Even With A 28% Surge, Cautious Investors Are Not Rewarding Paiho Shih Holdings Corporation's (TWSE:8404) Performance Completely

Paiho Shih Holdings Corporation (TWSE:8404) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 9.8% isn't as impressive.

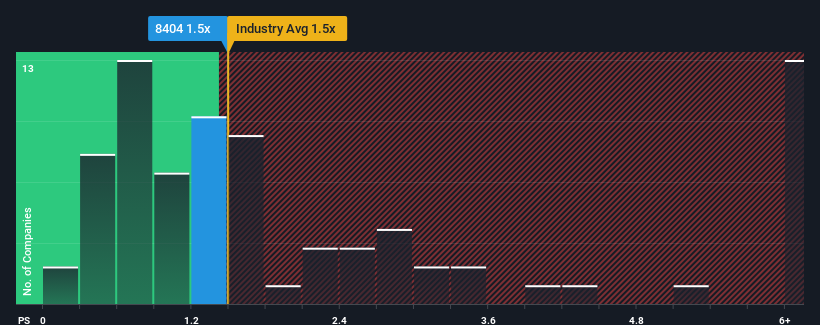

Although its price has surged higher, there still wouldn't be many who think Paiho Shih Holdings' price-to-sales (or "P/S") ratio of 1.5x is worth a mention when it essentially matches the median P/S in Taiwan's Luxury industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Paiho Shih Holdings

How Has Paiho Shih Holdings Performed Recently?

Recent revenue growth for Paiho Shih Holdings has been in line with the industry. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Paiho Shih Holdings.How Is Paiho Shih Holdings' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Paiho Shih Holdings' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 7.6% gain to the company's revenues. Still, lamentably revenue has fallen 32% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 26% as estimated by the lone analyst watching the company. That's shaping up to be materially higher than the 12% growth forecast for the broader industry.

In light of this, it's curious that Paiho Shih Holdings' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Paiho Shih Holdings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Paiho Shih Holdings currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Paiho Shih Holdings (2 are a bit unpleasant!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:8404

Paiho Shih Holdings

Through its subsidiaries, engages in production and sale of fasteners, elastics, ribbons, laces, and other accessories, textiles as well as sells real estate properties in Cayman Islands and internationally.

Questionable track record with very low risk.

Market Insights

Community Narratives