- Taiwan

- /

- Basic Materials

- /

- TPEX:5520

Can Lih Tai Construction Enterprise Co., Ltd. (GTSM:5520) Performance Keep Up Given Its Mixed Bag Of Fundamentals?

Most readers would already know that Lih Tai Construction Enterprise's (GTSM:5520) stock increased by 9.7% over the past three months. Given that the stock prices usually follow long-term business performance, we wonder if the company's mixed financials could have any adverse effect on its current price price movement In this article, we decided to focus on Lih Tai Construction Enterprise's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for Lih Tai Construction Enterprise

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Lih Tai Construction Enterprise is:

14% = NT$273m ÷ NT$2.0b (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. That means that for every NT$1 worth of shareholders' equity, the company generated NT$0.14 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Lih Tai Construction Enterprise's Earnings Growth And 14% ROE

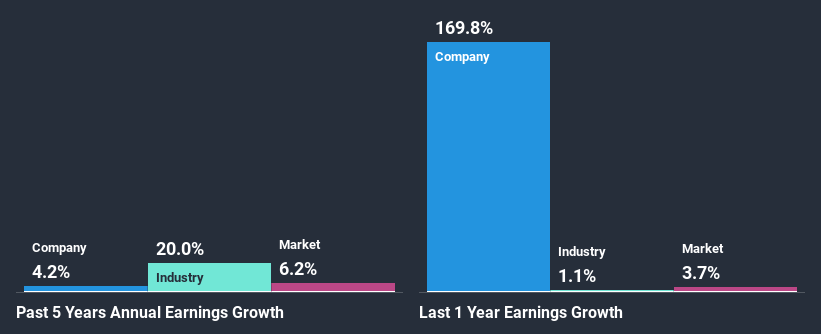

At first glance, Lih Tai Construction Enterprise seems to have a decent ROE. Further, the company's ROE compares quite favorably to the industry average of 12%. However, for some reason, the higher returns aren't reflected in Lih Tai Construction Enterprise's meagre five year net income growth average of 4.2%. That's a bit unexpected from a company which has such a high rate of return. We reckon that a low growth, when returns are quite high could be the result of certain circumstances like low earnings retention or poor allocation of capital.

As a next step, we compared Lih Tai Construction Enterprise's net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 20% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Lih Tai Construction Enterprise is trading on a high P/E or a low P/E, relative to its industry.

Is Lih Tai Construction Enterprise Efficiently Re-investing Its Profits?

Lih Tai Construction Enterprise has a very high three-year median payout ratio of 109%, which suggests that the company is dipping into more than just its profits to pay its dividend and that shows in its low earnings growth number. This is indicative of risk.

Moreover, Lih Tai Construction Enterprise has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Summary

Overall, we have mixed feelings about Lih Tai Construction Enterprise. In spite of the high ROE, the company has failed to see growth in its earnings due to it paying out most of its profits as dividend, with almost nothing left to invest into its own business. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. You can do your own research on Lih Tai Construction Enterprise and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

If you’re looking to trade Lih Tai Construction Enterprise, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:5520

Lih Tai Construction Enterprise

Produces and sells ready-mixed concrete products in Taiwan.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success