- Taiwan

- /

- Metals and Mining

- /

- TWSE:1589

Investors Still Waiting For A Pull Back In Yeong Guan Energy Technology Group Co., Ltd. (TWSE:1589)

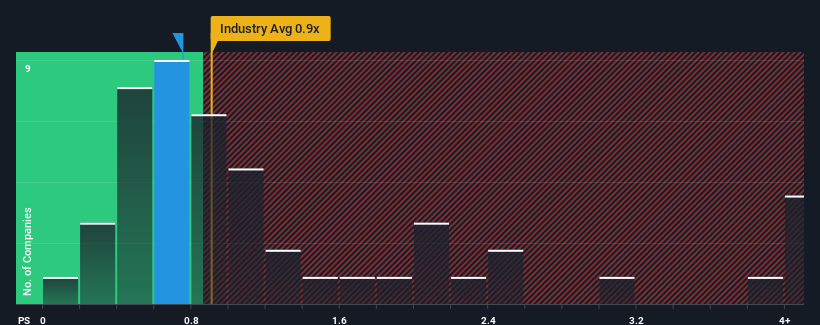

It's not a stretch to say that Yeong Guan Energy Technology Group Co., Ltd.'s (TWSE:1589) price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" for companies in the Metals and Mining industry in Taiwan, where the median P/S ratio is around 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Yeong Guan Energy Technology Group

What Does Yeong Guan Energy Technology Group's P/S Mean For Shareholders?

Recent times have been pleasing for Yeong Guan Energy Technology Group as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. Those who are bullish on Yeong Guan Energy Technology Group will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on Yeong Guan Energy Technology Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

Yeong Guan Energy Technology Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 3.8% gain to the company's revenues. Revenue has also lifted 17% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 7.0% over the next year. That's shaping up to be similar to the 6.8% growth forecast for the broader industry.

With this information, we can see why Yeong Guan Energy Technology Group is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Yeong Guan Energy Technology Group's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at Yeong Guan Energy Technology Group's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Before you take the next step, you should know about the 2 warning signs for Yeong Guan Energy Technology Group (1 is significant!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1589

Yeong Guan Energy Technology Group

Yeong Guan Energy Technology Group Co., Ltd.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives