It's Down 27% But Lai Yih Footwear Co., Ltd. (TWSE:6890) Could Be Riskier Than It Looks

Lai Yih Footwear Co., Ltd. (TWSE:6890) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

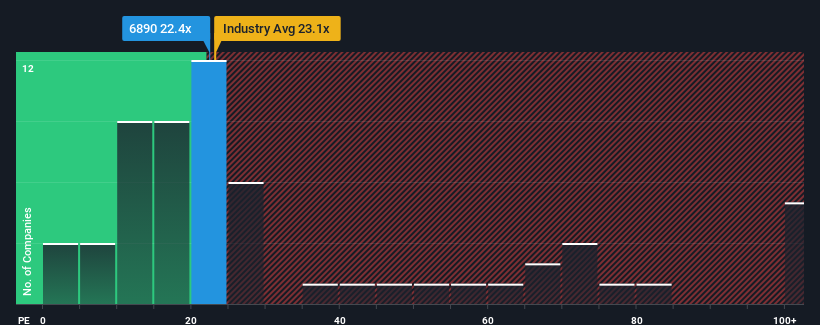

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Lai Yih Footwear's P/E ratio of 22.4x, since the median price-to-earnings (or "P/E") ratio in Taiwan is also close to 21x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's superior to most other companies of late, Lai Yih Footwear has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Lai Yih Footwear

How Is Lai Yih Footwear's Growth Trending?

In order to justify its P/E ratio, Lai Yih Footwear would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 157% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 1,425% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 25% per annum during the coming three years according to the seven analysts following the company. That's shaping up to be materially higher than the 15% each year growth forecast for the broader market.

In light of this, it's curious that Lai Yih Footwear's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Lai Yih Footwear's P/E

Lai Yih Footwear's plummeting stock price has brought its P/E right back to the rest of the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Lai Yih Footwear's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with Lai Yih Footwear (including 1 which is concerning).

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6890

Lai Yih Footwear

Produces and sells vulcanized shoes, athletic footwear, cold-pressed shoes, and specialized functional footwear.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives