- Taiwan

- /

- Consumer Durables

- /

- TWSE:6743

AMPACS Corporation (TWSE:6743) Soars 25% But It's A Story Of Risk Vs Reward

AMPACS Corporation (TWSE:6743) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Unfortunately, despite the strong performance over the last month, the full year gain of 3.0% isn't as attractive.

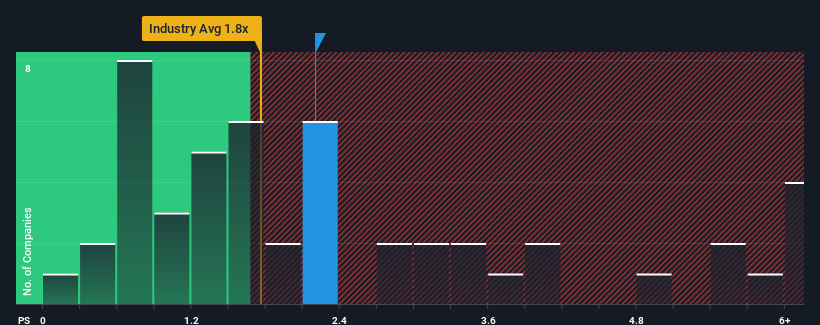

Even after such a large jump in price, there still wouldn't be many who think AMPACS' price-to-sales (or "P/S") ratio of 2.2x is worth a mention when the median P/S in Taiwan's Consumer Durables industry is similar at about 1.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for AMPACS

How Has AMPACS Performed Recently?

AMPACS has been struggling lately as its revenue has declined faster than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on AMPACS will help you uncover what's on the horizon.How Is AMPACS' Revenue Growth Trending?

In order to justify its P/S ratio, AMPACS would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 24%. The last three years don't look nice either as the company has shrunk revenue by 23% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 88% as estimated by the sole analyst watching the company. With the industry only predicted to deliver 15%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that AMPACS is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does AMPACS' P/S Mean For Investors?

AMPACS appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at AMPACS' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

You always need to take note of risks, for example - AMPACS has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on AMPACS, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6743

AMPACS

Designs, manufactures, and sells consumer electronics and the development of plastic components and molds.

Proven track record and fair value.

Market Insights

Community Narratives