- Taiwan

- /

- Metals and Mining

- /

- TWSE:2023

Yieh Phui Enterprise Co., Ltd. (TWSE:2023) Doing What It Can To Lift Shares

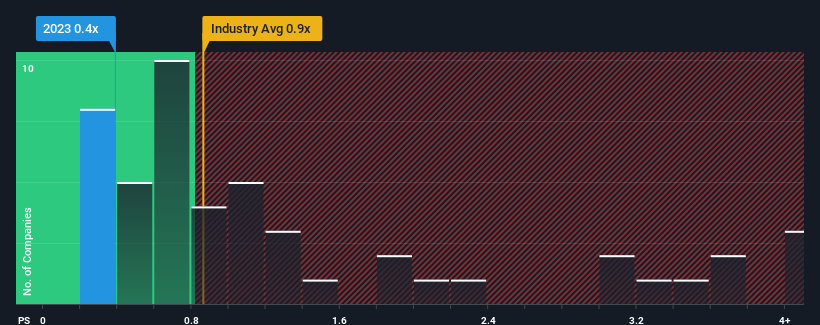

With a median price-to-sales (or "P/S") ratio of close to 0.9x in the Metals and Mining industry in Taiwan, you could be forgiven for feeling indifferent about Yieh Phui Enterprise Co., Ltd.'s (TWSE:2023) P/S ratio of 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Yieh Phui Enterprise

What Does Yieh Phui Enterprise's Recent Performance Look Like?

For instance, Yieh Phui Enterprise's receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Yieh Phui Enterprise, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Yieh Phui Enterprise?

Yieh Phui Enterprise's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.6%. Regardless, revenue has managed to lift by a handy 22% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 4.5% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Yieh Phui Enterprise is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What Does Yieh Phui Enterprise's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To our surprise, Yieh Phui Enterprise revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It is also worth noting that we have found 1 warning sign for Yieh Phui Enterprise that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2023

Yieh Phui Enterprise

Processes, manufactures, markets, imports and exports, and trades in steel products in Taiwan, rest of Asia, the United States, Europe, and internationally.

Good value with very low risk.

Market Insights

Community Narratives