Li Peng Enterprise (TWSE:1447) soars 14% this week, taking five-year gains to 47%

When you buy and hold a stock for the long term, you definitely want it to provide a positive return. Furthermore, you'd generally like to see the share price rise faster than the market. But Li Peng Enterprise Co., Ltd. (TWSE:1447) has fallen short of that second goal, with a share price rise of 47% over five years, which is below the market return. However, more recent buyers should be happy with the increase of 39% over the last year.

Since the stock has added NT$1.1b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Li Peng Enterprise

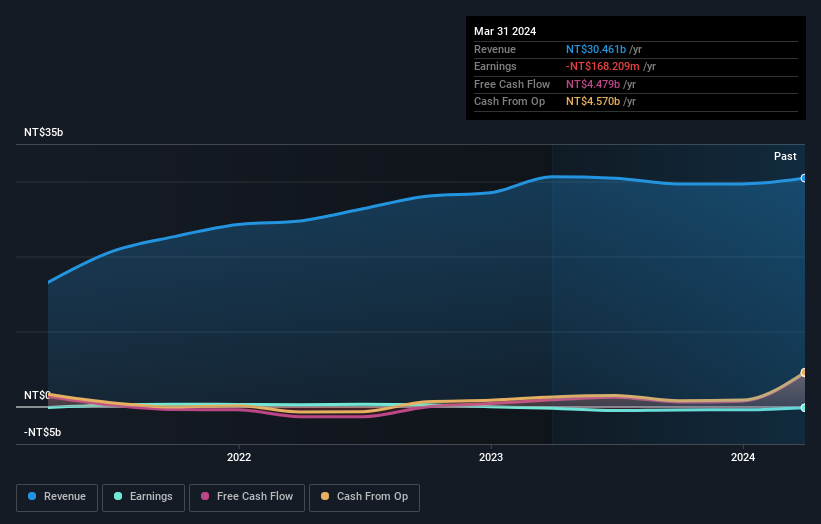

Because Li Peng Enterprise made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, Li Peng Enterprise can boast revenue growth at a rate of 19% per year. That's well above most pre-profit companies. It's nice to see shareholders have made a profit, but the gain of 8% over the period isn't that impressive compared to the overall market. That's surprising given the strong revenue growth. Arguably this falls in a potential sweet spot - modest share price gains but good top line growth over the long term justifies investigation, in our book.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Li Peng Enterprise's TSR for the year was broadly in line with the market average, at 39%. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 8%. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Li Peng Enterprise that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1447

Li Peng Enterprise

Engages in production and sale of fibers and yarns in Asia and internationally.

Excellent balance sheet and good value.