- Taiwan

- /

- Medical Equipment

- /

- TPEX:4138

What Would Shareholders Who Purchased Dynamic Medical Technologies'(GTSM:4138) Stock Five Years Ago Be Earning on Their Investment Today?

The main aim of stock picking is to find the market-beating stocks. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term Dynamic Medical Technologies Inc. (GTSM:4138) shareholders for doubting their decision to hold, with the stock down 30% over a half decade. The good news is that the stock is up 1.4% in the last week.

See our latest analysis for Dynamic Medical Technologies

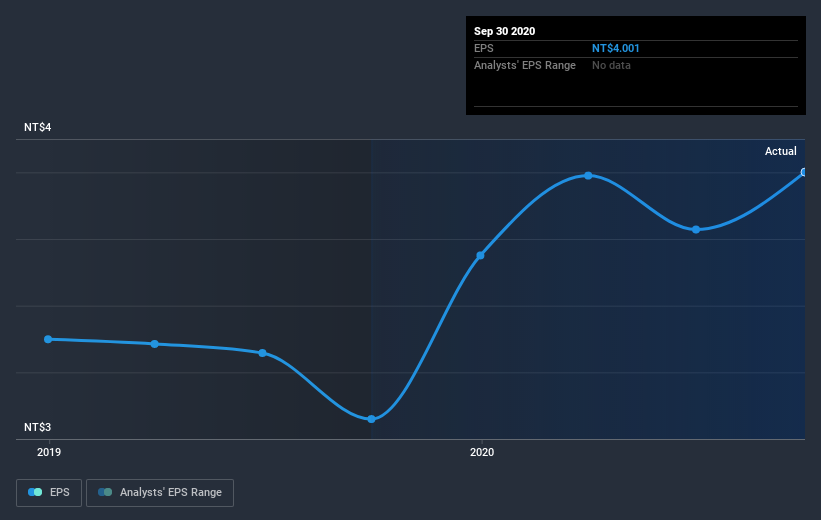

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Looking back five years, both Dynamic Medical Technologies' share price and EPS declined; the latter at a rate of 1.7% per year. This reduction in EPS is less than the 7% annual reduction in the share price. This implies that the market is more cautious about the business these days.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What about the Total Shareholder Return (TSR)?

We've already covered Dynamic Medical Technologies' share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Dynamic Medical Technologies shareholders, and that cash payout explains why its total shareholder loss of 4.7%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Dynamic Medical Technologies provided a TSR of 8.1% over the last twelve months. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 0.9% per year, over five years. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Dynamic Medical Technologies (of which 1 is a bit unpleasant!) you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade Dynamic Medical Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:4138

Dynamic Medical Technologies

Dynamic Medical Technologies Inc., together with its subsidiaries, maintains and markets aesthetic lasers and light-based equipment in Taiwan and Hong Kong.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives