Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Lan Fa Textile Co., Ltd. (TWSE:1459) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Lan Fa Textile

How Much Debt Does Lan Fa Textile Carry?

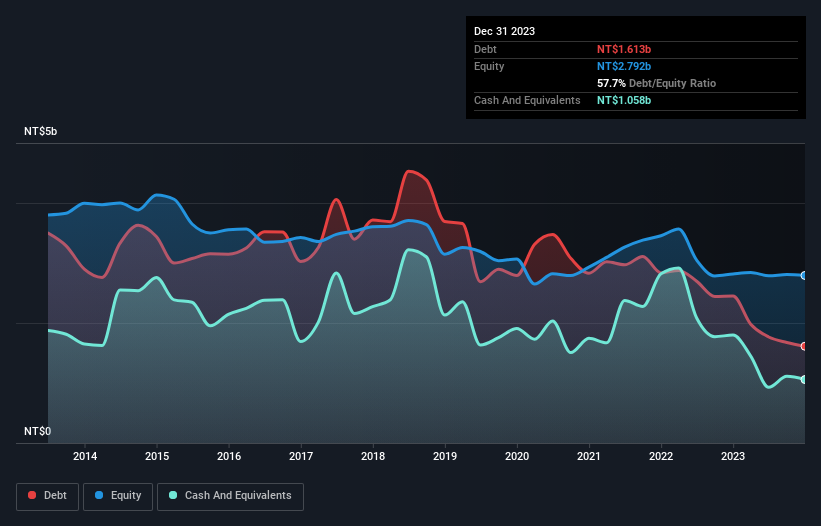

The image below, which you can click on for greater detail, shows that Lan Fa Textile had debt of NT$1.61b at the end of December 2023, a reduction from NT$2.45b over a year. However, it also had NT$1.06b in cash, and so its net debt is NT$554.8m.

A Look At Lan Fa Textile's Liabilities

Zooming in on the latest balance sheet data, we can see that Lan Fa Textile had liabilities of NT$1.21b due within 12 months and liabilities of NT$585.7m due beyond that. Offsetting this, it had NT$1.06b in cash and NT$155.2m in receivables that were due within 12 months. So it has liabilities totalling NT$584.8m more than its cash and near-term receivables, combined.

Since publicly traded Lan Fa Textile shares are worth a total of NT$3.44b, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Lan Fa Textile will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Lan Fa Textile had a loss before interest and tax, and actually shrunk its revenue by 38%, to NT$1.2b. That makes us nervous, to say the least.

Caveat Emptor

While Lan Fa Textile's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. To be specific the EBIT loss came in at NT$273m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Surprisingly, we note that it actually reported positive free cash flow of NT$30m and a profit of NT$24m. So if we focus on those metrics there seems to be a chance the company will manage its debt without much trouble. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 1 warning sign for Lan Fa Textile that you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1459

Lan Fa Textile

Engages in the manufacture and sale of polyester textured yarn in Taiwan.

Good value with proven track record.

Market Insights

Community Narratives