Taiwan Fertilizer Co., Ltd.'s (TPE:1722) Has Performed Well But Fundamentals Look Varied: Is There A Clear Direction For The Stock?

Most readers would already know that Taiwan Fertilizer's (TPE:1722) stock increased by 7.5% over the past three months. However, the company's financials look a bit inconsistent and market outcomes are ultimately driven by long-term fundamentals, meaning that the stock could head in either direction. Particularly, we will be paying attention to Taiwan Fertilizer's ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Taiwan Fertilizer

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Taiwan Fertilizer is:

5.1% = NT$2.6b ÷ NT$51b (Based on the trailing twelve months to September 2020).

The 'return' is the yearly profit. One way to conceptualize this is that for each NT$1 of shareholders' capital it has, the company made NT$0.05 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Taiwan Fertilizer's Earnings Growth And 5.1% ROE

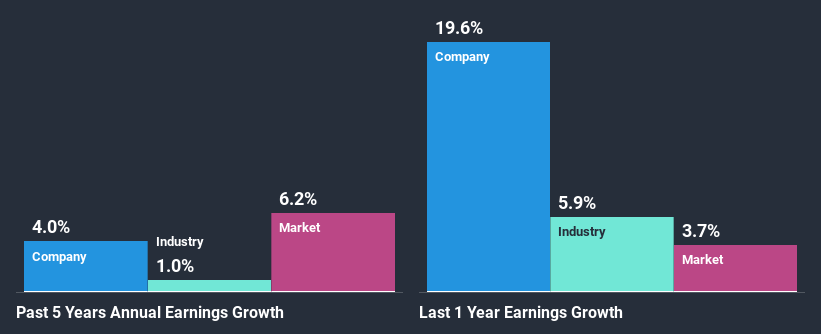

At first glance, Taiwan Fertilizer's ROE doesn't look very promising. We then compared the company's ROE to the broader industry and were disappointed to see that the ROE is lower than the industry average of 7.7%. Accordingly, Taiwan Fertilizer's low net income growth of 4.0% over the past five years can possibly be explained by the low ROE amongst other factors.

As a next step, we compared Taiwan Fertilizer's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 1.0%.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about Taiwan Fertilizer's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Taiwan Fertilizer Efficiently Re-investing Its Profits?

The high three-year median payout ratio of 99% (that is, the company retains only 1.2% of its income) over the past three years for Taiwan Fertilizer suggests that the company's earnings growth was lower as a result of paying out a majority of its earnings.

In addition, Taiwan Fertilizer has been paying dividends over a period of at least ten years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 95% of its profits over the next three years. Therefore, the company's future ROE is also not expected to change by much with analysts predicting an ROE of 5.0%.

Summary

On the whole, we feel that the performance shown by Taiwan Fertilizer can be open to many interpretations. While the company has posted impressive earnings growth, its poor ROE and low earnings retention makes us doubtful if that growth could continue, if by any chance the business is faced with any sort of risk. Wrapping up, we would proceed with caution with this company and one way of doing that would be to look at the risk profile of the business. To know the 2 risks we have identified for Taiwan Fertilizer visit our risks dashboard for free.

If you’re looking to trade Taiwan Fertilizer, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Fertilizer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1722

Taiwan Fertilizer

Manufactures and sells inorganic and organic fertilizers, and other chemical products in Taiwan and internationally.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026