If You Had Bought Lan Fa TextileLtd's (TPE:1459) Shares Five Years Ago You Would Be Down 20%

Ideally, your overall portfolio should beat the market average. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Lan Fa Textile Co.,Ltd. (TPE:1459) shareholders for doubting their decision to hold, with the stock down 20% over a half decade.

See our latest analysis for Lan Fa TextileLtd

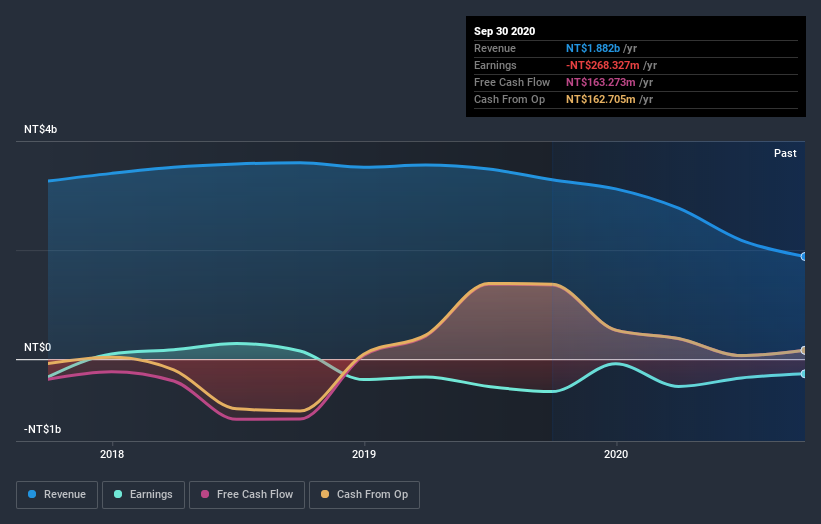

Lan Fa TextileLtd wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade Lan Fa TextileLtd reduced its trailing twelve month revenue by 6.1% for each year. While far from catastrophic that is not good. The share price decline at a rate of 4% per year is disappointing. Unfortunately, though, it makes sense given the lack of either profits or revenue growth. Without profits, its hard to see how shareholders win if the revenue keeps falling.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Lan Fa TextileLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered Lan Fa TextileLtd's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Lan Fa TextileLtd shareholders, and that cash payout explains why its total shareholder loss of 18%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Lan Fa TextileLtd shareholders gained a total return of 19% during the year. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 3% per year, over five years. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Lan Fa TextileLtd better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Lan Fa TextileLtd (including 1 which is shouldn't be ignored) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade Lan Fa TextileLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:1459

Lan Fa Textile

Engages in the manufacture and sale of polyester textured yarn in Taiwan.

Good value with proven track record.

Market Insights

Community Narratives