- Taiwan

- /

- Basic Materials

- /

- TWSE:1101

Shareholders Should Be Pleased With TCC Group Holdings Co., Ltd.'s (TWSE:1101) Price

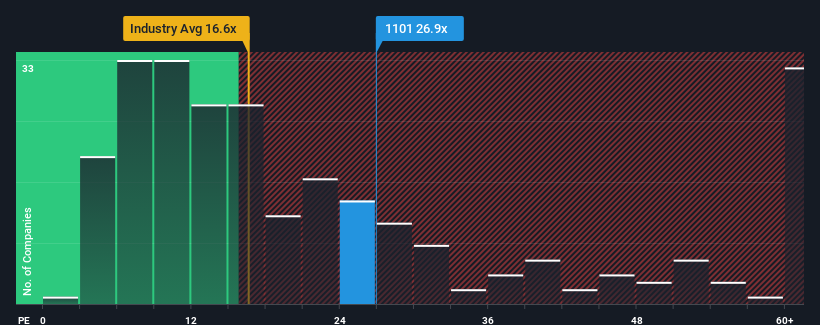

TCC Group Holdings Co., Ltd.'s (TWSE:1101) price-to-earnings (or "P/E") ratio of 26.9x might make it look like a sell right now compared to the market in Taiwan, where around half of the companies have P/E ratios below 20x and even P/E's below 14x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times haven't been advantageous for TCC Group Holdings as its earnings have been rising slower than most other companies. It might be that many expect the uninspiring earnings performance to recover significantly, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for TCC Group Holdings

How Is TCC Group Holdings' Growth Trending?

In order to justify its P/E ratio, TCC Group Holdings would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 62% drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 29% over the next year. Meanwhile, the rest of the market is forecast to only expand by 25%, which is noticeably less attractive.

In light of this, it's understandable that TCC Group Holdings' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that TCC Group Holdings maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for TCC Group Holdings that you need to take into consideration.

Of course, you might also be able to find a better stock than TCC Group Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if TCC Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1101

TCC Group Holdings

Engages in the production and sale of cement and ready-mix concrete in Taiwan and internationally.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives