Subdued Growth No Barrier To Sun Yad Construction Co.,Ltd (TWSE:1316) With Shares Advancing 36%

Despite an already strong run, Sun Yad Construction Co.,Ltd (TWSE:1316) shares have been powering on, with a gain of 36% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 48% in the last year.

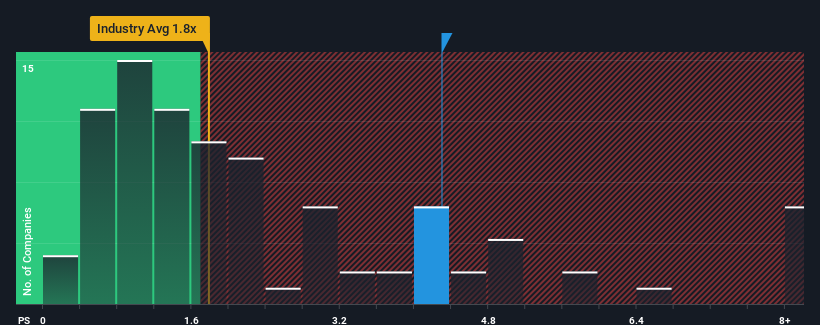

Since its price has surged higher, you could be forgiven for thinking Sun Yad ConstructionLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.3x, considering almost half the companies in Taiwan's Chemicals industry have P/S ratios below 1.8x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Sun Yad ConstructionLtd

What Does Sun Yad ConstructionLtd's Recent Performance Look Like?

For instance, Sun Yad ConstructionLtd's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Sun Yad ConstructionLtd will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Sun Yad ConstructionLtd's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 53%. The last three years don't look nice either as the company has shrunk revenue by 24% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 7.1% shows it's an unpleasant look.

With this in mind, we find it worrying that Sun Yad ConstructionLtd's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

The strong share price surge has lead to Sun Yad ConstructionLtd's P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Sun Yad ConstructionLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Before you settle on your opinion, we've discovered 3 warning signs for Sun Yad ConstructionLtd (1 shouldn't be ignored!) that you should be aware of.

If these risks are making you reconsider your opinion on Sun Yad ConstructionLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1316

Sun Yad ConstructionLtd

Engages in polymer chemical raw materials in Taiwan, Asia, and internationally.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives