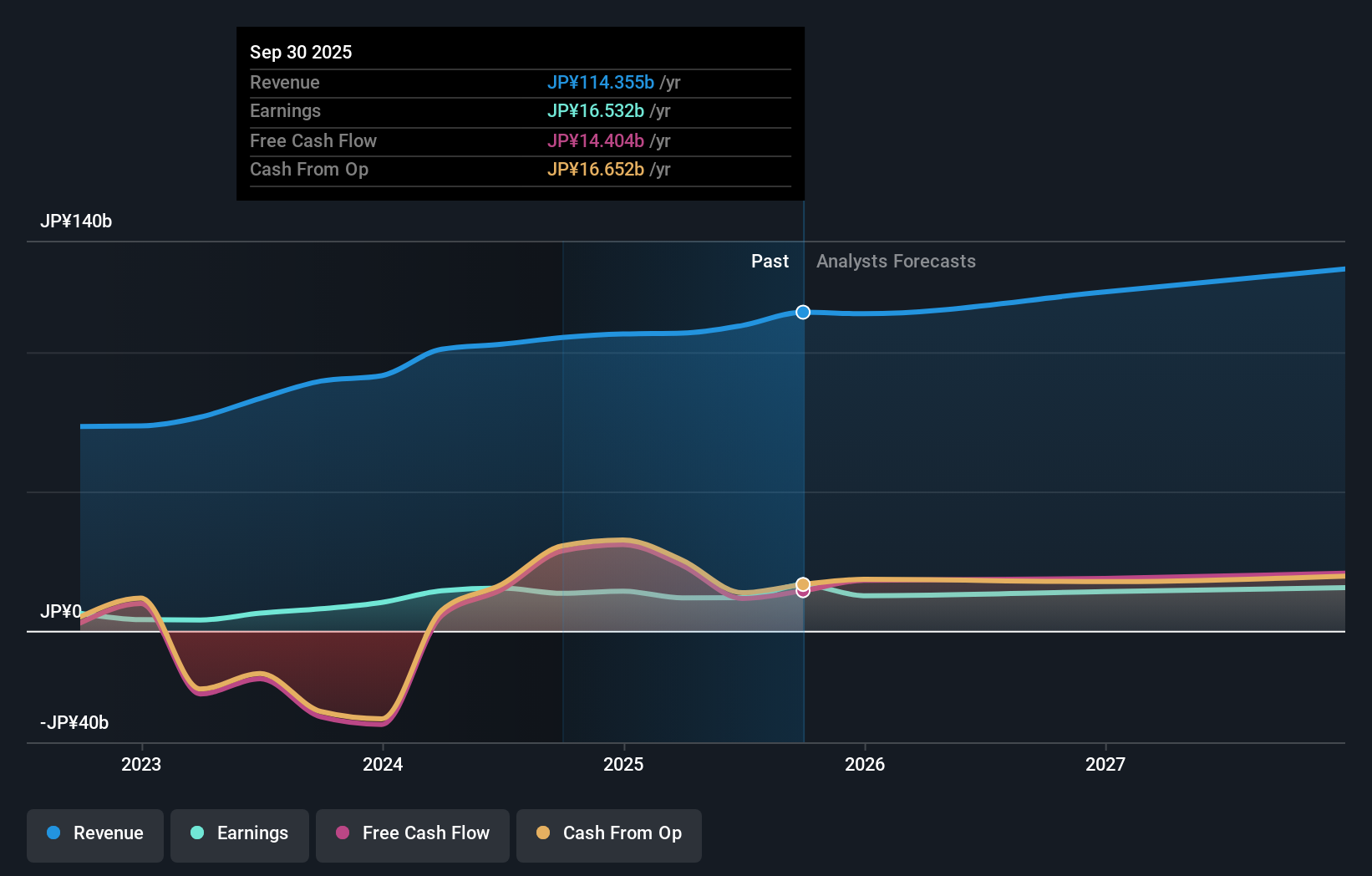

Noritsu Koki, a promising player in the industrials sector, has been making waves with its robust earnings growth of 69% over the past year, outpacing the industry average of 11%. The company is trading at a compelling value, priced 34% below its estimated fair value. Over five years, Noritsu Koki has significantly improved its financial health by reducing its debt to equity ratio from 50% to just under 17%, while maintaining high-quality earnings. With more cash than total debt and positive free cash flow, it seems well-positioned despite forecasts suggesting a modest decline in earnings ahead.

- Get an in-depth perspective on Noritsu Koki's performance by reading our health report here.

Assess Noritsu Koki's past performance with our detailed historical performance reports.

Nan Pao Resins Chemical (TWSE:4766)

Simply Wall St Value Rating: ★★★★★★

Overview: Nan Pao Resins Chemical Co., Ltd. is involved in the manufacturing, wholesale, and retail of synthetic resins and plastics, adhesives, resin coatings, dyes, and pigments across multiple continents including Asia and Oceania, with a market capitalization of approximately NT$35.27 billion.

Operations: Nan Pao Resins Chemical generates revenue primarily from Taiwan (NT$8.19 billion), Vietnam (NT$7.29 billion), and Mainland Area (NT$7.40 billion). The company also has significant revenue streams from Australia, contributing NT$3.07 billion, while other regions add NT$2.56 billion to its total revenue before adjustments and write-offs of NT$6.77 billion are factored in.

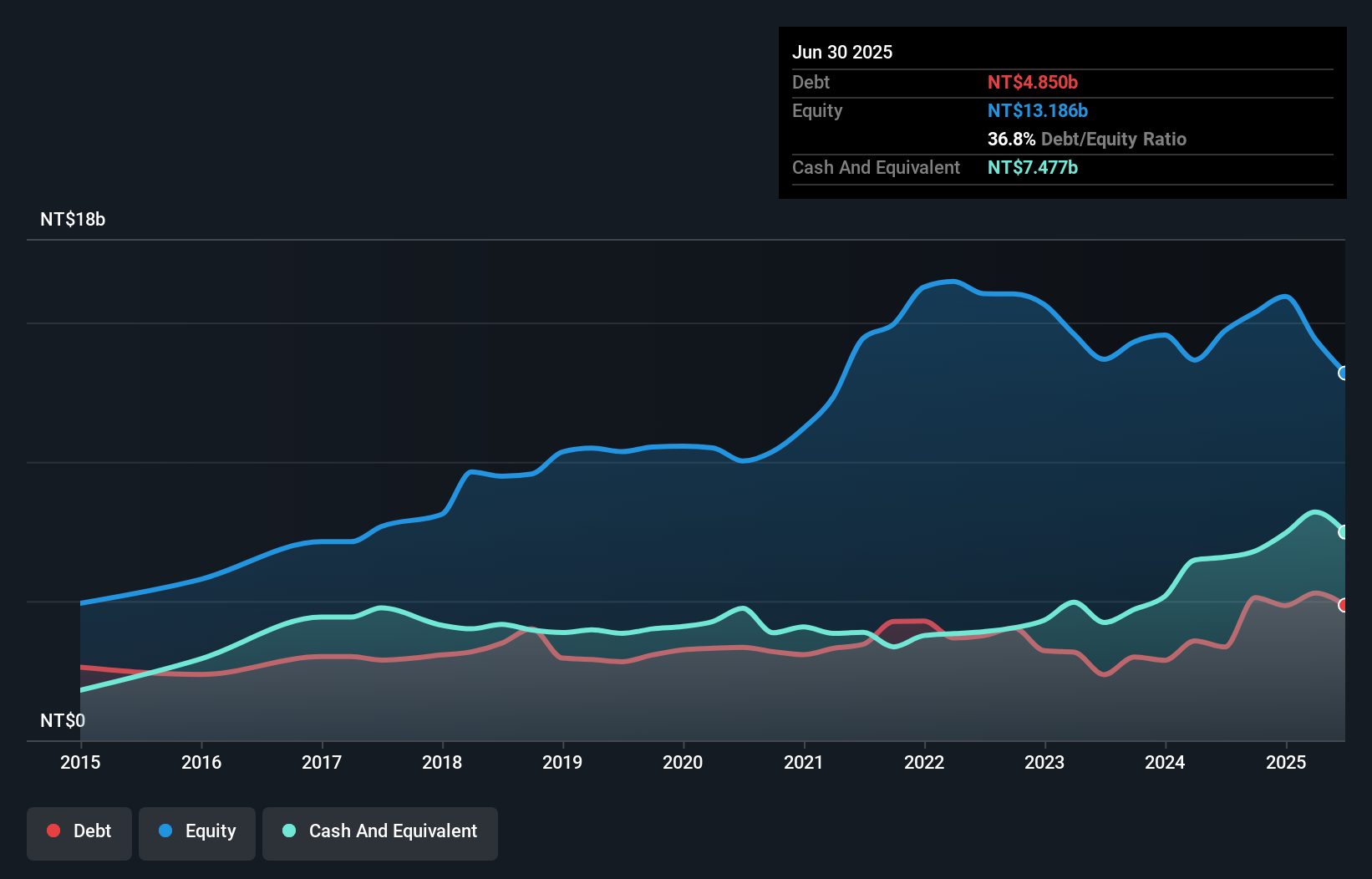

Nan Pao Resins Chemical, a nimble player in the chemicals sector, has shown robust performance with earnings growth of 42.5% over the past year, outpacing industry averages. The company reported second-quarter sales of TWD 5.78 billion and net income of TWD 672 million, marking a notable rise from last year's figures. Trading at approximately 29% below its estimated fair value suggests potential undervaluation against peers. With more cash than total debt and a reduced debt-to-equity ratio from 27% to 23% over five years, Nan Pao appears financially stable and well-positioned for future opportunities in its market space.

Next Steps

- Dive into all 4666 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nan Pao Resins Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4766

Nan Pao Resins Chemical

Engages in the manufacturing, wholesale, and retail sale of synthetic resins and plastics, adhesives, resin coatings, dyes, and pigments in Asia, Oceania, Taiwan, Europe, America, and Africa.

Flawless balance sheet, undervalued and pays a dividend.