- Taiwan

- /

- Consumer Durables

- /

- TPEX:8916

Top 3 Dividend Stocks For November 2024

Reviewed by Simply Wall St

As global markets experience broad-based gains and U.S. indexes approach record highs, investors are navigating a landscape marked by geopolitical tensions and economic uncertainties. Amid this backdrop, dividend stocks can offer a blend of income and potential stability, making them an attractive option for those looking to capitalize on the current market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.34% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.18% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.55% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.55% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.91% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.42% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

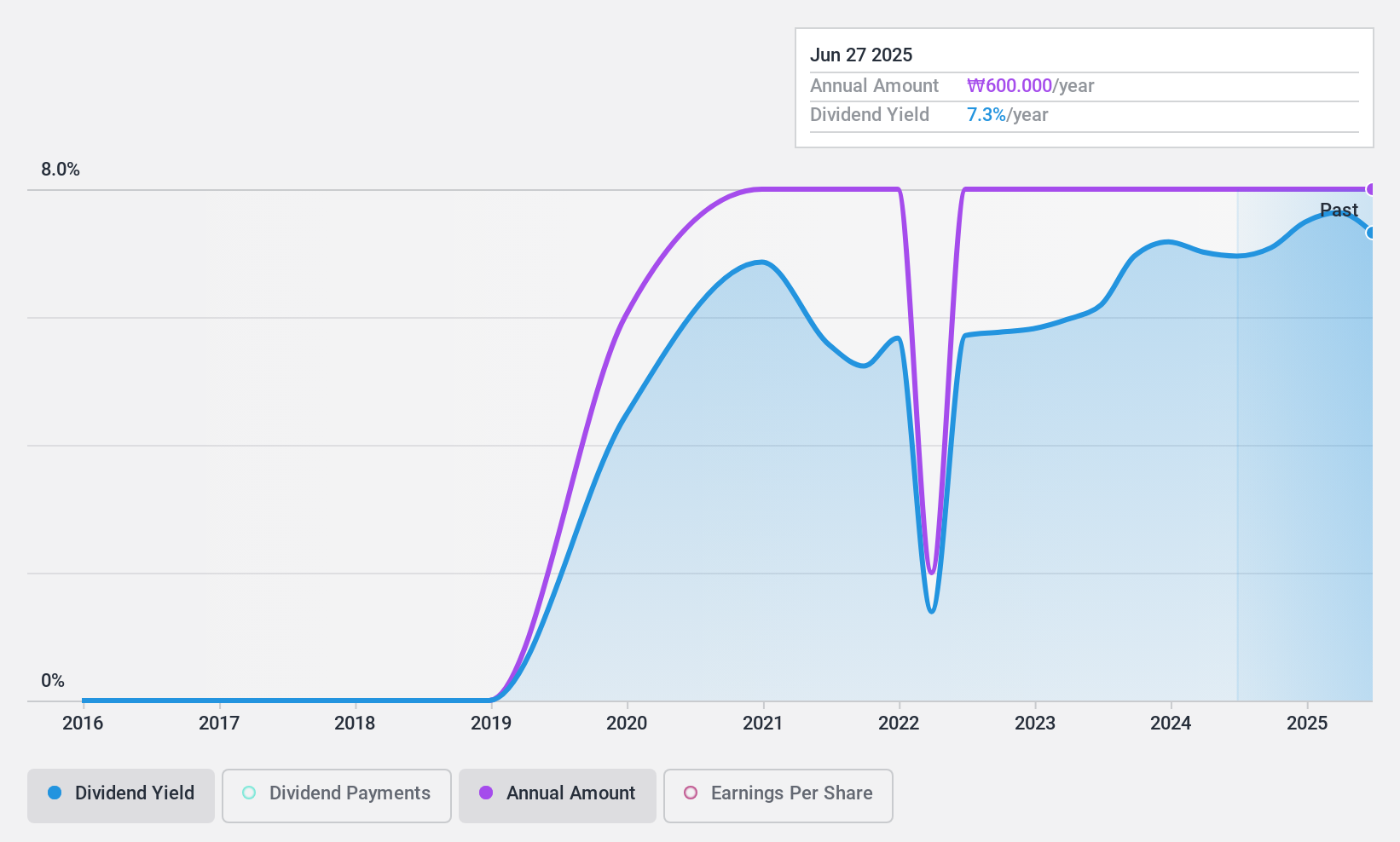

iMarketKorea (KOSE:A122900)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: iMarketKorea Inc. is an industrial material distribution service company operating both in South Korea and internationally, with a market cap of ₩259.58 billion.

Operations: iMarketKorea Inc.'s revenue segments include industrial material distribution services both domestically and internationally.

Dividend Yield: 7.3%

iMarketKorea offers a compelling dividend profile with a payout ratio of 71.4%, indicating dividends are well-covered by earnings and cash flows, the latter at 49%. Despite only five years of dividend history, payments have been stable and growing, placing its yield in the top 25% of KR market payers. However, recent removal from the S&P Global BMI Index may warrant attention for potential impacts on investor sentiment.

- Click here and access our complete dividend analysis report to understand the dynamics of iMarketKorea.

- According our valuation report, there's an indication that iMarketKorea's share price might be on the expensive side.

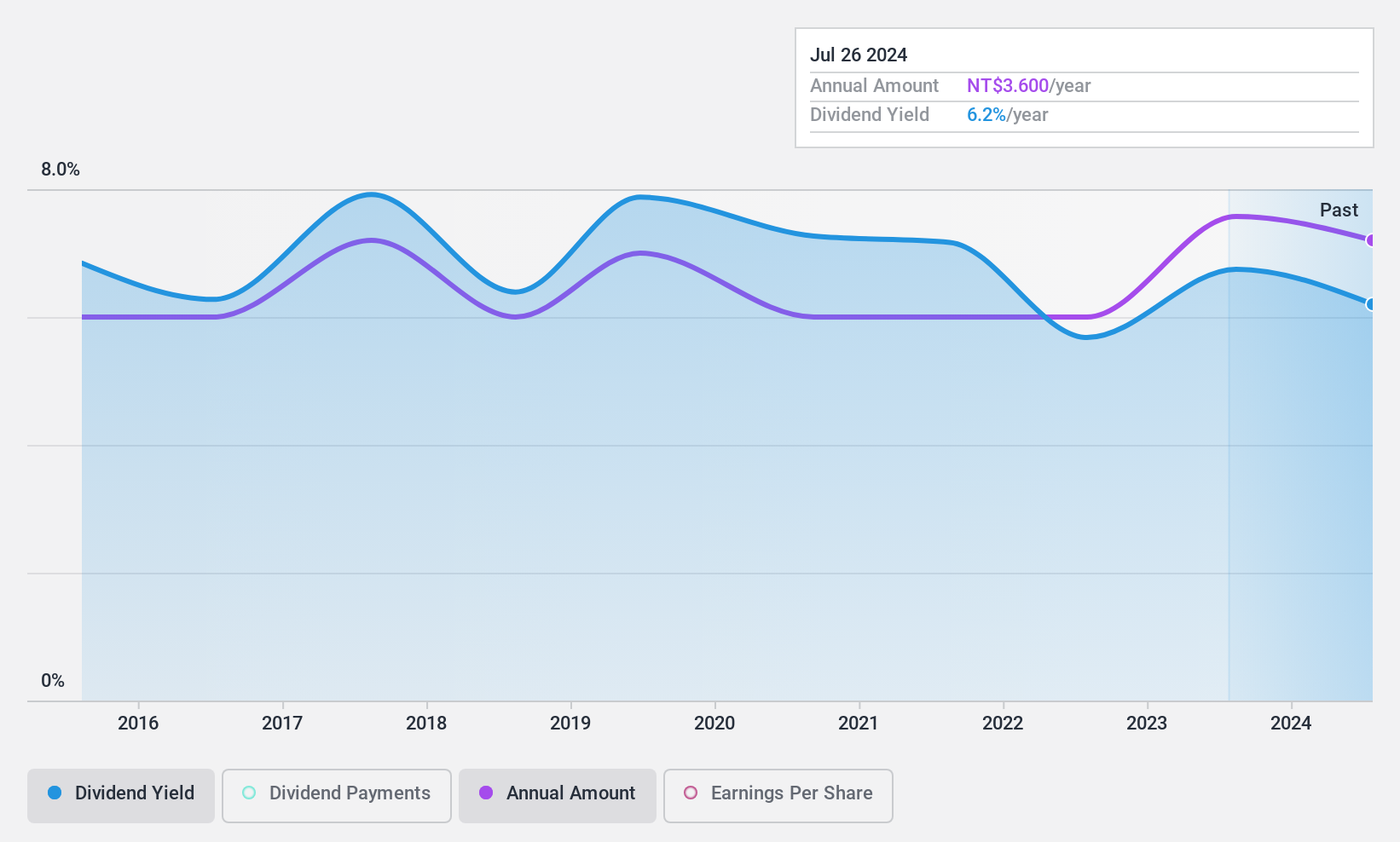

Kwong Lung Enterprise (TPEX:8916)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kwong Lung Enterprise Co., Ltd. manufactures and sells apparel in Taiwan, China, Vietnam, and Japan with a market cap of NT$8.60 billion.

Operations: Kwong Lung Enterprise Co., Ltd. generates revenue from several segments, including Home Textiles (NT$1.47 billion), Raw Down Material (NT$1.74 billion), and Ready-To-Wear Clothing (NT$4.45 billion).

Dividend Yield: 6.3%

Kwong Lung Enterprise's dividend yield of 6.33% ranks in the top 25% of the TW market, yet it faces sustainability challenges with a payout ratio at 98.8%, indicating dividends are not well-covered by earnings or cash flows, which have a high cash payout ratio of 124.8%. Despite these concerns, dividends have been stable and growing over the past decade. Recent earnings showed decreased net income despite slight sales growth, highlighting financial pressures.

- Unlock comprehensive insights into our analysis of Kwong Lung Enterprise stock in this dividend report.

- In light of our recent valuation report, it seems possible that Kwong Lung Enterprise is trading beyond its estimated value.

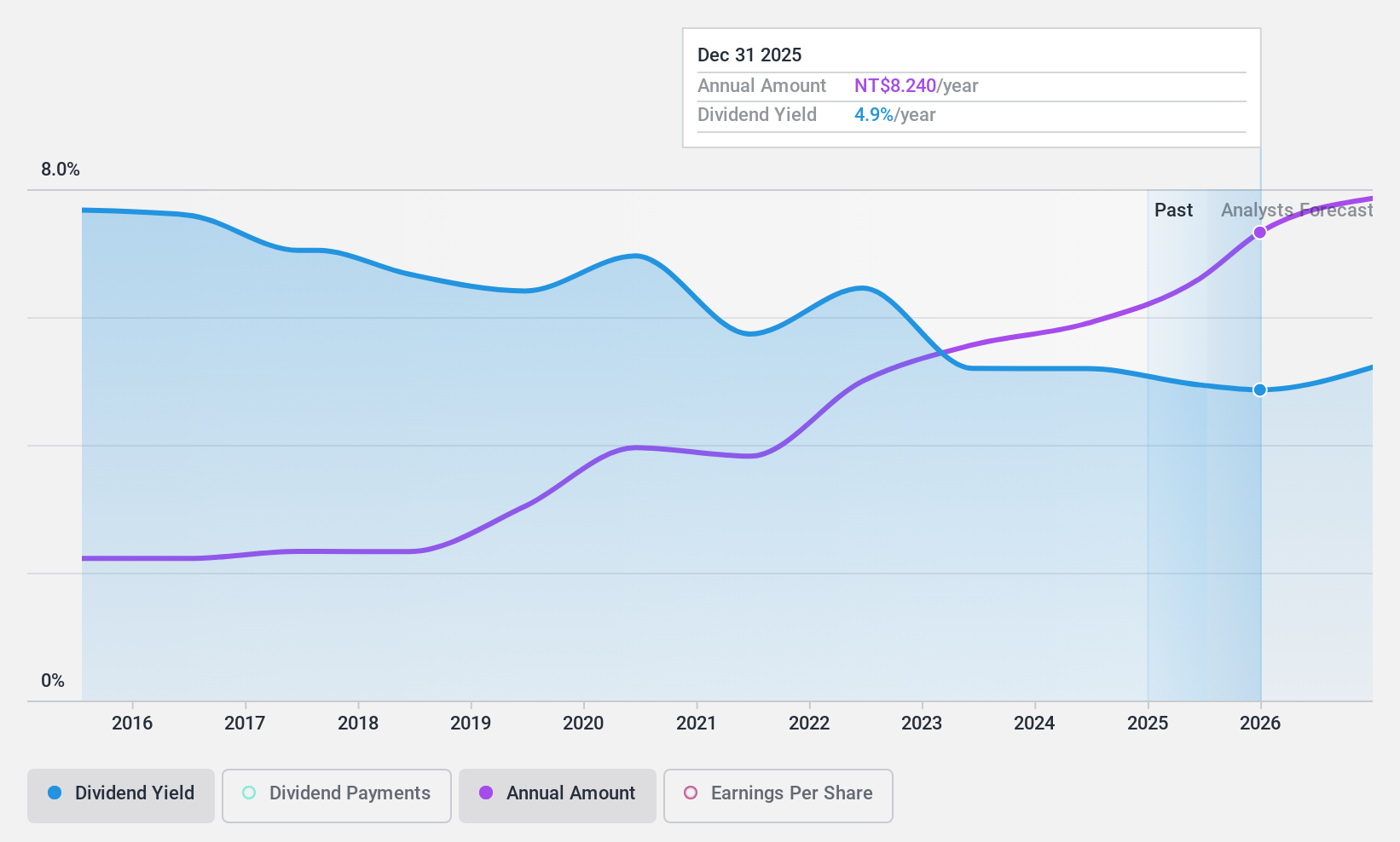

Stark Technology (TWSE:2480)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Stark Technology Inc. offers system integration services for information and communication technology products in Taiwan, with a market cap of NT$13.40 billion.

Operations: Stark Technology Inc. generates revenue of NT$7.27 billion from its computer services segment.

Dividend Yield: 5.3%

Stark Technology's dividend yield of 5.27% ranks in the top 25% of the TW market, supported by a payout ratio of 89.9%, indicating dividends are covered by earnings and an 84.8% cash payout ratio ensures coverage by cash flows as well. Dividends have been stable and growing over the past decade, reflecting reliability despite slight fluctuations in recent net income, which was TWD 181.61 million for Q3 compared to TWD 184.21 million last year.

- Delve into the full analysis dividend report here for a deeper understanding of Stark Technology.

- Our valuation report unveils the possibility Stark Technology's shares may be trading at a discount.

Summing It All Up

- Click here to access our complete index of 1981 Top Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kwong Lung Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8916

Kwong Lung Enterprise

Engages in the manufacture and sale of apparel in Taiwan, China, Vietnam, and Japan.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives