- Taiwan

- /

- Basic Materials

- /

- TWSE:2504

3 Asian Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

Amidst ongoing trade tensions and economic fluctuations, Asian markets have shown resilience, with Chinese stocks gaining momentum due to expectations of government stimulus. In this dynamic environment, dividend stocks can offer a stable income stream and potential for portfolio enhancement, making them an attractive consideration for investors seeking to navigate the current market landscape.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.44% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.07% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.20% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.39% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.50% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.42% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.18% | ★★★★★★ |

| Daicel (TSE:4202) | 5.01% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.87% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.37% | ★★★★★★ |

Click here to see the full list of 1240 stocks from our Top Asian Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

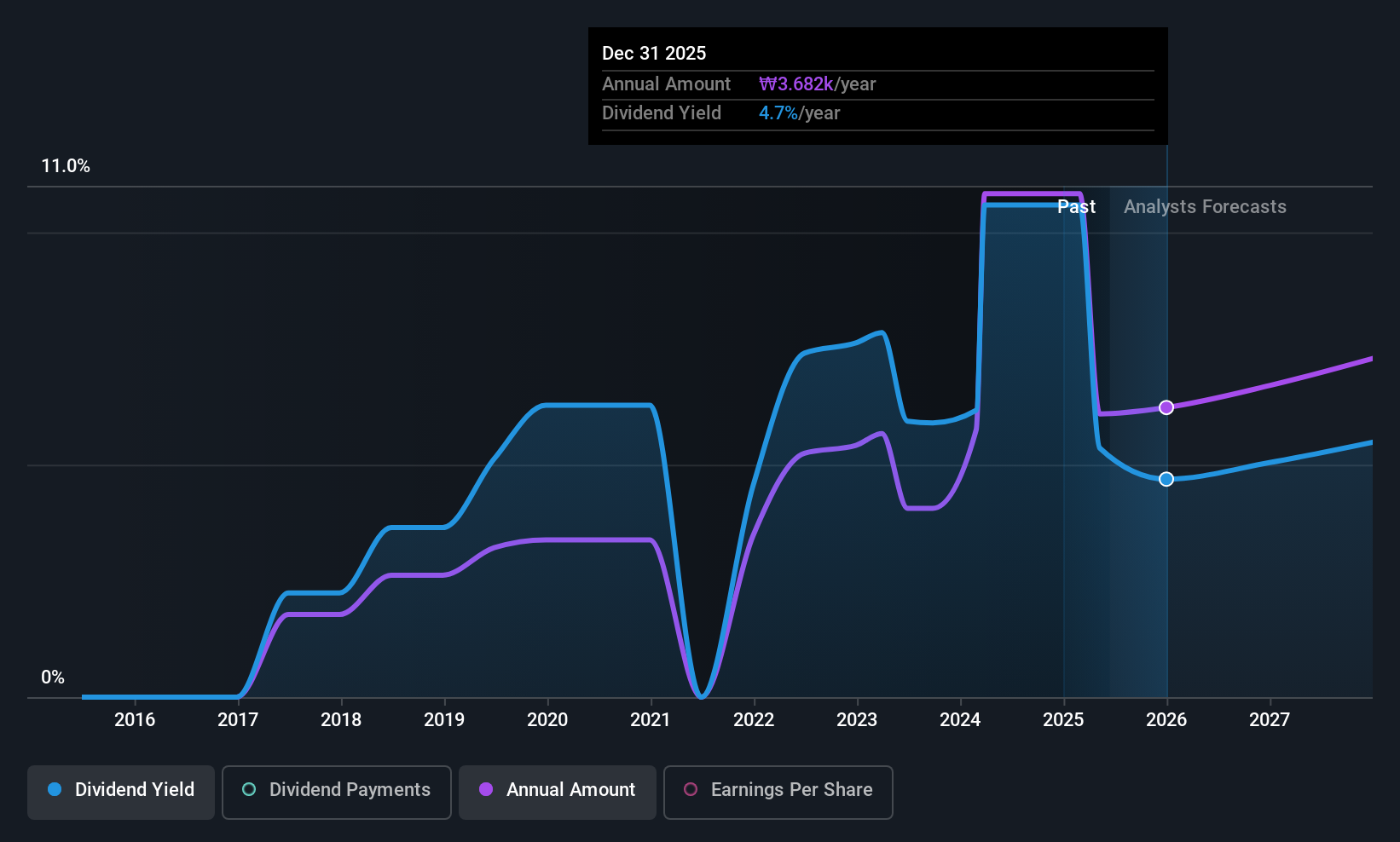

Hana Financial Group (KOSE:A086790)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hana Financial Group Inc., with a market cap of ₩21.19 trillion, operates through its subsidiaries to offer financial services in South Korea.

Operations: Hana Financial Group Inc. generates revenue through its subsidiaries by providing a range of financial services in South Korea.

Dividend Yield: 4.6%

Hana Financial Group's dividend yield of 4.64% places it among the top 25% of dividend payers in Korea, supported by a low payout ratio of 27.6%, indicating strong coverage by earnings. Despite recent earnings growth and favorable valuation compared to peers, the company has an unstable dividend track record over its eight-year history, with payments being volatile at times. Recent share buybacks totaling KRW 154.29 billion may indicate confidence in financial stability and shareholder value enhancement strategies.

- Navigate through the intricacies of Hana Financial Group with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Hana Financial Group's current price could be quite moderate.

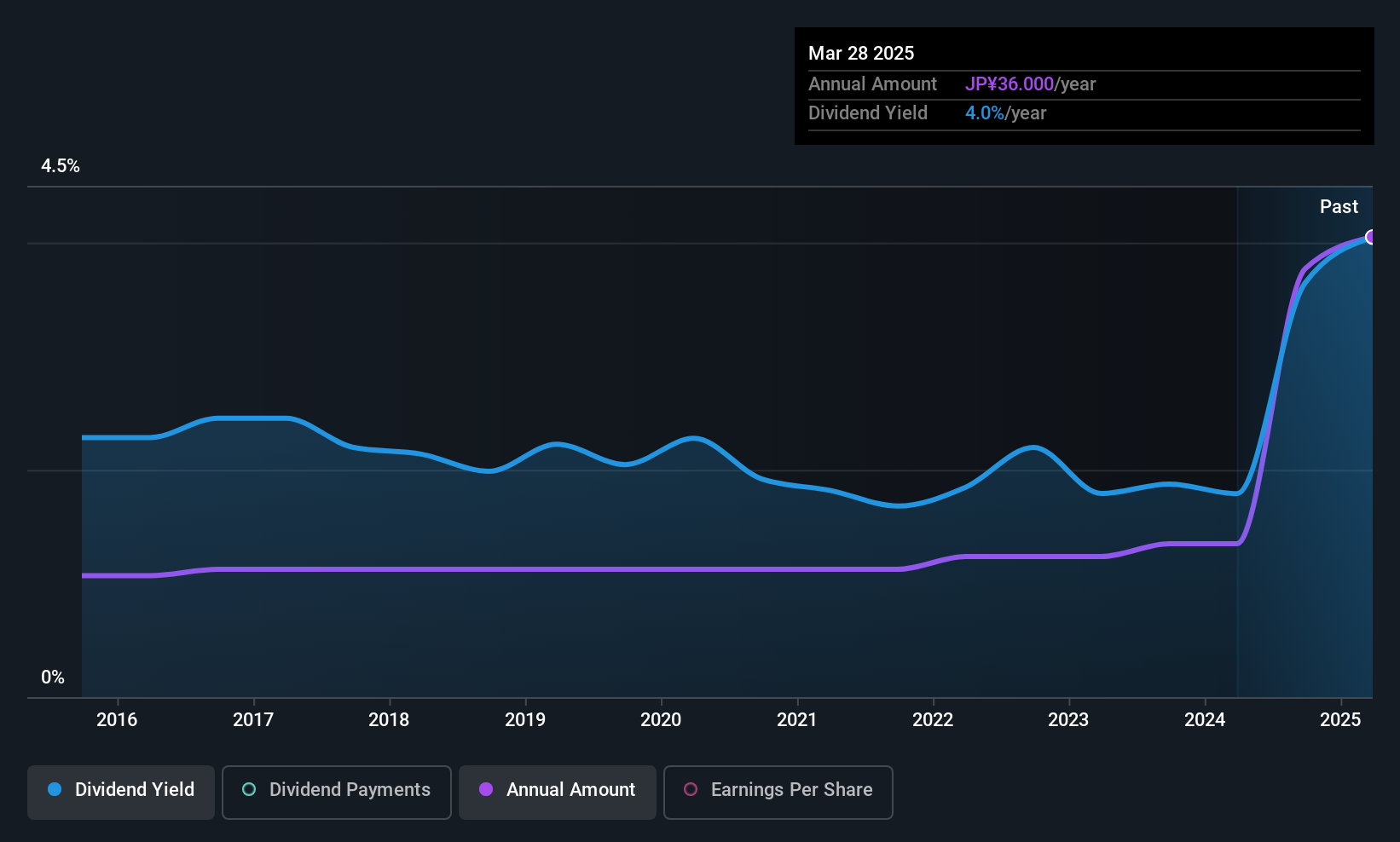

Japan Transcity (TSE:9310)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Japan Transcity Corporation operates in the logistics sector both domestically and internationally, with a market cap of ¥63.07 billion.

Operations: Japan Transcity Corporation generates revenue primarily from its Integrated Logistics Services segment, which accounts for ¥122.71 billion.

Dividend Yield: 3.7%

Japan Transcity's dividend yield of 3.72% is below the top quartile in Japan, but its dividends are well-covered by both earnings and cash flows, with payout ratios of 40.7% and 20.5%, respectively. The company has a stable ten-year dividend history with recent increases to JPY 22.50 per share for FY2025, though guidance suggests a decrease to JPY 19 per share for FY2026 year-end, reflecting strategic adjustments amid evolving financial forecasts and operational efficiencies.

- Dive into the specifics of Japan Transcity here with our thorough dividend report.

- Upon reviewing our latest valuation report, Japan Transcity's share price might be too optimistic.

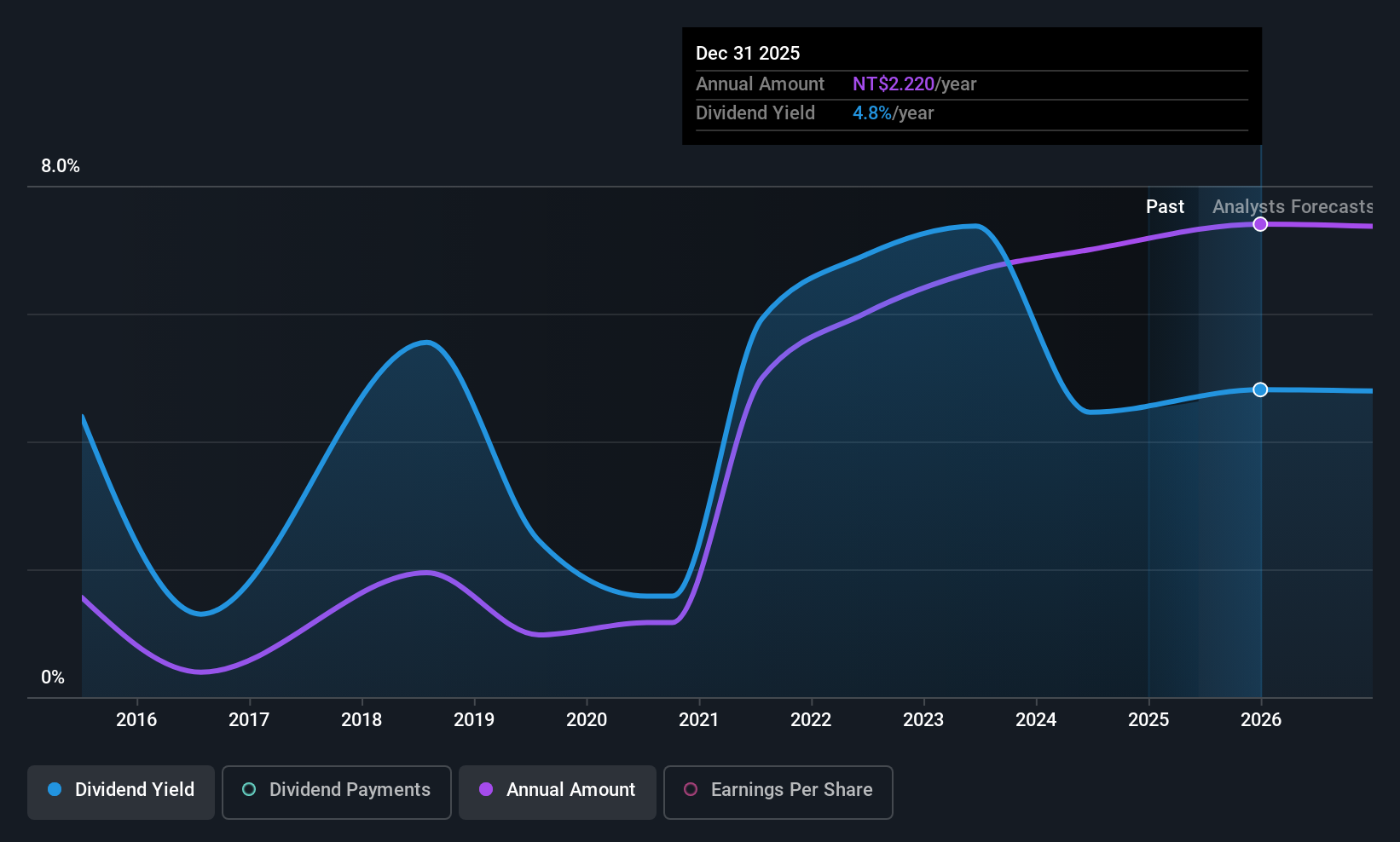

Goldsun Building Materials (TWSE:2504)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Goldsun Building Materials Co., Ltd. operates in Taiwan and Mainland China, producing and selling premixed concrete, cement, and calcium silicate board with a market cap of NT$53.55 billion.

Operations: Goldsun Building Materials Co., Ltd. generates its revenue primarily from the Taiwan ready-mixed business, which accounts for NT$18.89 billion, and the Ready-Mixed Cement Business in Mainland China, contributing NT$1.09 billion.

Dividend Yield: 6.2%

Goldsun Building Materials recently approved a cash dividend of TWD 2.8 per share, totaling TWD 3.30 billion, with payments set for July 18, 2025. Despite being in the top quartile for dividend yield in Taiwan at 6.15%, its dividends have been volatile and are not supported by free cash flows, though they are covered by earnings with a payout ratio of 71.6%. Earnings grew last year but future declines are forecasted.

- Click here to discover the nuances of Goldsun Building Materials with our detailed analytical dividend report.

- Our valuation report here indicates Goldsun Building Materials may be overvalued.

Make It Happen

- Navigate through the entire inventory of 1240 Top Asian Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2504

Goldsun Building Materials

Engages in the production and sale of premixed concrete, cement, and calcium silicate board in Taiwan and Mainland China.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives