3 Asian Dividend Stocks To Consider With At Least 5.4% Yield

Reviewed by Simply Wall St

As global markets navigate a complex landscape of rising consumer inflation in the U.S. and mixed economic signals from Europe and Asia, investors are increasingly looking toward dividend stocks as a source of steady income amidst uncertainty. In this context, identifying Asian dividend stocks with attractive yields can provide a reliable income stream while potentially offering some cushion against market volatility.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.43% | ★★★★★★ |

| NCD (TSE:4783) | 4.21% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.27% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.25% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.53% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.79% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.14% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.44% | ★★★★★★ |

| Daicel (TSE:4202) | 4.83% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.00% | ★★★★★★ |

Click here to see the full list of 1201 stocks from our Top Asian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

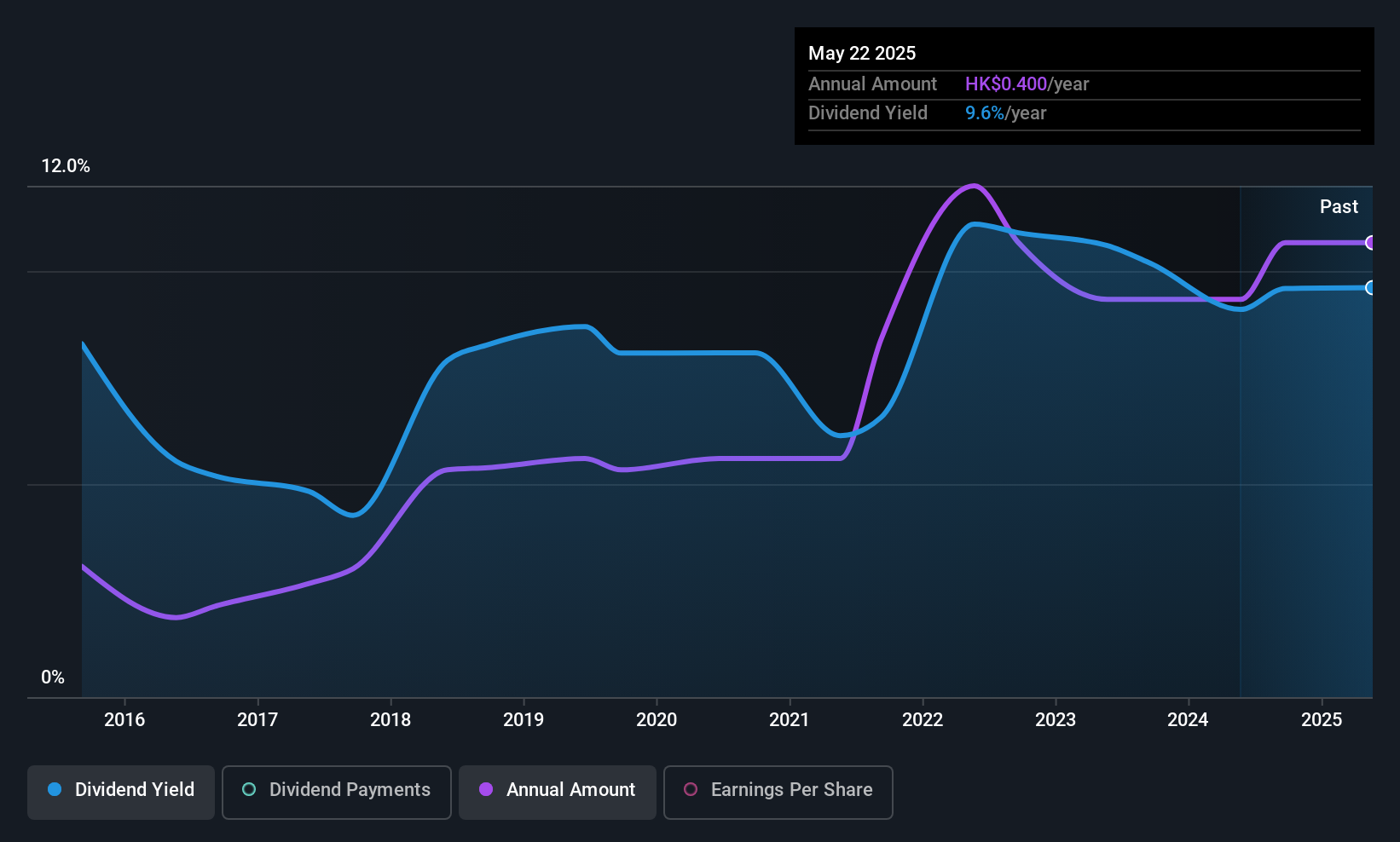

S.A.S. Dragon Holdings (SEHK:1184)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: S.A.S. Dragon Holdings Limited is an investment holding company that offers electronic supply chain services across Hong Kong, Mainland China, Taiwan, the United States, Vietnam, Singapore, Macao and internationally with a market cap of HK$2.87 billion.

Operations: S.A.S. Dragon Holdings Limited generates revenue primarily from the distribution of electronic components and semiconductor products, totaling HK$27.76 billion.

Dividend Yield: 8.7%

S.A.S. Dragon Holdings recently declared a final dividend of HK$25 per share for 2024, reflecting its commitment to shareholder returns despite a history of volatile dividends. The payout ratio of 49.9% indicates dividends are well-covered by earnings and cash flows, suggesting sustainability. However, the company's dividend reliability is questionable due to past volatility. Trading at 27.3% below estimated fair value may present an attractive opportunity for investors prioritizing high yields in Hong Kong's market.

- Dive into the specifics of S.A.S. Dragon Holdings here with our thorough dividend report.

- Upon reviewing our latest valuation report, S.A.S. Dragon Holdings' share price might be too pessimistic.

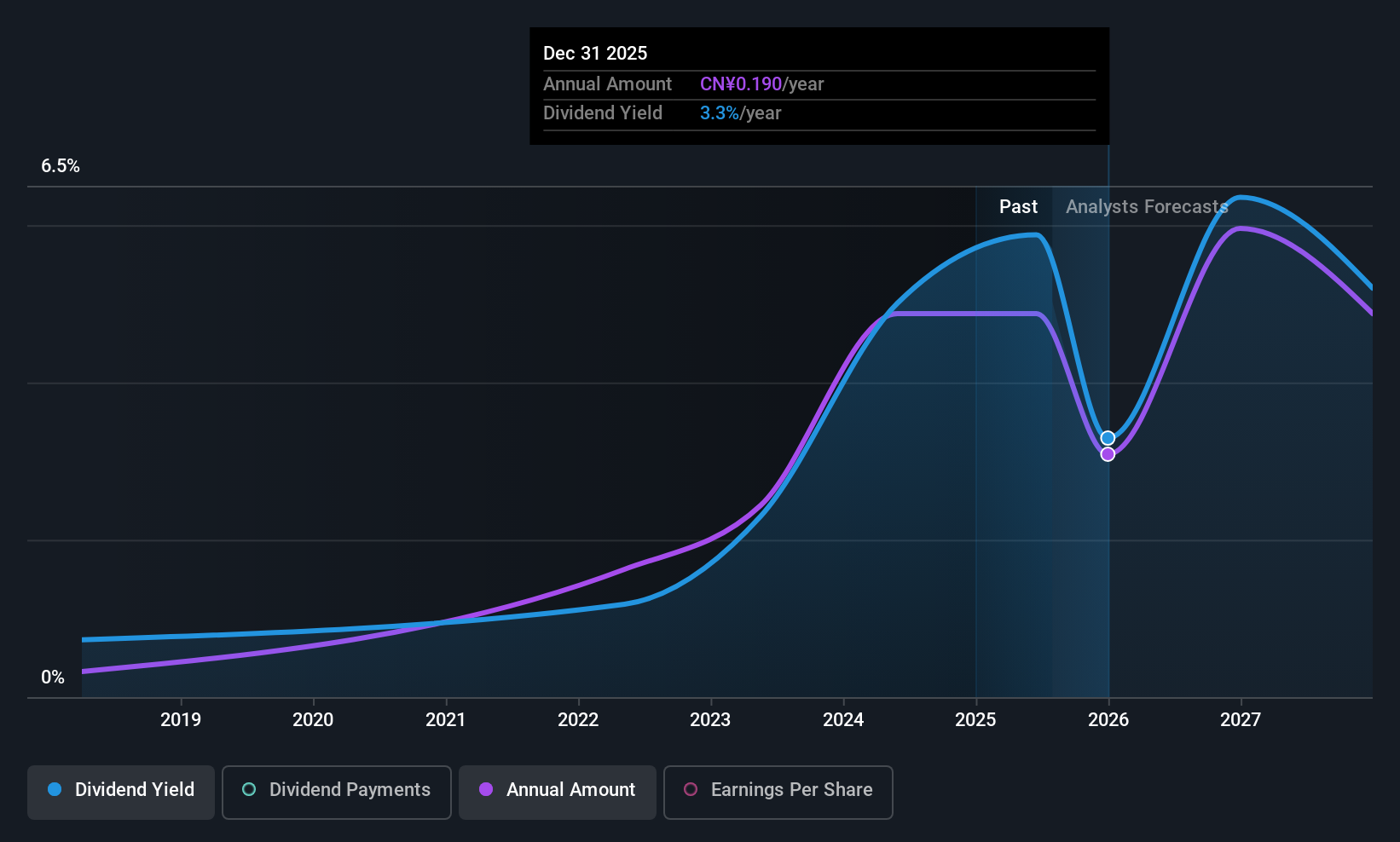

Inner Mongolia Berun Chemical (SZSE:000683)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Inner Mongolia Berun Chemical Company Limited, with a market cap of CN¥20.34 billion, operates in China focusing on soda ash, methanol, fertilizers, and agricultural production materials through its subsidiaries.

Operations: Inner Mongolia Berun Chemical Company Limited generates revenue primarily from its operations in soda ash, methanol, fertilizers, and agricultural production materials within China.

Dividend Yield: 5.5%

Inner Mongolia Berun Chemical's dividend payments have been volatile over the past decade, yet they are well-covered by earnings and cash flows with a payout ratio of 69.2% and a cash payout ratio of 32%. The company trades at 82.7% below its estimated fair value, offering potential value for investors. Recently, it affirmed a final cash dividend of CNY 3 per 10 shares for 2024, indicating ongoing shareholder returns despite an unstable track record.

- Click here and access our complete dividend analysis report to understand the dynamics of Inner Mongolia Berun Chemical.

- Our valuation report unveils the possibility Inner Mongolia Berun Chemical's shares may be trading at a discount.

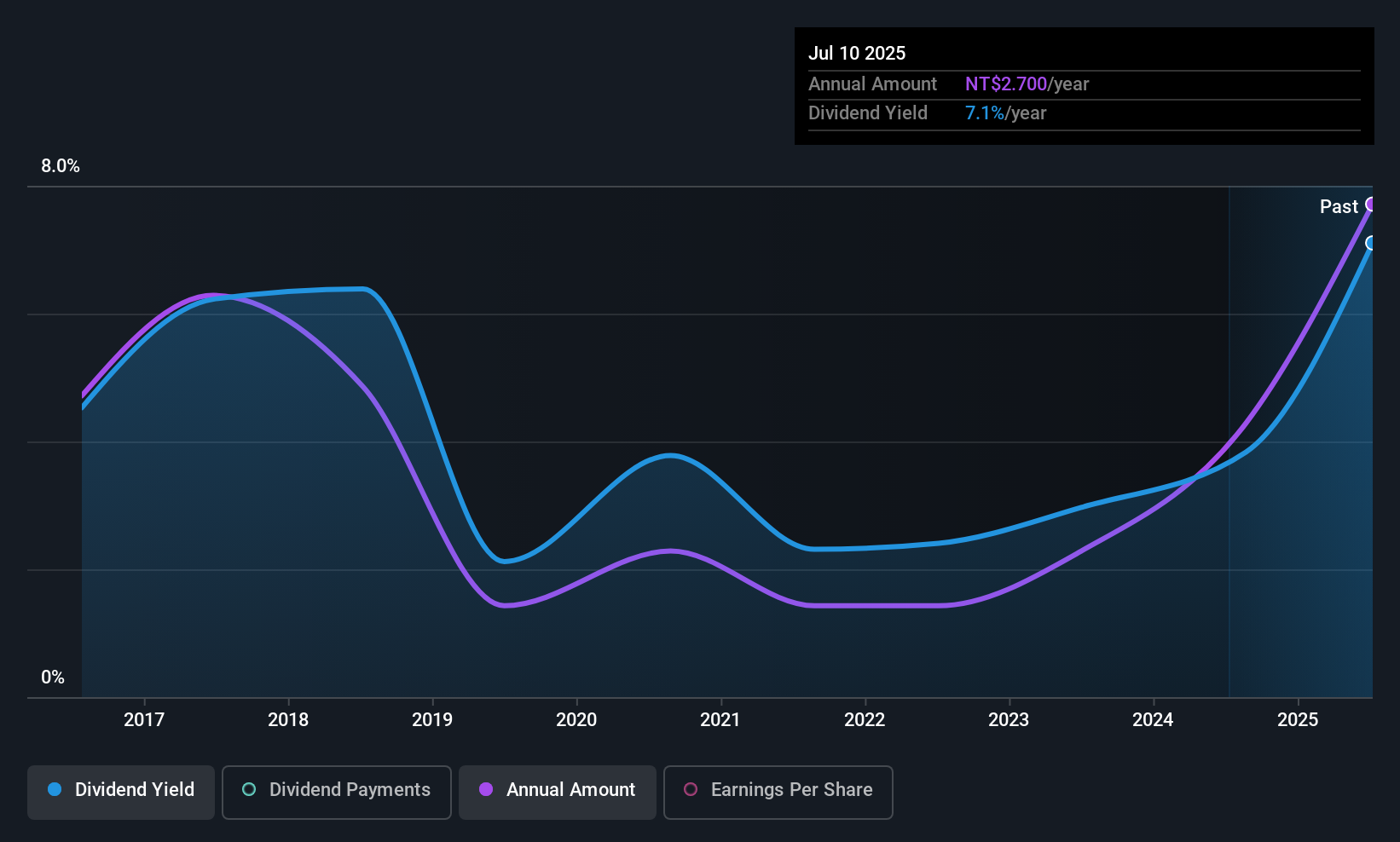

San Fang Chemical Industry (TWSE:1307)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: San Fang Chemical Industry Co., Ltd. is involved in the manufacturing and sale of artificial leather, synthetic resin, and other materials across Taiwan, China, Hong Kong, Southeast Asia, and international markets with a market cap of NT$13.78 billion.

Operations: San Fang Chemical Industry Co., Ltd. generates revenue through its segments, with NT$1.09 billion from GII, NT$2.83 billion from PTS, NT$1.84 billion from Sanfang Development Co., Ltd., and NT$8.50 billion from SAN Fang Chemical Industry Co., Ltd.

Dividend Yield: 7.8%

San Fang Chemical Industry recently approved a TWD 2.7 cash dividend per share for 2024, highlighting a commitment to shareholder returns despite past dividend volatility. The company's high payout ratio of 104.9% indicates dividends exceed free cash flow, raising sustainability concerns. Although earnings have grown by 47.1%, the dividend's coverage by earnings remains tight with a payout ratio of 71.8%. Trading at a P/E ratio of 9.2x, it offers value compared to the TW market average of 18.7x amidst recent board changes.

- Click to explore a detailed breakdown of our findings in San Fang Chemical Industry's dividend report.

- The valuation report we've compiled suggests that San Fang Chemical Industry's current price could be inflated.

Turning Ideas Into Actions

- Unlock more gems! Our Top Asian Dividend Stocks screener has unearthed 1198 more companies for you to explore.Click here to unveil our expertly curated list of 1201 Top Asian Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1307

San Fang Chemical Industry

Manufactures and sells artificial leather, synthetic resin, and other materials in Taiwan, China, Hong Kong, Southeast Asia, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives