Undiscovered Gems None And 2 Other Small Caps with Promising Potential

Reviewed by Simply Wall St

In a week marked by geopolitical tensions and concerns over consumer spending, major U.S. indices saw declines, with the S&P 600 for small-cap stocks reflecting broader market sentiment as it faced pressures from tariff fears and economic uncertainty. Amid these challenges, investors are increasingly on the lookout for potential opportunities in small-cap stocks that demonstrate resilience through strong fundamentals and innovative business models, characteristics that may position them well despite current market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Force Motors | 8.95% | 26.62% | 61.62% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Grade Upon Technology | 4.99% | 7.57% | 67.08% | ★★★★★★ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 31.26% | 0.80% | 0.71% | ★★★★☆☆ |

| Changshu Fengfan Power Equipment | 91.61% | 6.89% | 31.92% | ★★★★☆☆ |

| Yukiguni Maitake | 126.48% | -5.17% | -33.78% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

| Sichuan Dowell Science and Technology | 34.59% | 12.97% | -14.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Crystal Growth & Energy EquipmentLtd (SHSE:688478)

Simply Wall St Value Rating: ★★★★★★

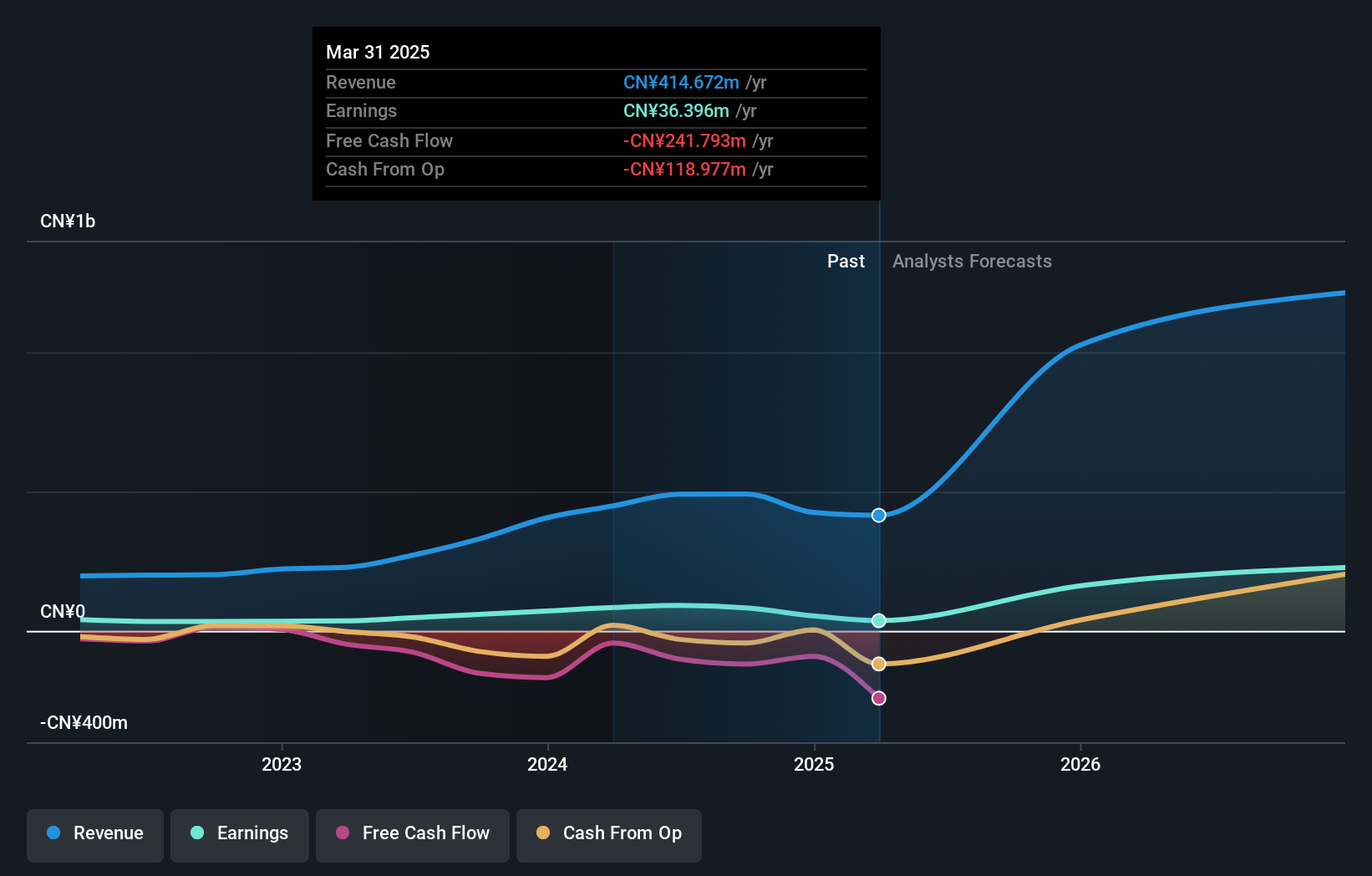

Overview: Crystal Growth & Energy Equipment Co., Ltd. (SHSE:688478) is a company involved in the development and production of equipment for crystal growth and energy applications, with a market capitalization of CN¥4.37 billion.

Operations: The company generates revenue primarily from the sale of equipment for crystal growth and energy applications. It has a market capitalization of CN¥4.37 billion.

Crystal Growth & Energy Equipment Ltd. showcases robust earnings growth, with a 39.5% increase over the past year, surpassing the Semiconductor industry's 13.9%. Despite not being free cash flow positive, it maintains a debt-free status and high-quality non-cash earnings. The company recently completed a share buyback of 1.23%, costing CNY 50.09 million (approximately US$7 million), which might enhance shareholder value. A notable acquisition saw Lu Yu acquire a 6.51% stake for CNY 290 million (around US$41 million). With earnings forecasted to grow at an impressive rate of over 43% annually, its prospects appear promising despite recent index exclusion challenges.

Jiangsu Smartwin Electronics TechnologyLtd (SZSE:301106)

Simply Wall St Value Rating: ★★★★★★

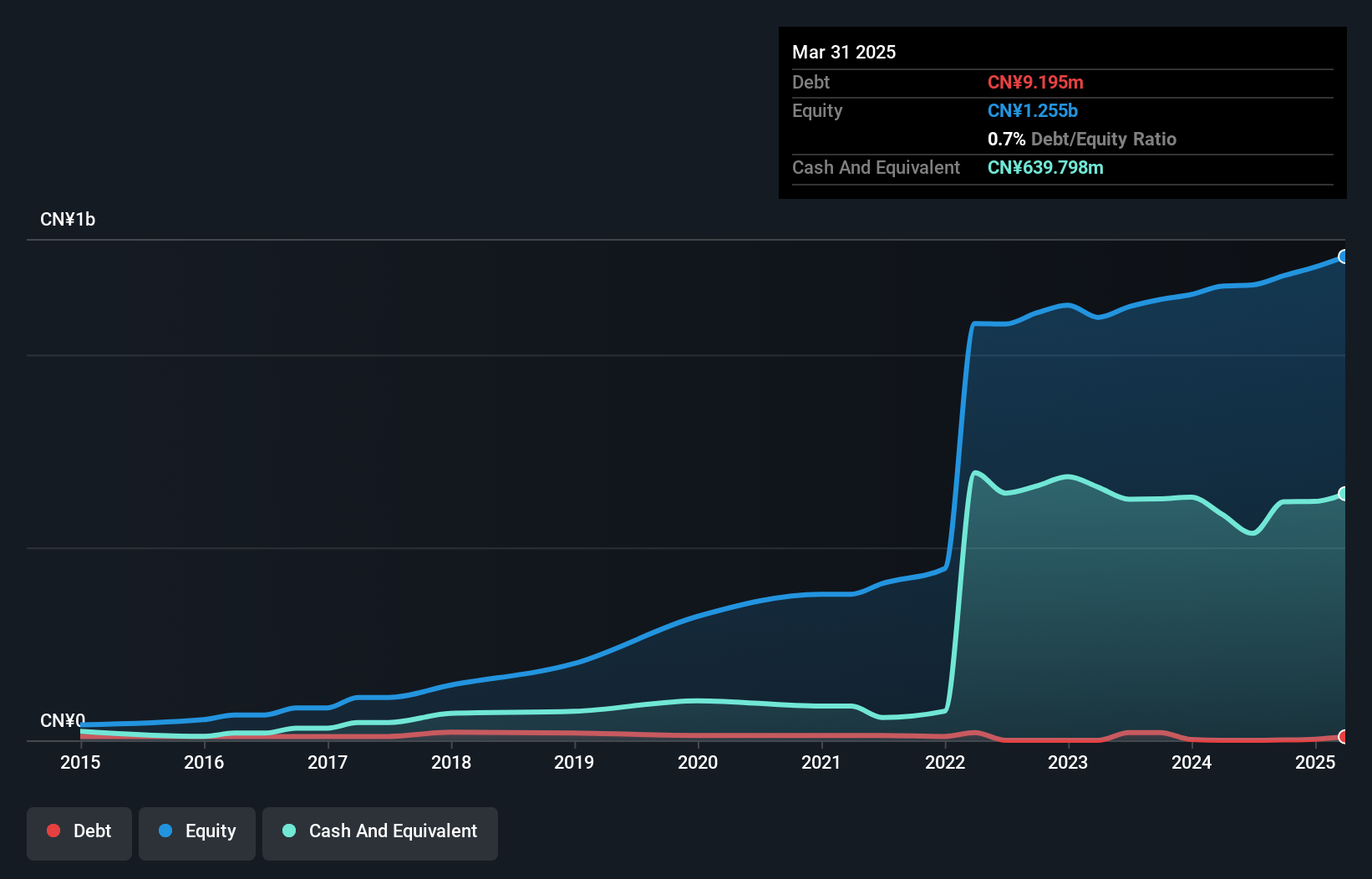

Overview: Jiangsu Smartwin Electronics Technology Co., Ltd. manufactures and sells liquid crystal displays and display modules both in China and internationally, with a market cap of CN¥3.16 billion.

Operations: Jiangsu Smartwin Electronics Technology Co., Ltd. generates revenue primarily from its electronic components and parts segment, totaling CN¥758.76 million.

Jiangsu Smartwin Electronics Technology, a nimble player in the electronics sector, showcases strong financial health with its debt-to-equity ratio dropping from 4.9 to 0.07 over five years and earnings growth of 16.8% last year, outpacing the industry average of 1.6%. The company seems to be managing its finances well, as it earns more interest than it pays and maintains high-quality past earnings. Despite a recent decision to cancel a private placement transaction approved by shareholders, Smartwin's price-to-earnings ratio of 34.7x remains attractive compared to the CN market average of 38.1x.

TTET Union (TWSE:1232)

Simply Wall St Value Rating: ★★★★★★

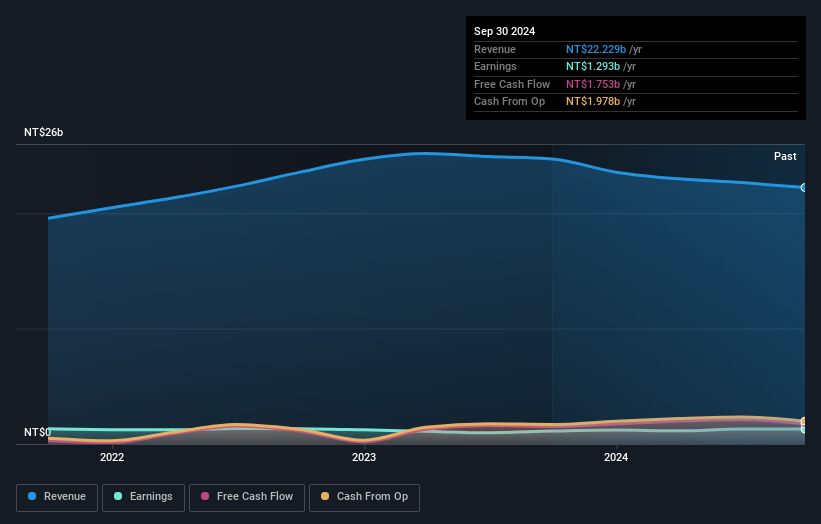

Overview: TTET Union Corporation is a soybean crusher with operations in Taiwan, Malaysia, Japan, and internationally, and has a market cap of NT$24.48 billion.

Operations: TTET Union generates revenue primarily from its Big Series Gains segment, amounting to NT$16.92 billion, and Master Channels Corporation, contributing NT$5.64 billion. The company also records a loss of NT$0.33 billion from its Internal Divisions segment.

TTET Union, a smaller player in the financial sector, showcases robust performance with high-quality earnings and interest payments well-covered by profits. The company is trading at 60% below its estimated fair value, suggesting potential undervaluation. Over the past year, earnings grew by 15%, outpacing the food industry's growth of 13%. With a debt-to-equity ratio reduced from 9.9 to 0.6 over five years, TTET's financial health appears solid. Recent events include proposed amendments to their Articles of Incorporation and forthcoming fiscal results announcement on February 20, which may provide further insights into their strategic direction.

- Get an in-depth perspective on TTET Union's performance by reading our health report here.

Gain insights into TTET Union's historical performance by reviewing our past performance report.

Key Takeaways

- Explore the 4757 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TTET Union might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1232

TTET Union

Operates as a soybean crusher in Taiwan, Malaysia, Japan, and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)