Shareholders Of Shin Foong Specialty and Applied Materials (TPE:6582) Must Be Happy With Their 281% Total Return

Shin Foong Specialty and Applied Materials Co., Ltd. (TPE:6582) shareholders have seen the share price descend 27% over the month. But in three years the returns have been great. Indeed, the share price is up a very strong 223% in that time. So the recent fall in the share price should be viewed in that context. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

See our latest analysis for Shin Foong Specialty and Applied Materials

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

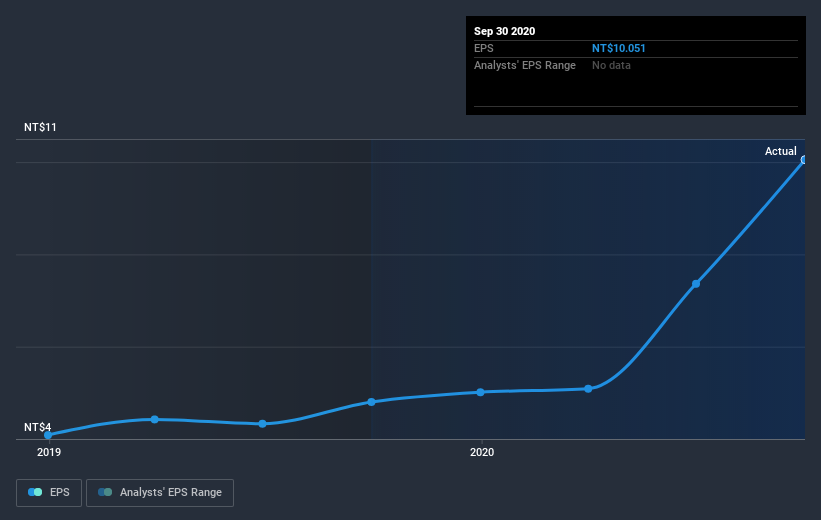

During three years of share price growth, Shin Foong Specialty and Applied Materials achieved compound earnings per share growth of 34% per year. In comparison, the 48% per year gain in the share price outpaces the EPS growth. This indicates that the market is feeling more optimistic on the stock, after the last few years of progress. That's not necessarily surprising considering the three-year track record of earnings growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Shin Foong Specialty and Applied Materials has grown profits over the years, but the future is more important for shareholders. This free interactive report on Shin Foong Specialty and Applied Materials' balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Shin Foong Specialty and Applied Materials the TSR over the last 3 years was 281%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that Shin Foong Specialty and Applied Materials rewarded shareholders with a total shareholder return of 181% over the last year. That's including the dividend. That's better than the annualized TSR of 56% over the last three years. Given the track record of solid returns over varying time frames, it might be worth putting Shin Foong Specialty and Applied Materials on your watchlist. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Shin Foong Specialty and Applied Materials (at least 1 which is concerning) , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade Shin Foong Specialty and Applied Materials, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:6582

Shin Foong Specialty and Applied Materials

Shin Foong Specialty and Applied Materials Co., Ltd.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives