- Taiwan

- /

- Consumer Durables

- /

- TWSE:6807

FY Group Ltd. (TWSE:6807) Stock Catapults 25% Though Its Price And Business Still Lag The Market

The FY Group Ltd. (TWSE:6807) share price has done very well over the last month, posting an excellent gain of 25%. The annual gain comes to 183% following the latest surge, making investors sit up and take notice.

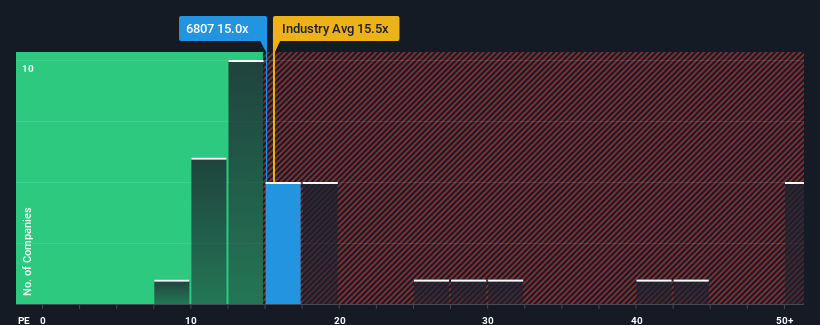

In spite of the firm bounce in price, given about half the companies in Taiwan have price-to-earnings ratios (or "P/E's") above 22x, you may still consider FY Group as an attractive investment with its 15x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for FY Group as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for FY Group

Is There Any Growth For FY Group?

In order to justify its P/E ratio, FY Group would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 61% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 42% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's an unpleasant look.

In light of this, it's understandable that FY Group's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Key Takeaway

The latest share price surge wasn't enough to lift FY Group's P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of FY Group revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 1 warning sign for FY Group you should be aware of.

Of course, you might also be able to find a better stock than FY Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6807

FY Group

Engages in the research, development, manufacture, and sale of indoor furniture in Taiwan, Europe, the United States, and Japan.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives