- Taiwan

- /

- Hospitality

- /

- TPEX:2729

Here's Why TTFB's (GTSM:2729) Statutory Earnings Are Arguably Too Conservative

Broadly speaking, profitable businesses are less risky than unprofitable ones. That said, the current statutory profit is not always a good guide to a company's underlying profitability. In this article, we'll look at how useful this year's statutory profit is, when analysing TTFB (GTSM:2729).

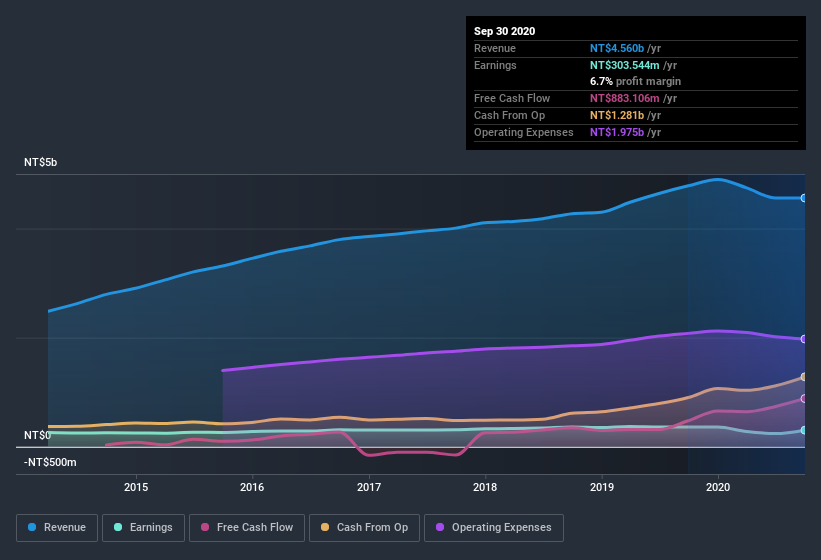

While TTFB was able to generate revenue of NT$4.56b in the last twelve months, we think its profit result of NT$303.5m was more important. The chart below shows how it has grown revenue over the last three years, but that profit has declined.

Check out our latest analysis for TTFB

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. As a result, we think it's well worth considering what TTFB's cashflow (when compared to its earnings) can tell us about the nature of its statutory profit. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of TTFB.

Zooming In On TTFB's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

TTFB has an accrual ratio of -0.39 for the year to September 2020. Therefore, its statutory earnings were very significantly less than its free cashflow. In fact, it had free cash flow of NT$883m in the last year, which was a lot more than its statutory profit of NT$303.5m. TTFB's free cash flow improved over the last year, which is generally good to see.

Our Take On TTFB's Profit Performance

Happily for shareholders, TTFB produced plenty of free cash flow to back up its statutory profit numbers. Because of this, we think TTFB's underlying earnings potential is as good as, or possibly even better, than the statutory profit makes it seem! On the other hand, its EPS actually shrunk in the last twelve months. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. At Simply Wall St, we found 2 warning signs for TTFB and we think they deserve your attention.

Today we've zoomed in on a single data point to better understand the nature of TTFB's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading TTFB or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TTFB might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:2729

TTFB

Engages in chain catering businesses in Taiwan, Shanghai, and Suzhou.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026