- Taiwan

- /

- Paper and Forestry Products

- /

- TWSE:1906

Baolong International (TWSE:1906) Has Announced That Its Dividend Will Be Reduced To NT$0.15

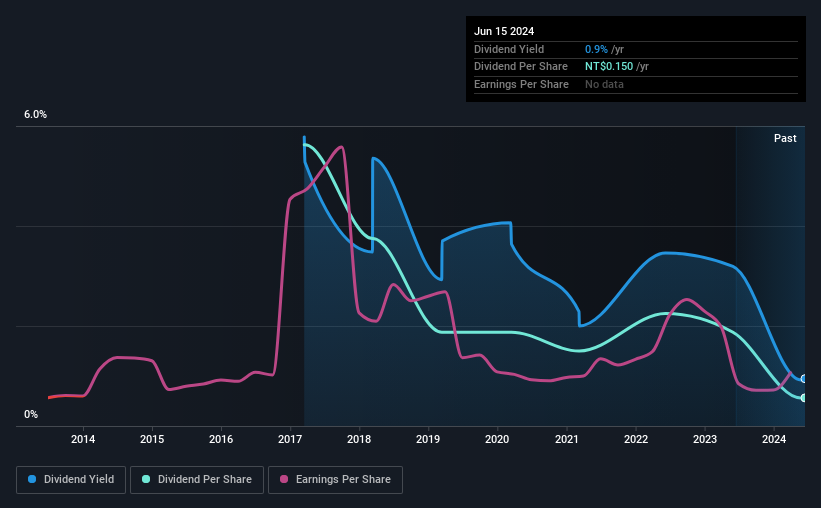

Baolong International Co., Ltd. (TWSE:1906) has announced that on 25th of July, it will be paying a dividend ofNT$0.15, which a reduction from last year's comparable dividend. This means that the dividend yield is 0.9%, which is a bit low when comparing to other companies in the industry.

View our latest analysis for Baolong International

Baolong International's Dividend Is Well Covered By Earnings

If it is predictable over a long period, even low dividend yields can be attractive. Before making this announcement, Baolong International was paying a whopping 112% as a dividend, but this only made up 19% of its overall earnings. While the business may be attempting to set a balanced dividend policy, a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

Looking forward, EPS could fall by 25.9% if the company can't turn things around from the last few years. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 21%, which is definitely feasible to continue.

Baolong International's Dividend Has Lacked Consistency

Even in its relatively short history, the company has reduced the dividend at least once. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. The dividend has gone from an annual total of NT$1.50 in 2017 to the most recent total annual payment of NT$0.15. This works out to a decline of approximately 90% over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Dividend Has Limited Growth Potential

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Over the past five years, it looks as though Baolong International's EPS has declined at around 26% a year. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

Baolong International's Dividend Doesn't Look Sustainable

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. While Baolong International is earning enough to cover the payments, the cash flows are lacking. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 4 warning signs for Baolong International (of which 1 is significant!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Baolong International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1906

Slight risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.