- Taiwan

- /

- Consumer Durables

- /

- TWSE:9935

Ching Feng Home FashionsLtd (TPE:9935) Has A Somewhat Strained Balance Sheet

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Ching Feng Home Fashions Co.,Ltd (TPE:9935) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Ching Feng Home FashionsLtd

What Is Ching Feng Home FashionsLtd's Debt?

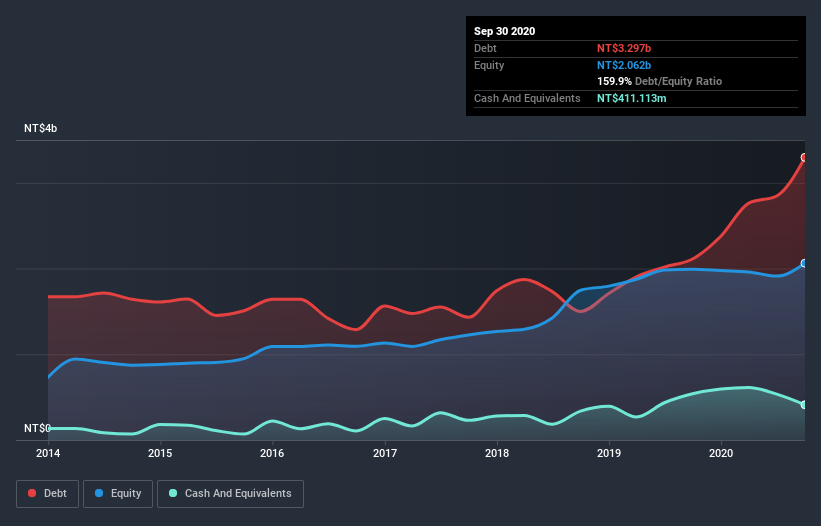

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Ching Feng Home FashionsLtd had NT$3.30b of debt, an increase on NT$2.11b, over one year. However, it also had NT$411.1m in cash, and so its net debt is NT$2.89b.

How Healthy Is Ching Feng Home FashionsLtd's Balance Sheet?

The latest balance sheet data shows that Ching Feng Home FashionsLtd had liabilities of NT$2.29b due within a year, and liabilities of NT$2.61b falling due after that. On the other hand, it had cash of NT$411.1m and NT$2.28b worth of receivables due within a year. So it has liabilities totalling NT$2.21b more than its cash and near-term receivables, combined.

Ching Feng Home FashionsLtd has a market capitalization of NT$5.39b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Ching Feng Home FashionsLtd's debt to EBITDA ratio of 5.1 suggests a heavy debt load, its interest coverage of 9.7 implies it services that debt with ease. Our best guess is that the company does indeed have significant debt obligations. If Ching Feng Home FashionsLtd can keep growing EBIT at last year's rate of 18% over the last year, then it will find its debt load easier to manage. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Ching Feng Home FashionsLtd's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Ching Feng Home FashionsLtd burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

While Ching Feng Home FashionsLtd's net debt to EBITDA makes us cautious about it, its track record of converting EBIT to free cash flow is no better. But at least its interest cover is a gleaming silver lining to those clouds. When we consider all the factors discussed, it seems to us that Ching Feng Home FashionsLtd is taking some risks with its use of debt. While that debt can boost returns, we think the company has enough leverage now. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 2 warning signs we've spotted with Ching Feng Home FashionsLtd .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading Ching Feng Home FashionsLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:9935

Ching Feng Home FashionsLtd

Engages in the manufacture and sale of home decor products in Taiwan.

Adequate balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026