- Taiwan

- /

- Hospitality

- /

- TWSE:2727

Wowprime Corp.'s (TPE:2727) Stock Is Rallying But Financials Look Ambiguous: Will The Momentum Continue?

Wowprime's (TPE:2727) stock is up by a considerable 52% over the past month. But the company's key financial indicators appear to be differing across the board and that makes us question whether or not the company's current share price momentum can be maintained. Particularly, we will be paying attention to Wowprime's ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Wowprime

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Wowprime is:

6.2% = NT$256m ÷ NT$4.1b (Based on the trailing twelve months to December 2020).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every NT$1 worth of equity, the company was able to earn NT$0.06 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Wowprime's Earnings Growth And 6.2% ROE

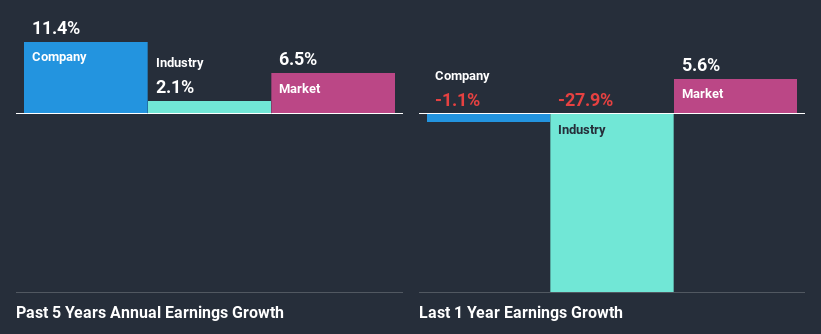

On the face of it, Wowprime's ROE is not much to talk about. However, its ROE is similar to the industry average of 7.5%, so we won't completely dismiss the company. On the other hand, Wowprime reported a moderate 11% net income growth over the past five years. Considering the moderately low ROE, it is quite possible that there might be some other aspects that are positively influencing the company's earnings growth. Such as - high earnings retention or an efficient management in place.

Next, on comparing with the industry net income growth, we found that Wowprime's growth is quite high when compared to the industry average growth of 2.1% in the same period, which is great to see.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. Is 2727 fairly valued? This infographic on the company's intrinsic value has everything you need to know.

Is Wowprime Efficiently Re-investing Its Profits?

The really high three-year median payout ratio of 103% for Wowprime suggests that the company is paying its shareholders more than what it is earning. In spite of this, the company was able to grow its earnings respectably, as we saw above. Although, the high payout ratio is certainly something we would keep an eye on if the company is not able to keep up its growth, or if business deteriorates. You can see the 2 risks we have identified for Wowprime by visiting our risks dashboard for free on our platform here.

Additionally, Wowprime has paid dividends over a period of nine years which means that the company is pretty serious about sharing its profits with shareholders.

Conclusion

On the whole, we feel that the performance shown by Wowprime can be open to many interpretations. While the company has posted impressive earnings growth, its poor ROE and low earnings retention makes us doubtful if that growth could continue, if by any chance the business is faced with any sort of risk. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. To gain further insights into Wowprime's past profit growth, check out this visualization of past earnings, revenue and cash flows.

When trading Wowprime or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wowprime might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:2727

Wowprime

Operates restaurants and coffee/tea shops in Taiwan and Mainland China.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026