- Taiwan

- /

- Consumer Durables

- /

- TWSE:2439

Undiscovered Gems Three Stocks to Watch in December 2024

Reviewed by Simply Wall St

As global markets react to the Federal Reserve's cautious stance on interest rates and political uncertainties, smaller-cap indexes have notably struggled, reflecting broader investor anxiety. Despite these challenges, the resilience of certain economic indicators suggests opportunities for discerning investors willing to explore beyond the usual suspects. In this environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding for those seeking undiscovered gems in a volatile market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Libra Insurance | 38.26% | 44.30% | 56.31% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

ASRock Rack Incorporation (TPEX:7711)

Simply Wall St Value Rating: ★★★★★★

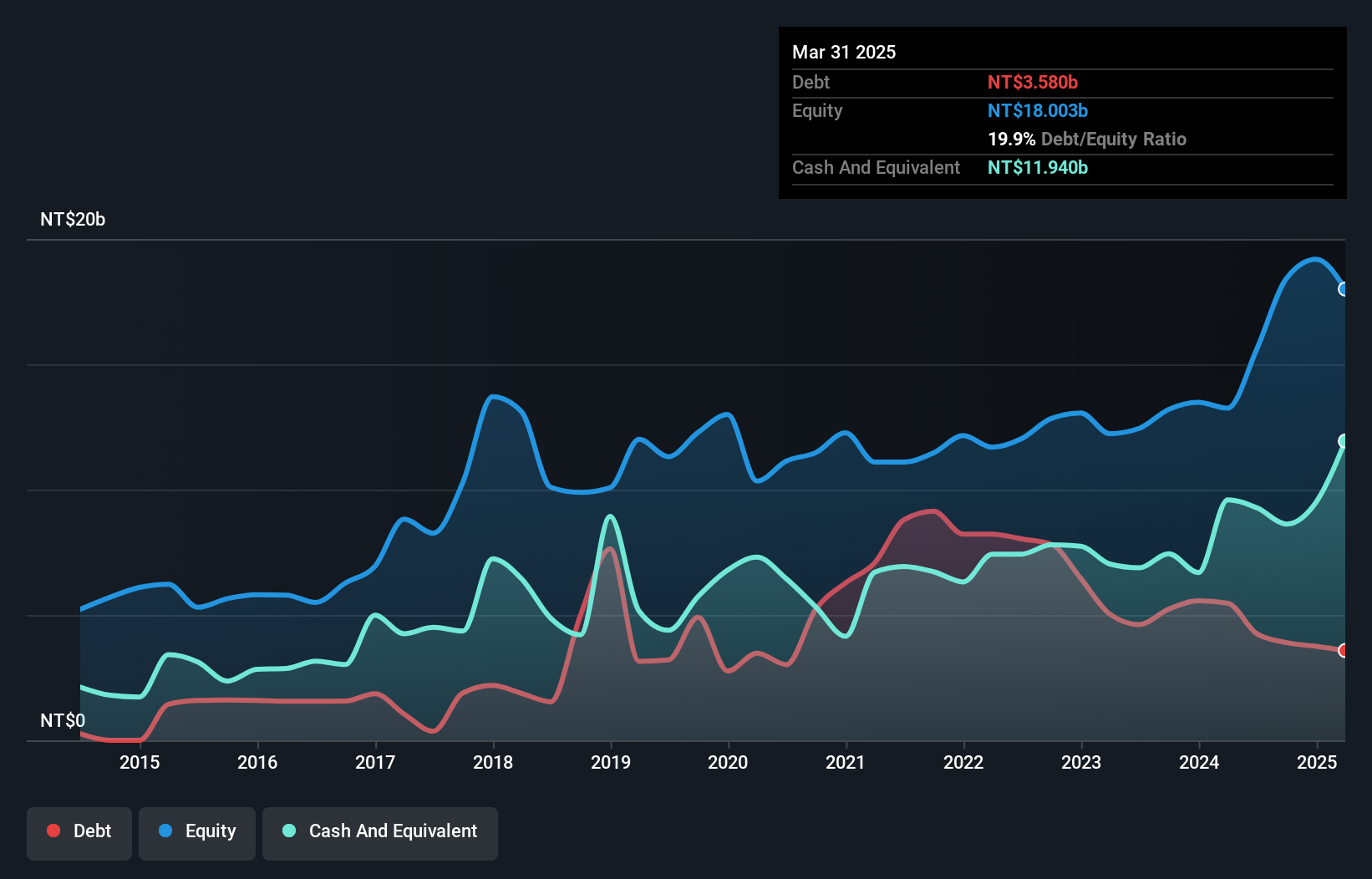

Overview: ASRock Rack Incorporation specializes in developing and selling server motherboards and systems both in Taiwan and internationally, with a market cap of NT$18.88 billion.

Operations: ASRock Rack generates its revenue primarily from the sale of server motherboards and systems across Taiwan and international markets. The company's financial performance is reflected in its market capitalization of NT$18.88 billion.

ASRock Rack Incorporation is making waves with a notable 269% earnings growth over the past year, outpacing the tech industry's 11.4%. The company operates debt-free, eliminating concerns about interest coverage and highlighting its financial prudence. Despite being highly illiquid, it trades at a substantial 65.4% discount to its estimated fair value, suggesting potential undervaluation. Recent board changes and a successful funding round on October 31, 2024, indicate strategic shifts and strengthened capital positions. This small cap's high-quality earnings and positive free cash flow position it as an intriguing prospect in the tech sector.

K&O Energy Group (TSE:1663)

Simply Wall St Value Rating: ★★★★★★

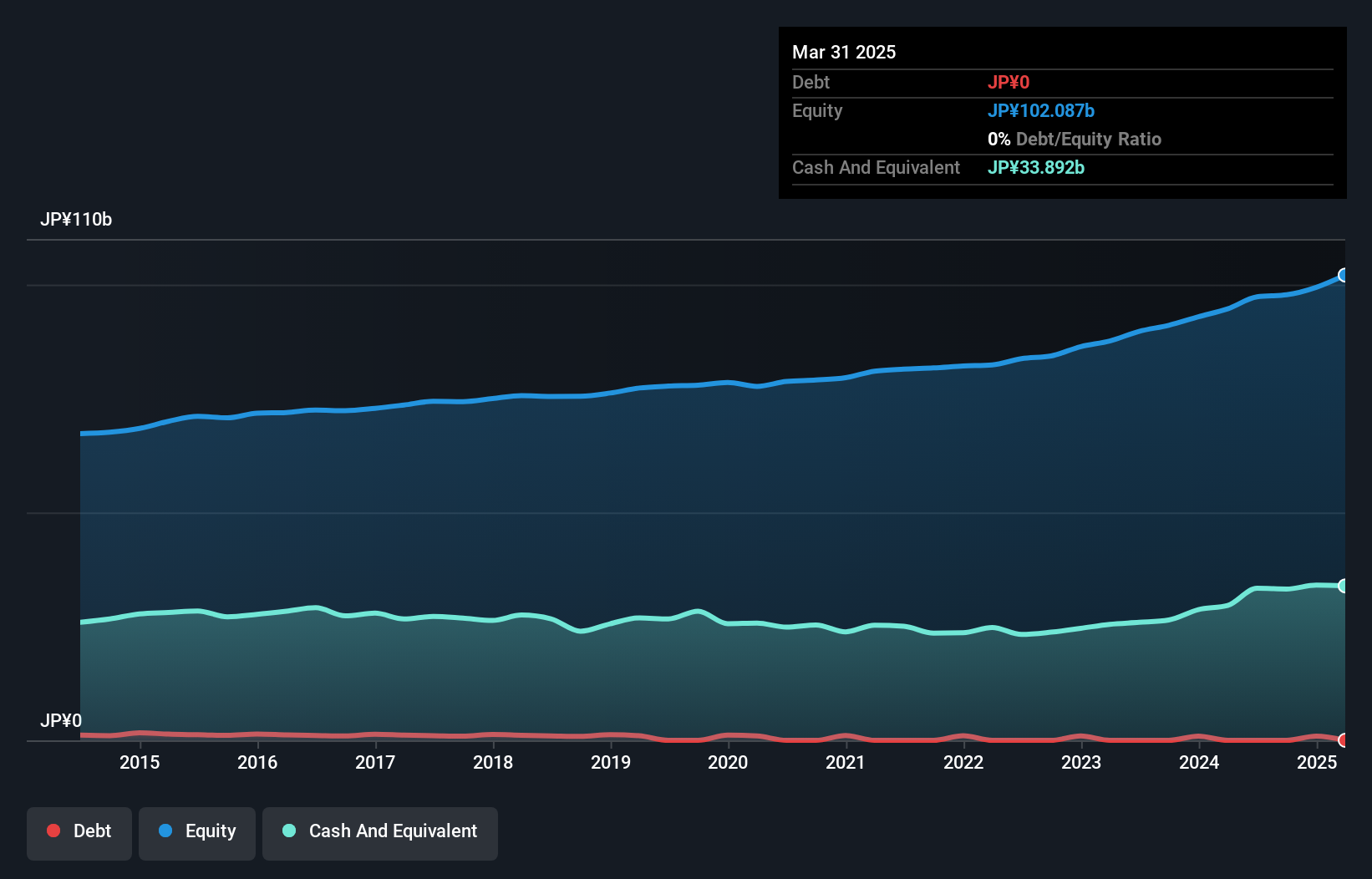

Overview: K&O Energy Group Inc. focuses on the development, production, supply, and sale of natural gas and iodine in Japan, with a market capitalization of ¥80.51 billion.

Operations: The company generates revenue primarily through the sale of natural gas and iodine. It has a market capitalization of ¥80.51 billion.

K&O Energy Group seems to be an intriguing player in the energy sector, currently trading at 59.4% below its estimated fair value, which might catch the eye of value seekers. Over the past year, it has demonstrated robust earnings growth of 12.1%, significantly outpacing the gas utilities industry average of -46.6%. The company is debt-free, eliminating concerns about interest coverage and financial strain from liabilities. Despite a volatile share price in recent months, K&O's high-quality earnings and positive free cash flow suggest a stable operational footing moving forward into potentially challenging market conditions.

Merry Electronics (TWSE:2439)

Simply Wall St Value Rating: ★★★★★☆

Overview: Merry Electronics Co., Ltd. operates in the manufacture, processing, repair, and sale of various electronic and telecommunication products across multiple regions including the United States, Taiwan, Europe, and China with a market cap of NT$27.12 billion.

Operations: Merry Electronics generates significant revenue from Taiwan (NT$32.85 billion) and Shenzhen (NT$13.24 billion), with additional contributions from Singapore (NT$8.02 billion) and Vietnam (NT$5.20 billion). The company incurs a notable elimination of profit and loss between departments amounting to NT$23.23 billion, impacting its overall financial performance.

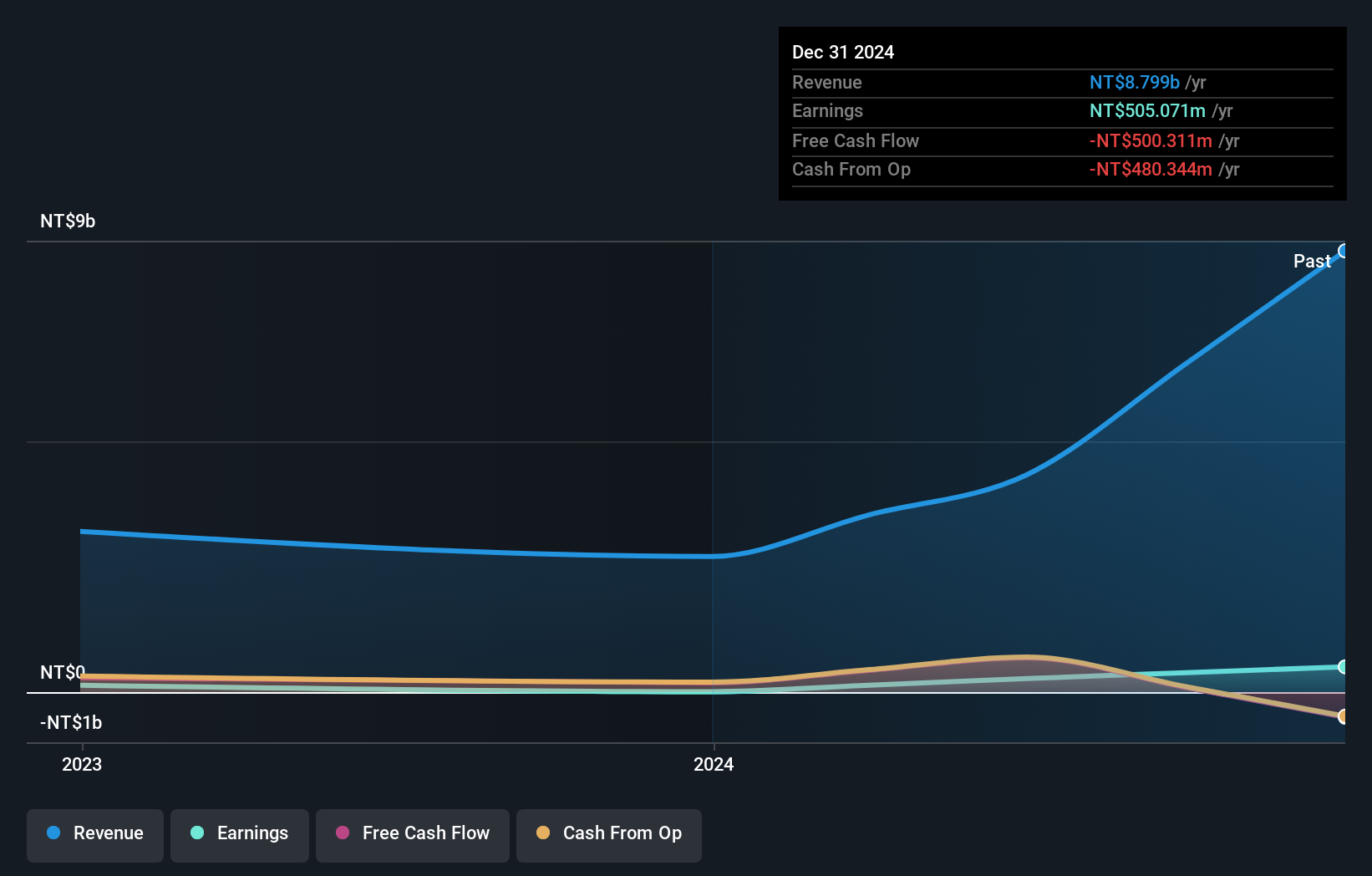

Merry Electronics, a nimble player in the electronics sector, has shown impressive growth with earnings rising 62.7% over the past year, outpacing the broader Consumer Durables industry. The company's debt-to-equity ratio has improved significantly from 40% to 21.1% over five years, indicating a stronger financial position. Recent sales figures reveal a mixed bag; November saw a 6.89% rise compared to last year, while October experienced a drop of 9.34%. Despite this volatility, Merry's price-to-earnings ratio of 13.9x suggests it is undervalued compared to the Taiwan market average of 20.7x.

- Take a closer look at Merry Electronics' potential here in our health report.

Examine Merry Electronics' past performance report to understand how it has performed in the past.

Summing It All Up

- Navigate through the entire inventory of 4611 Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2439

Merry Electronics

Engages in the manufacture, processing, repair, and sale of electric appliances, audiovisual electric products, telecommunication equipment and apparatus, computers and computing peripheral equipment, restrained telecom radio frequency equipment, medical appliances, and electronic parts and components in the United States, Taiwan, Europe, China, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives