Undiscovered Gems Including Jadard Technology And Two Other Small Caps With Strong Fundamentals

Reviewed by Simply Wall St

In a week marked by volatility, global markets have been influenced by mixed corporate earnings and heightened competition fears in the AI sector, with U.S. stocks experiencing fluctuations and the Dow Jones Industrial Average managing modest gains. Meanwhile, central banks across Europe and Japan have adjusted their monetary policies to address ongoing inflation concerns, further impacting market dynamics. In this environment, identifying small-cap stocks with strong fundamentals becomes crucial for investors seeking potential growth opportunities. Companies like Jadard Technology and others that demonstrate robust financial health may offer promising prospects amid these challenging conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| DoshishaLtd | NA | 2.43% | 2.36% | ★★★★★★ |

| NOROO PAINT & COATINGS | 12.38% | 4.96% | 8.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | 0.74% | 13.97% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wan Hwa Enterprise | NA | -7.43% | -7.24% | ★★★★★★ |

| First Copper Technology | 17.03% | 3.07% | 19.66% | ★★★★★★ |

| New Asia Construction & Development | 65.89% | 5.34% | 12.05% | ★★★★★☆ |

| Nippon Sharyo | 59.09% | -1.22% | -12.92% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Jadard Technology (SHSE:688252)

Simply Wall St Value Rating: ★★★★★★

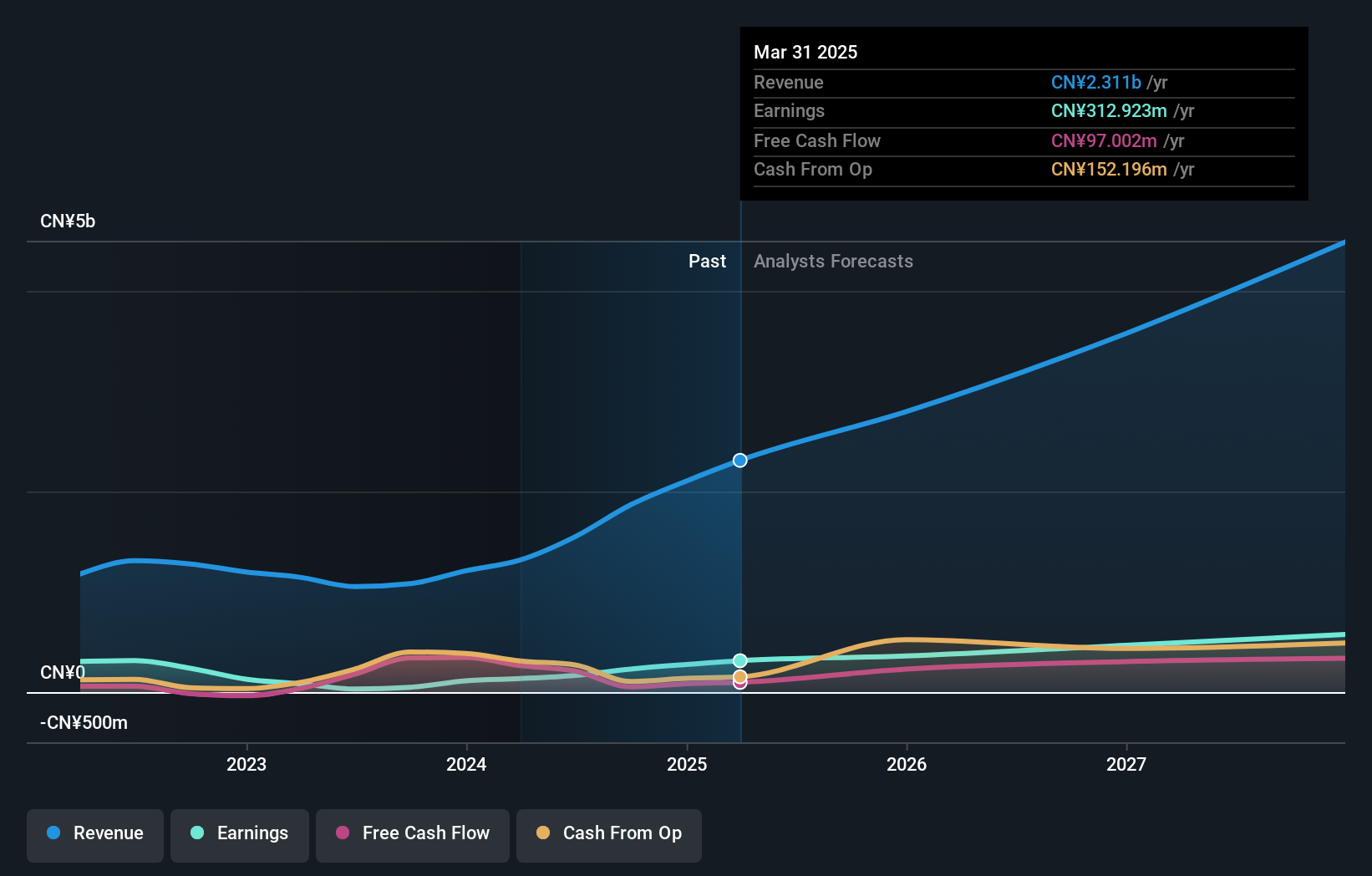

Overview: Jadard Technology Inc. is engaged in the research, development, design, and sales of integrated chips and mobile terminal ICs with a market capitalization of CN¥10.38 billion.

Operations: Jadard Technology generates revenue primarily from the electronic components and parts segment, amounting to CN¥1.87 billion.

Jadard Technology, a nimble player in the semiconductor arena, showcases impressive financial health with no debt and a significant reduction from a 79% debt-to-equity ratio five years ago. Its earnings surged by 377.7% last year, outpacing the industry average of 12.9%, and are expected to grow at an annual rate of 28.81%. The company also benefits from high-quality non-cash earnings while maintaining a favorable price-to-earnings ratio of 45.1x compared to the industry's 62.9x average. These factors suggest Jadard is poised for continued robust growth within its sector despite being relatively under-the-radar.

- Unlock comprehensive insights into our analysis of Jadard Technology stock in this health report.

Explore historical data to track Jadard Technology's performance over time in our Past section.

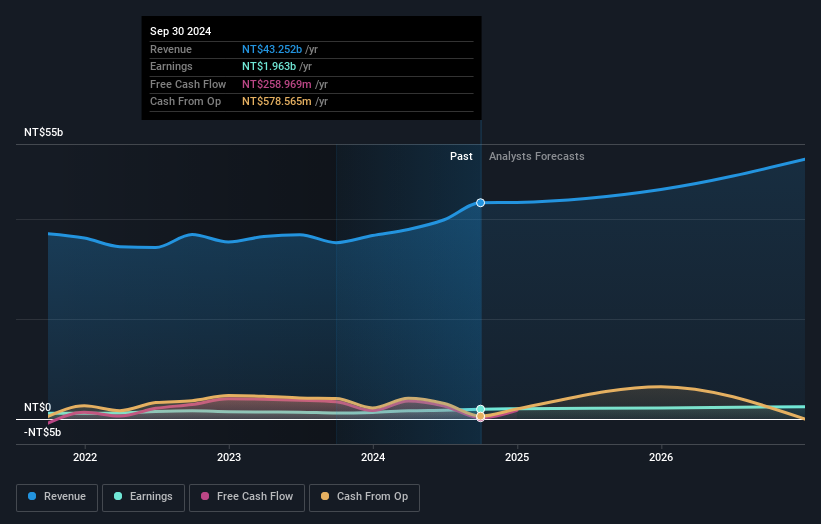

Merry Electronics (TWSE:2439)

Simply Wall St Value Rating: ★★★★★☆

Overview: Merry Electronics Co., Ltd. operates in the manufacture, processing, repair, and sale of a wide range of electronic products and components across various international markets, with a market capitalization of NT$29.15 billion.

Operations: Merry Electronics generates revenue primarily from Taiwan (NT$32.85 billion), Shenzhen (NT$13.24 billion), and Singapore (NT$8.02 billion). The company also reports significant operations in Vietnam, contributing NT$5.20 billion to its revenue stream.

Merry Electronics, a promising player in the electronics sector, has demonstrated robust performance with earnings growth of 62.7% over the past year, outpacing the industry average of 8.9%. The company has managed to reduce its debt-to-equity ratio from 40% to 21.1% over five years, indicating prudent financial management. With a price-to-earnings ratio of 14.8x, it presents good value compared to the market's 20.8x benchmark. Recent sales figures bolster confidence; December's consolidated sales reached TWD 3,886 million, marking a notable increase of nearly 24% year-on-year despite shareholder dilution concerns last year.

- Navigate through the intricacies of Merry Electronics with our comprehensive health report here.

Evaluate Merry Electronics' historical performance by accessing our past performance report.

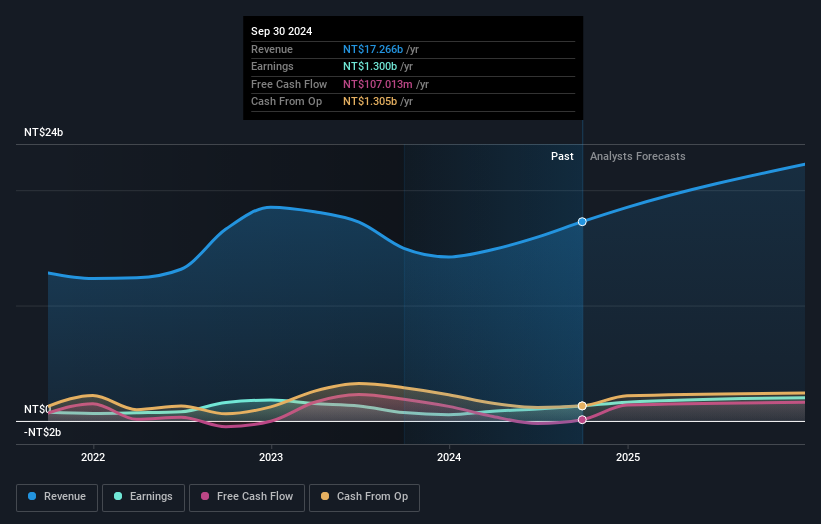

Sports Gear (TWSE:6768)

Simply Wall St Value Rating: ★★★★★★

Overview: Sports Gear Co., Ltd. is a company that manufactures and sells OEM footwear products across the United States, Europe, Asia, China, Taiwan, and internationally with a market cap of NT$28.72 billion.

Operations: Sports Gear Co., Ltd. generates its revenue primarily from its Footwear Manufacturing Business, which contributes NT$17.27 billion.

Sports Gear, a dynamic player in the industry, has shown impressive growth with its recent earnings report. The company reported a net income of TWD 344 million for Q3 2024, significantly up from TWD 82 million the previous year. Basic earnings per share surged to TWD 1.76 from TWD 0.42 year-over-year, reflecting strong operational performance. Revenue for December reached US$43.93 million, marking a healthy increase of over 13% compared to last December's figures. This upward trend is mirrored in the annual revenue growth of nearly 26%, suggesting robust market demand and effective business strategies driving its success forward.

- Dive into the specifics of Sports Gear here with our thorough health report.

Assess Sports Gear's past performance with our detailed historical performance reports.

Make It Happen

- Embark on your investment journey to our 4724 Undiscovered Gems With Strong Fundamentals selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6768

Sports Gear

Manufactures and sells OEM footwear products in the United States, Europe, Asia, China, Taiwan, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives