- Taiwan

- /

- Hospitality

- /

- TPEX:1259

Reflecting on An-Shin Food ServicesLtd's (GTSM:1259) Share Price Returns Over The Last Three Years

Many investors define successful investing as beating the market average over the long term. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term An-Shin Food Services Co.,Ltd. (GTSM:1259) shareholders have had that experience, with the share price dropping 16% in three years, versus a market return of about 60%. It's up 1.3% in the last seven days.

Check out our latest analysis for An-Shin Food ServicesLtd

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

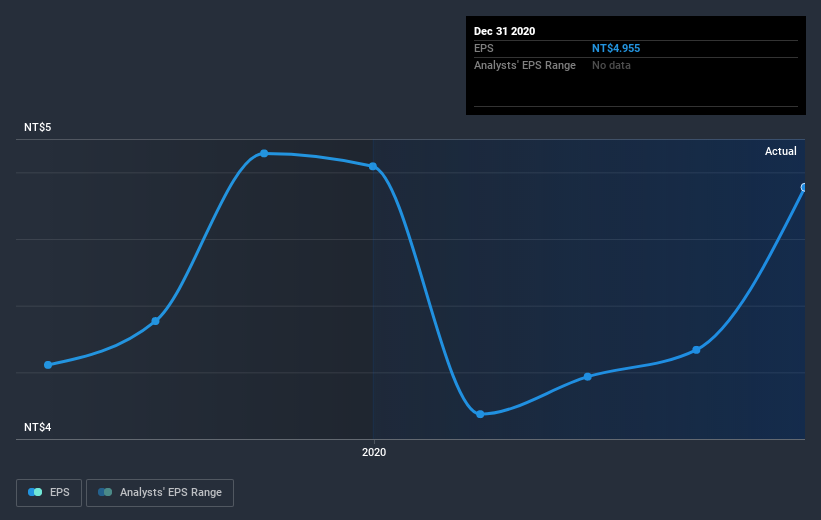

During the three years that the share price fell, An-Shin Food ServicesLtd's earnings per share (EPS) dropped by 1.8% each year. The share price decline of 6% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into An-Shin Food ServicesLtd's key metrics by checking this interactive graph of An-Shin Food ServicesLtd's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of An-Shin Food ServicesLtd, it has a TSR of -4.6% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

An-Shin Food ServicesLtd provided a TSR of 2.4% over the last twelve months. But that was short of the market average. On the bright side, the longer term returns (running at about 4% a year, over half a decade) look better. Maybe the share price is just taking a breather while the business executes on its growth strategy. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for An-Shin Food ServicesLtd (of which 1 is significant!) you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade An-Shin Food ServicesLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:1259

An-Shin Food ServicesLtd

Operates a chain of fast food restaurants under the MOS BURGER name in Taiwan and Mainland China.

Moderate risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives