- Czech Republic

- /

- Tobacco

- /

- SEP:TABAK

Unveiling Undiscovered Gems With Promising Potential In February 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and mixed economic indicators, small-cap stocks have shown resilience despite broader market challenges. In this dynamic environment, identifying promising stocks often involves looking for companies with strong fundamentals, innovative business models, and the ability to adapt to changing economic landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nihon Parkerizing | 0.31% | 2.12% | 6.94% | ★★★★★★ |

| Ohashi Technica | NA | 4.58% | -14.04% | ★★★★★★ |

| Otec | 8.17% | 3.43% | 1.06% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Komori | 9.28% | 8.79% | 64.70% | ★★★★★☆ |

| CMC | 1.42% | 1.60% | 10.14% | ★★★★★☆ |

| Marusan Securities | 5.46% | 0.83% | 4.55% | ★★★★★☆ |

| Nippon Ski Resort DevelopmentLtd | 43.84% | 7.58% | 32.78% | ★★★★★☆ |

| Mr Max Holdings | 54.12% | 0.97% | 4.23% | ★★★★☆☆ |

We'll examine a selection from our screener results.

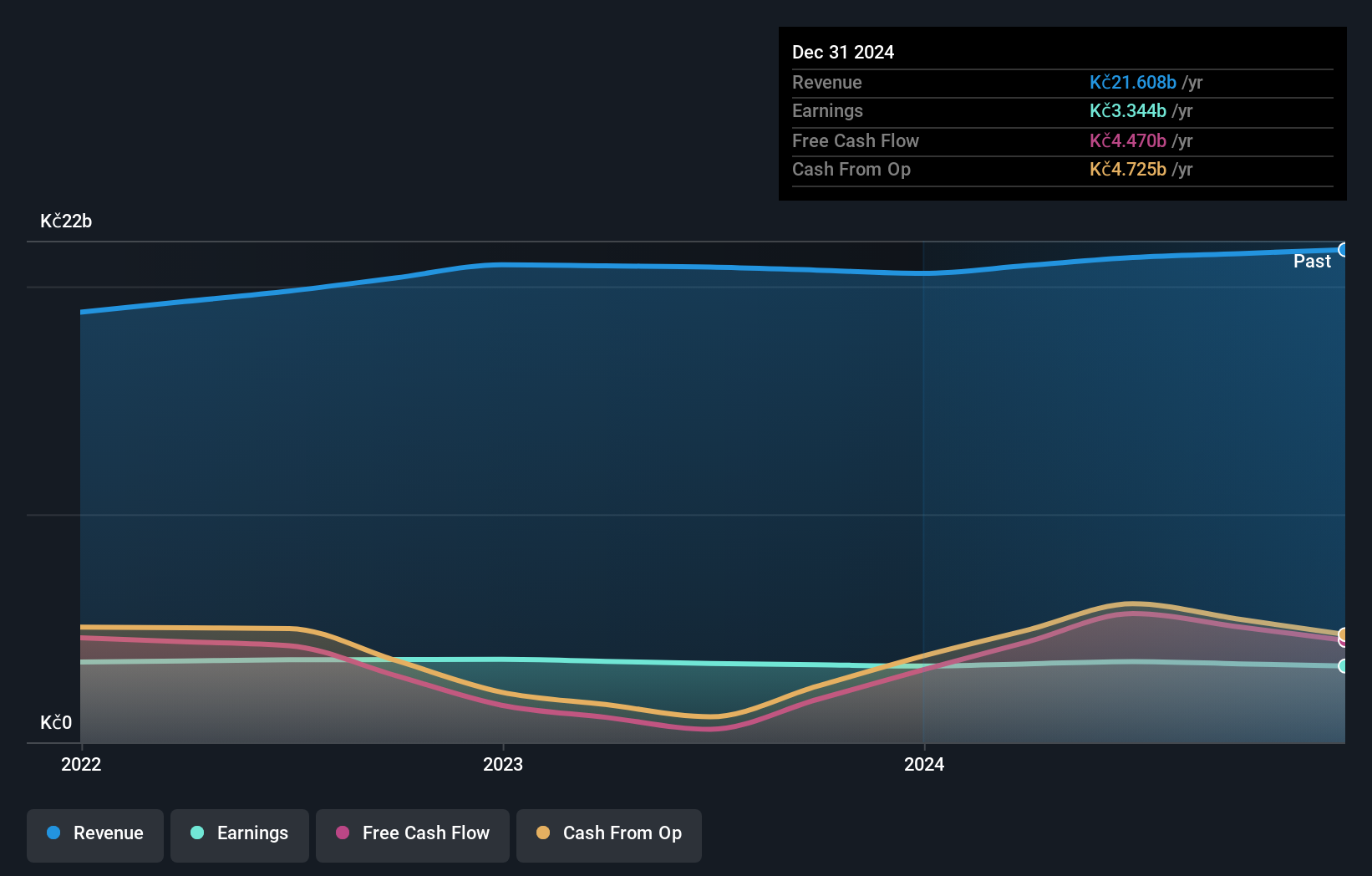

Philip Morris CR (SEP:TABAK)

Simply Wall St Value Rating: ★★★★★★

Overview: Philip Morris CR a.s., with a market cap of CZK47.66 billion, operates through its subsidiary Philip Morris Slovakia s.r.o. to manufacture and market tobacco products under brands such as Marlboro, L&M, Chesterfield, Petra Klasik, and Sparta in the Czech Republic and the Slovak Republic.

Operations: Philip Morris CR generates revenue primarily from the distribution of tobacco products in the Czech Republic (CZK14.69 billion) and the Slovak Republic (CZK6.16 billion). The company also earns from manufacturing services amounting to CZK2.78 billion.

Philip Morris CR, operating without debt and boasting high-quality earnings, trades at a significant 72.6% below its estimated fair value. Despite being debt-free now, it had a minimal debt-to-equity ratio of 0.01% five years ago. The company's free cash flow has been positive, with the latest figure reaching US$5.64 billion as of June 2024. However, earnings have seen a yearly decrease of 3% over the last five years and lagged behind the tobacco industry’s growth rate of 7.3%. This financial backdrop suggests potential undervaluation but highlights challenges in matching industry growth rates.

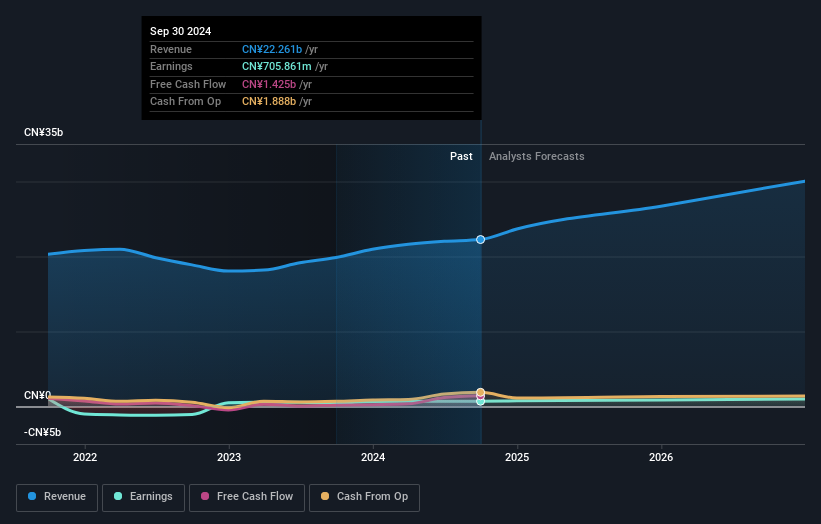

Jangho Group (SHSE:601886)

Simply Wall St Value Rating: ★★★★★★

Overview: Jangho Group Co., Ltd. operates in the architectural decoration industry across Mainland China, Hong Kong, Macau, Taiwan, and internationally with a market capitalization of CN¥6.37 billion.

Operations: Jangho Group generates revenue primarily from its architectural decoration business across various regions. The company has a market capitalization of CN¥6.37 billion.

With a debt to equity ratio dropping from 45.9% to 29.4% over five years, Jangho Group seems financially prudent, especially with its cash surpassing total debt levels. The company trades at a substantial discount of 95.2% below its estimated fair value, suggesting potential undervaluation in the market. Despite a notable one-off loss of CN¥277 million affecting recent results, earnings surged by 60.4%, outpacing the construction sector's -3.9%. This growth trajectory alongside strong EBIT coverage for interest payments (22x) indicates resilience and room for future expansion in profitability and value realization within the industry context.

- Click here to discover the nuances of Jangho Group with our detailed analytical health report.

Examine Jangho Group's past performance report to understand how it has performed in the past.

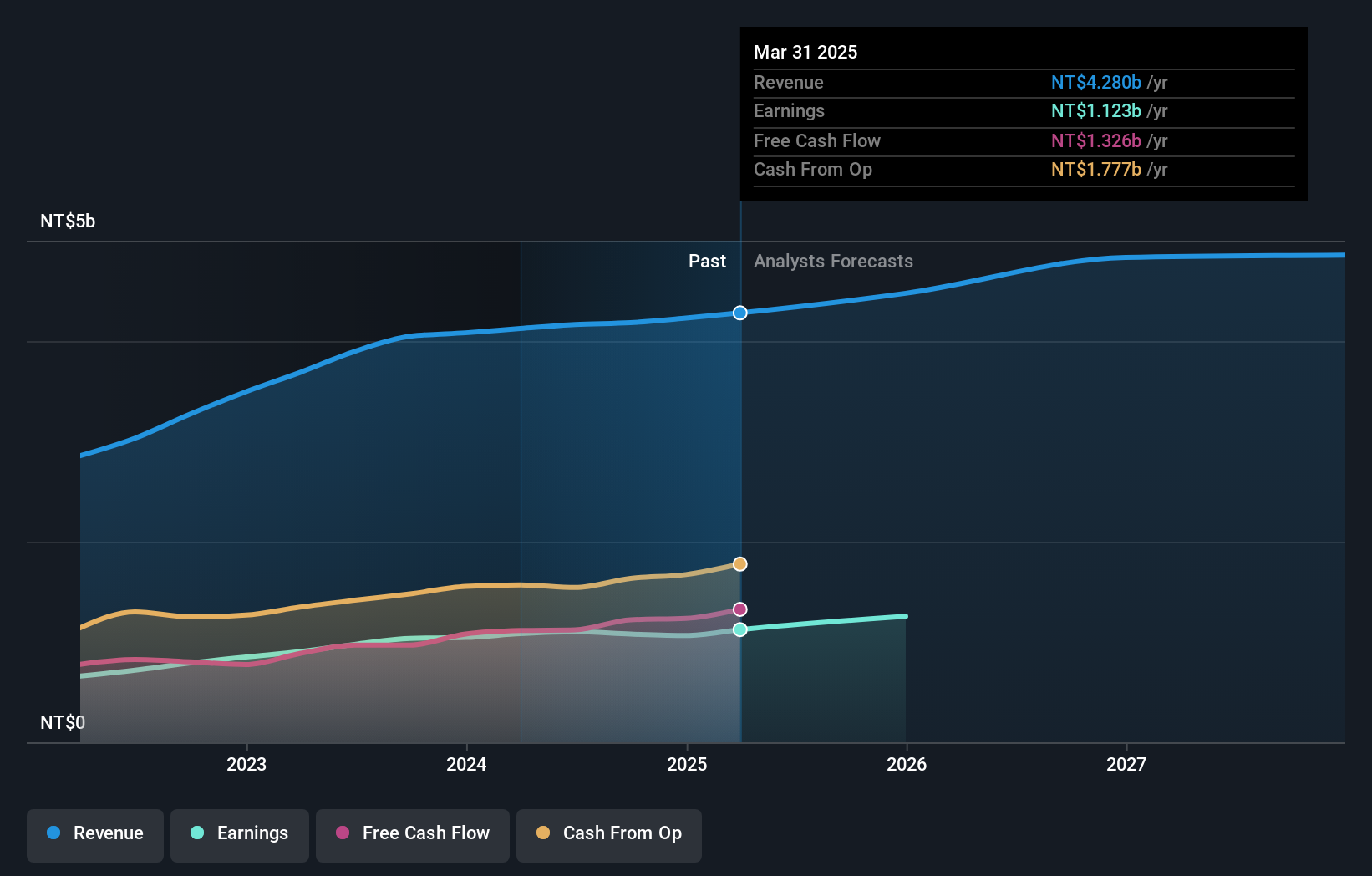

Universal Vision Biotechnology (TPEX:3218)

Simply Wall St Value Rating: ★★★★★☆

Overview: Universal Vision Biotechnology Co., Ltd. operates a chain of eye care clinics in Taiwan and China, with a market cap of NT$18.89 billion.

Operations: Universal Vision Biotechnology generates revenue primarily from its chain of eye care clinics in Taiwan and China. The company's financial performance is reflected in its market capitalization of NT$18.89 billion.

Universal Vision Biotechnology, a promising player in the healthcare sector, has shown a steady increase in earnings over the past five years at 27.8% annually. The company's recent quarterly sales reached TWD 1.08 billion, slightly up from last year's TWD 1.06 billion, though net income saw a dip to TWD 243.65 million from TWD 266.28 million previously. Despite this, Universal Vision remains attractive with its stock trading at nearly half its estimated fair value and maintaining high-quality earnings while managing interest payments effectively and having more cash than total debt on hand.

Seize The Opportunity

- Discover the full array of 4690 Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEP:TABAK

Philip Morris CR

Through its subsidiary, Philip Morris Slovakia s.r.o., manufactures and markets tobacco products under the Marlboro, L&M, Chesterfield, Petra Klasik, Sparta, and RGD brands in the Czech Republic and the Slovak Republic.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)