Exploring Harvia Oyj And 2 Other Small Cap Gems with Strong Potential

Reviewed by Simply Wall St

In a global market environment marked by moderate gains in major stock indexes and declining U.S. consumer confidence, small-cap stocks have shown resilience despite broader economic uncertainties. As investors navigate these fluctuating conditions, identifying promising small-cap companies like Harvia Oyj can offer unique opportunities for growth, particularly when they demonstrate strong fundamentals and potential to thrive amidst current challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AOKI Holdings | 30.67% | 2.30% | 45.17% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| GENOVA | 0.65% | 29.95% | 29.18% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.54% | 16.85% | 21.57% | ★★★★☆☆ |

| Nippon Sharyo | 60.16% | -1.87% | -14.86% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Harvia Oyj (HLSE:HARVIA)

Simply Wall St Value Rating: ★★★★☆☆

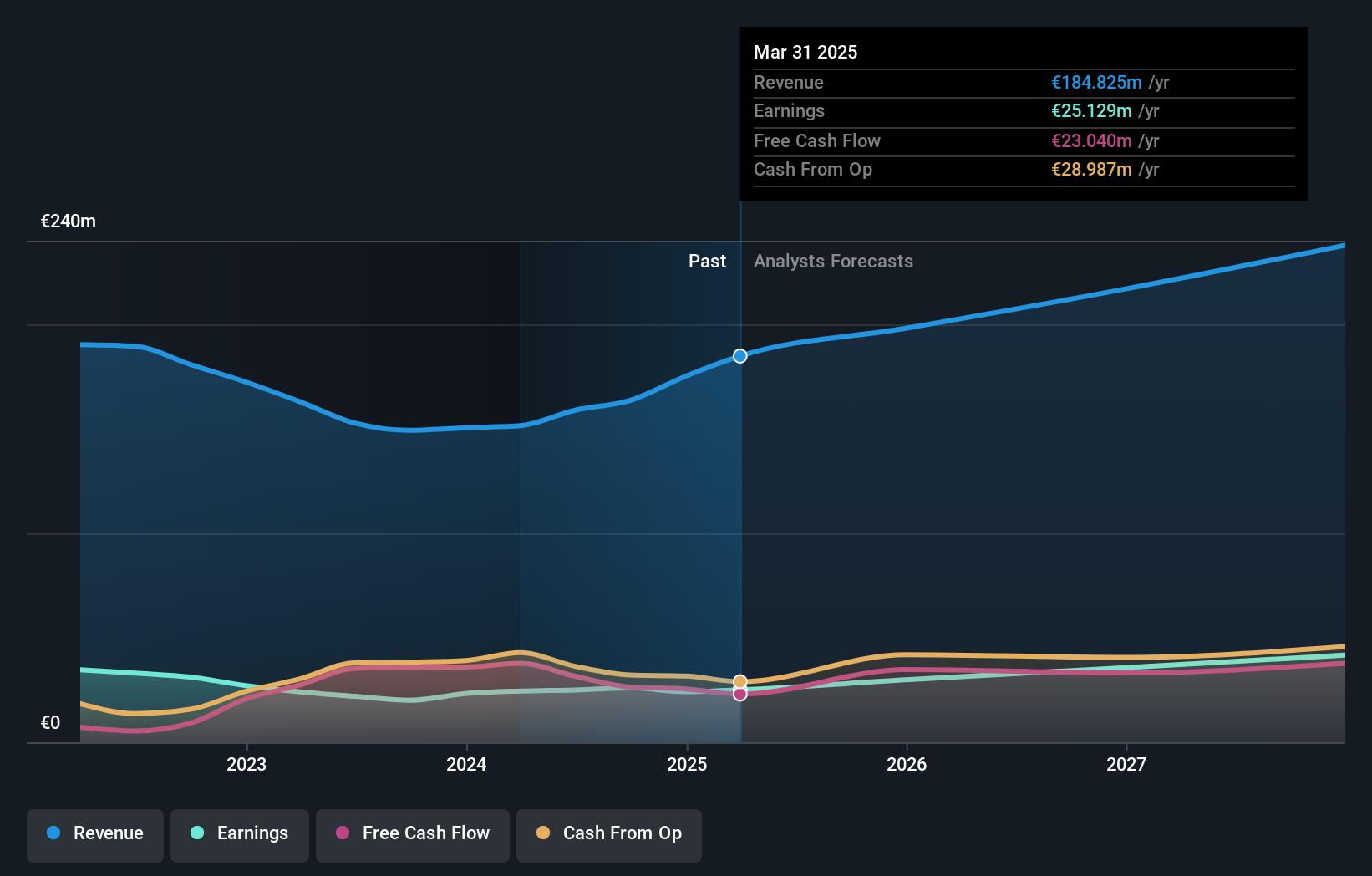

Overview: Harvia Oyj is a company that specializes in the manufacturing and distribution of traditional, steam, and infrared saunas, with a market capitalization of €812.08 million.

Operations: Harvia generates revenue primarily from its Building Materials - HVAC Equipment segment, totaling €163.66 million.

Harvia, a promising player in the leisure industry, has shown robust earnings growth of 29.5% over the past year, outpacing its industry peers. Despite a high net debt to equity ratio of 47%, its interest payments are comfortably covered with an EBIT coverage of 14.6 times. Recent financial results highlight a positive trajectory with third-quarter sales reaching €38.72 million and net income at €5.46 million, both improving from last year. With shares trading below estimated fair value and strategic leadership appointments like Ivan Sabato's, Harvia seems poised for continued growth in profitability and market presence.

- Click here to discover the nuances of Harvia Oyj with our detailed analytical health report.

Explore historical data to track Harvia Oyj's performance over time in our Past section.

Raoom trading (SASE:9529)

Simply Wall St Value Rating: ★★★★★★

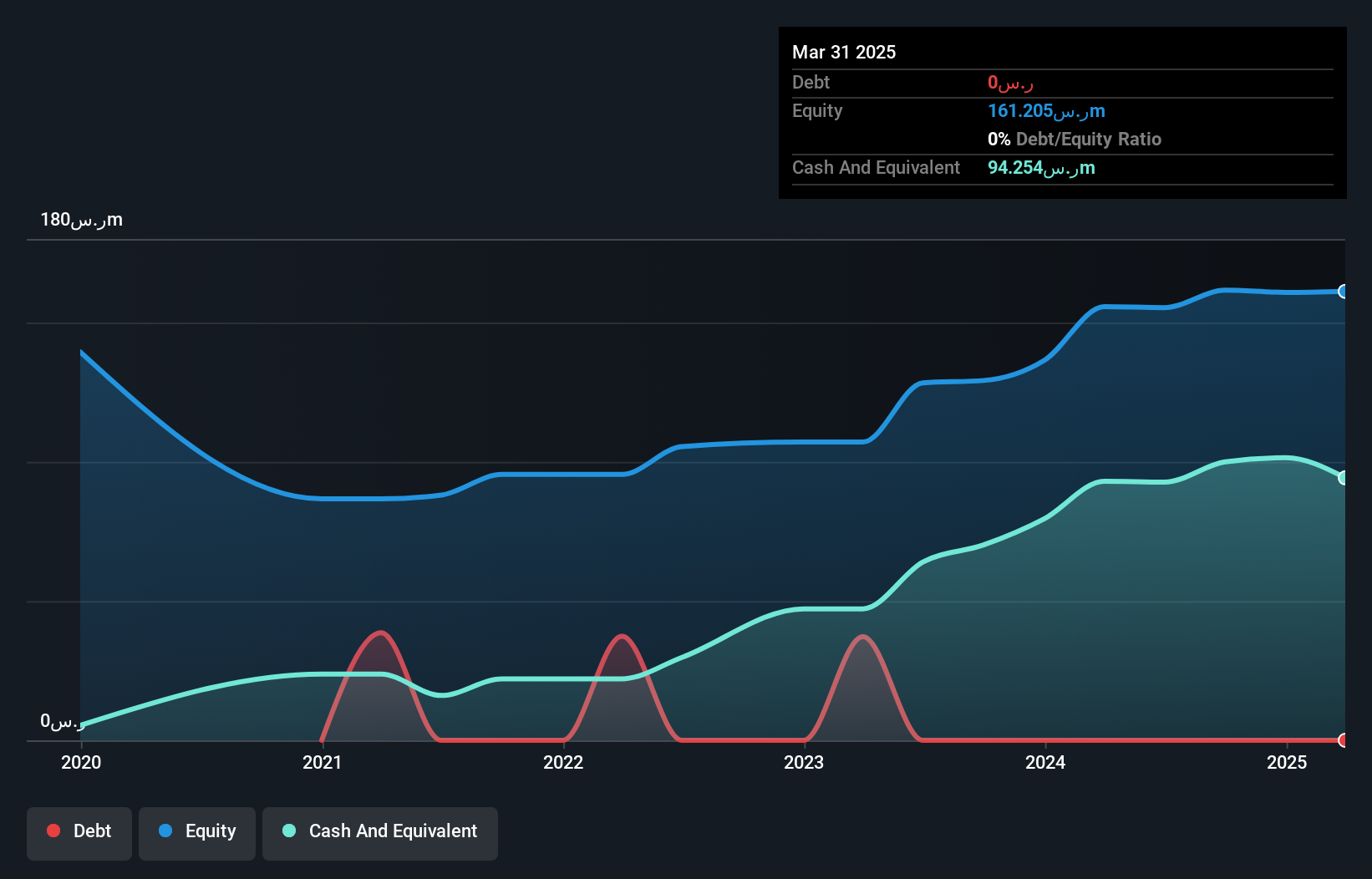

Overview: Raoom Trading Company engages in the manufacturing, processing, and trading of glass, mirrors, and aluminum decorations across the Kingdom of Saudi Arabia and Gulf countries with a market capitalization of SAR1.12 billion.

Operations: Raoom Trading generates revenue through the manufacturing, processing, and trading of glass, mirrors, and aluminum decorations. The company operates primarily within Saudi Arabia and Gulf countries.

Raoom Trading, a nimble player in its field, has shown resilience with a notable 13.1% earnings growth over the past year, outpacing the Building industry which saw an -11.6% trend. The company is debt-free and boasts a price-to-earnings ratio of 22.5x, slightly undercutting the SA market's average of 23.5x, suggesting potential value for investors seeking opportunities in smaller companies. Despite sales dipping to SAR 27.32 million from SAR 32.13 million in Q3 year-on-year, net income rose to SAR 10.97 million from SAR 8.74 million—a testament to its efficient operations amidst volatility and challenges in sales performance.

- Click here and access our complete health analysis report to understand the dynamics of Raoom trading.

Evaluate Raoom trading's historical performance by accessing our past performance report.

Sports Gear (TWSE:6768)

Simply Wall St Value Rating: ★★★★★★

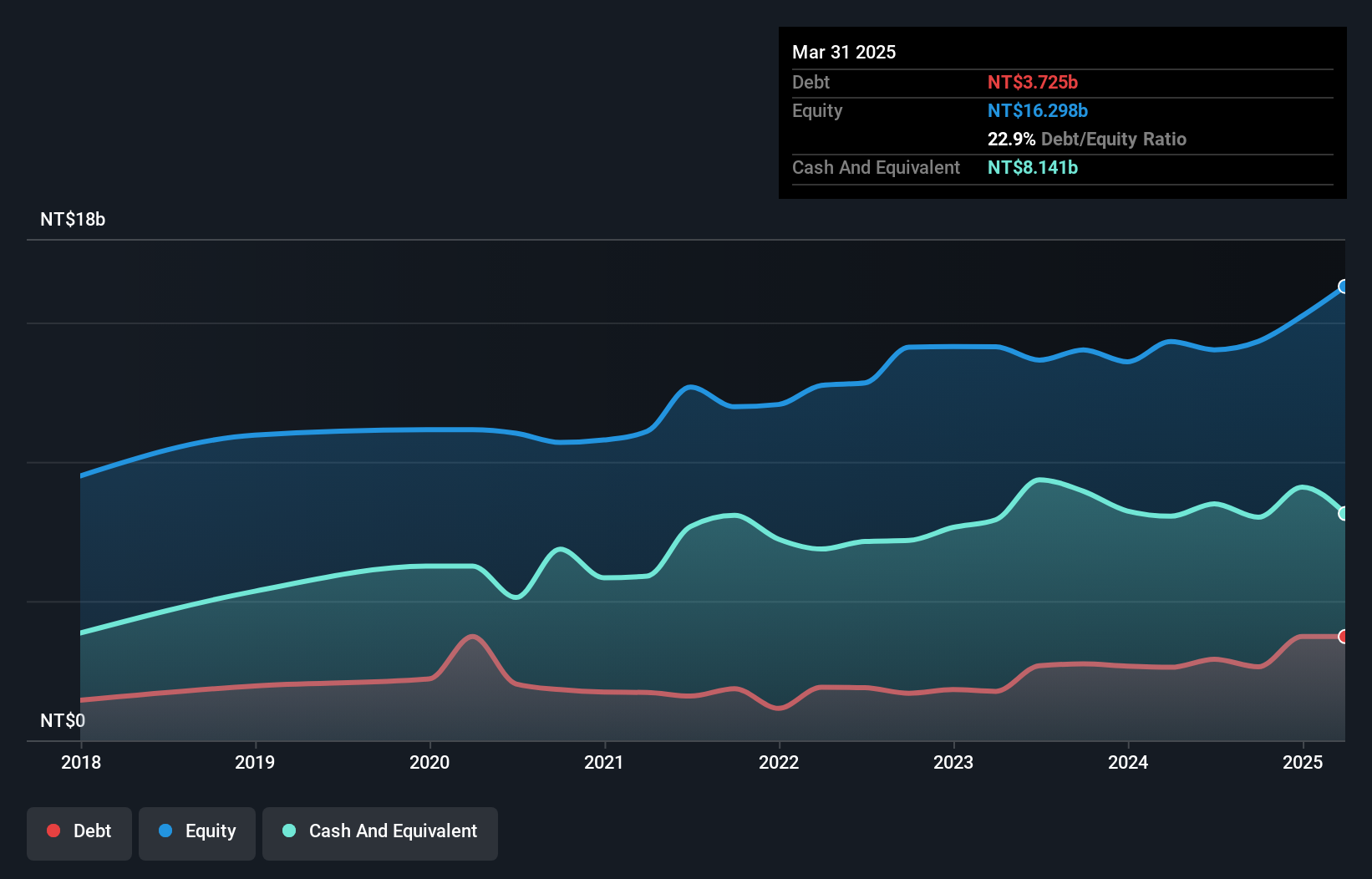

Overview: Sports Gear Co., Ltd. manufactures and sells OEM footwear products across the United States, Europe, Asia, China, Taiwan, and internationally with a market cap of NT$23.53 billion.

Operations: Sports Gear generates its revenue primarily from its footwear manufacturing business, amounting to NT$17.27 billion.

Sports Gear, a dynamic player in the sports equipment industry, is showing strong performance metrics. The company reported a significant increase in net income for the third quarter of 2024 at TWD 344 million, up from TWD 82 million the previous year. Revenue growth is robust with November's figures hitting US$51.95 million, marking a 9% rise from last year. Notably, earnings per share have surged to TWD 1.76 from TWD 0.42 year-on-year for Q3. Despite its smaller market cap status, Sports Gear's strategic moves like its recent fixed-income offering of TWD 1 billion suggest promising prospects ahead.

- Click to explore a detailed breakdown of our findings in Sports Gear's health report.

Examine Sports Gear's past performance report to understand how it has performed in the past.

Key Takeaways

- Explore the 4645 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harvia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:HARVIA

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives