- Taiwan

- /

- Tech Hardware

- /

- TWSE:2382

Growth Companies With High Insider Ownership And Up To 31% Earnings Growth

Reviewed by Simply Wall St

In the midst of recent market volatility and economic uncertainties, investors are seeking stability and potential growth opportunities. Despite the S&P 500 nearing correction territory and fluctuating consumer demand, certain growth companies with high insider ownership offer promising prospects. High insider ownership often indicates confidence in a company's future, which can be especially reassuring during turbulent times. In this article, we will explore three such companies that have demonstrated up to 31% earnings growth.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| Medley (TSE:4480) | 34% | 28.7% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 36.4% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.8% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Calliditas Therapeutics (OM:CALTX) | 12.7% | 52.9% |

| Adveritas (ASX:AV1) | 21.1% | 103.9% |

| Vow (OB:VOW) | 31.7% | 97.7% |

| UTI (KOSDAQ:A179900) | 33.1% | 122.7% |

Let's uncover some gems from our specialized screener.

Micro-Star International (TWSE:2377)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Micro-Star International Co., Ltd. manufactures and sells motherboards, interface cards, notebook computers, and other electronic products globally, with a market cap of NT$140.67 billion.

Operations: Micro-Star International Co., Ltd. generates revenue from the sale of motherboards, interface cards, notebook computers, and other electronic products across Asia, Europe, the United States, and internationally.

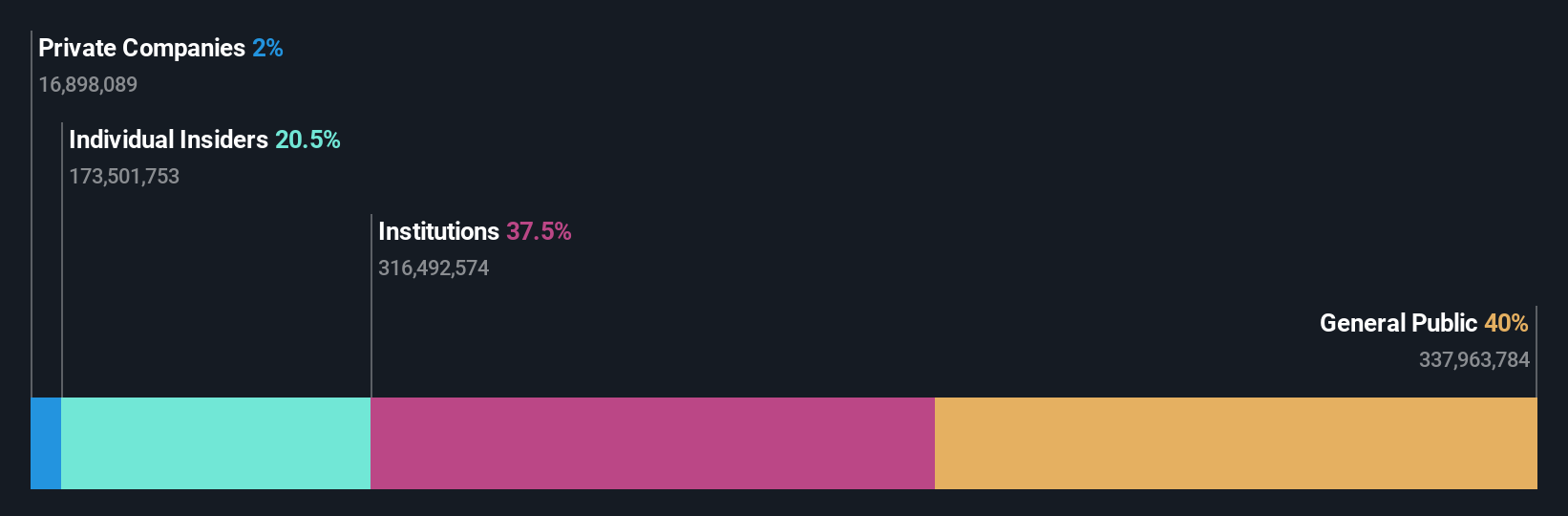

Insider Ownership: 20.5%

Earnings Growth Forecast: 30.1% p.a.

Micro-Star International (MSI) demonstrates characteristics of a growth company with high insider ownership. Recent earnings reports show solid growth, with Q2 sales at TWD 46.67 billion and net income at TWD 2.11 billion, reflecting year-over-year improvements. The company's focus on cutting-edge technologies like CXL-based server platforms positions it well in high-performance computing markets. While the dividend yield is not fully covered by free cash flows, MSI's earnings are forecasted to grow significantly over the next three years, indicating strong future potential.

- Unlock comprehensive insights into our analysis of Micro-Star International stock in this growth report.

- According our valuation report, there's an indication that Micro-Star International's share price might be on the cheaper side.

Quanta Computer (TWSE:2382)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Quanta Computer Inc. manufactures and sells notebook computers across Asia, the Americas, Europe, and internationally, with a market cap of NT$963.63 billion.

Operations: Revenue Segments (in millions of NT$): Quanta Computer Inc. generates revenue primarily through the manufacture and sale of notebook computers, serving markets in Asia, the Americas, Europe, and beyond.

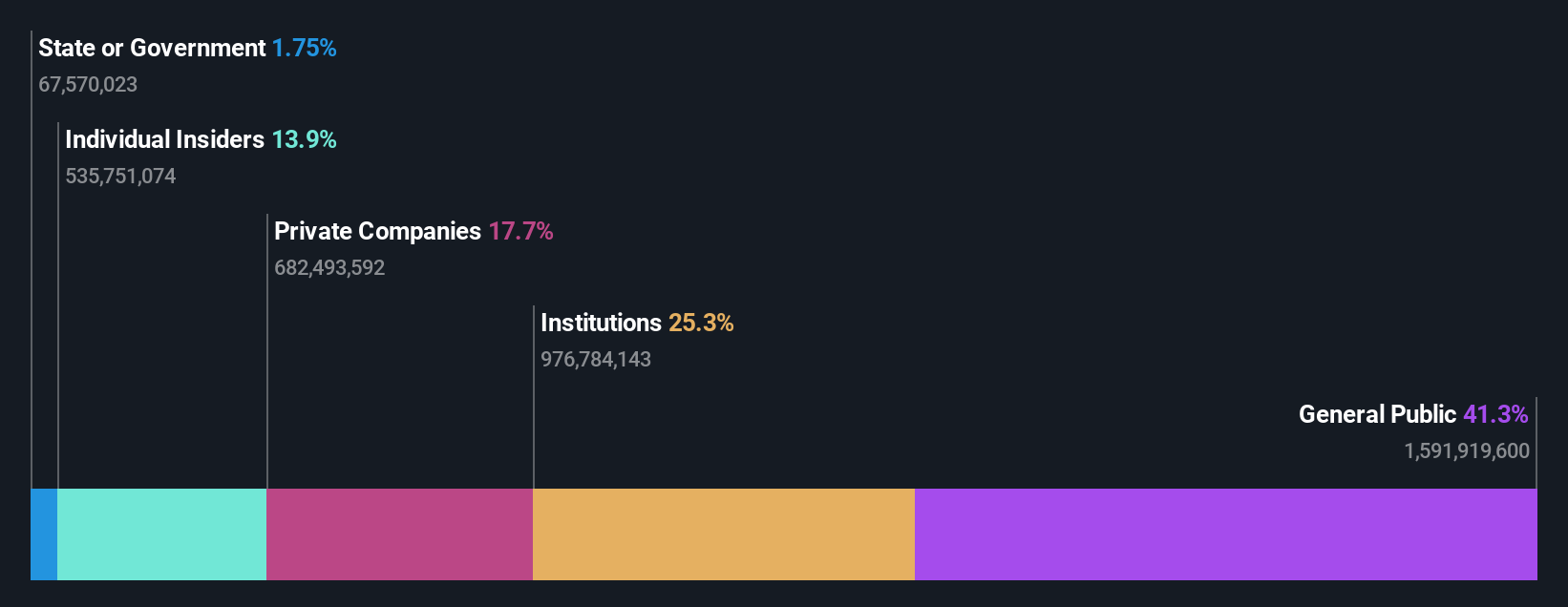

Insider Ownership: 13.7%

Earnings Growth Forecast: 19.4% p.a.

Quanta Computer exhibits traits of a growth company with high insider ownership. Recent Q2 earnings showed robust performance, with sales reaching TWD 309.95 billion and net income at TWD 15.13 billion, both up significantly year-over-year. The partnership with Obsidian Sensors to produce thermal imaging cameras for automobiles aligns well with future market needs, particularly given new safety regulations. Forecasts indicate strong revenue growth at 38.1% annually, outpacing the broader TW market's expectations.

- Navigate through the intricacies of Quanta Computer with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Quanta Computer is priced lower than what may be justified by its financials.

Merida Industry (TWSE:9914)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Merida Industry Co., Ltd. manufactures and sells bicycles and components across Taiwan, China, Hong Kong, Japan, and Europe with a market cap of NT$71.01 billion.

Operations: The company generates NT$24.72 billion from the manufacturing and sales of bicycles and their parts across its operational regions.

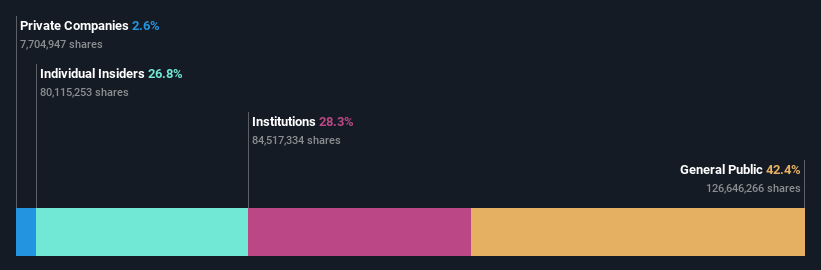

Insider Ownership: 26.8%

Earnings Growth Forecast: 31.8% p.a.

Merida Industry's earnings are forecast to grow 31.84% annually, significantly outpacing the TW market's 18.8%. Despite a recent decrease in dividends to TWD 6.0 per share, insider ownership remains robust with no substantial selling over the past three months. Revenue is expected to grow at 14% annually, faster than the market average of 11.7%. Recent board changes and corporate charter amendments indicate active governance aimed at sustaining growth momentum.

- Click to explore a detailed breakdown of our findings in Merida Industry's earnings growth report.

- The valuation report we've compiled suggests that Merida Industry's current price could be inflated.

Make It Happen

- Get an in-depth perspective on all 1472 Fast Growing Companies With High Insider Ownership by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Quanta Computer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2382

Quanta Computer

Manufactures and sells notebook computers in Asia, the Americas, Europe, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.