David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Mutto Optronics Corporation (GTSM:4950) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Mutto Optronics

How Much Debt Does Mutto Optronics Carry?

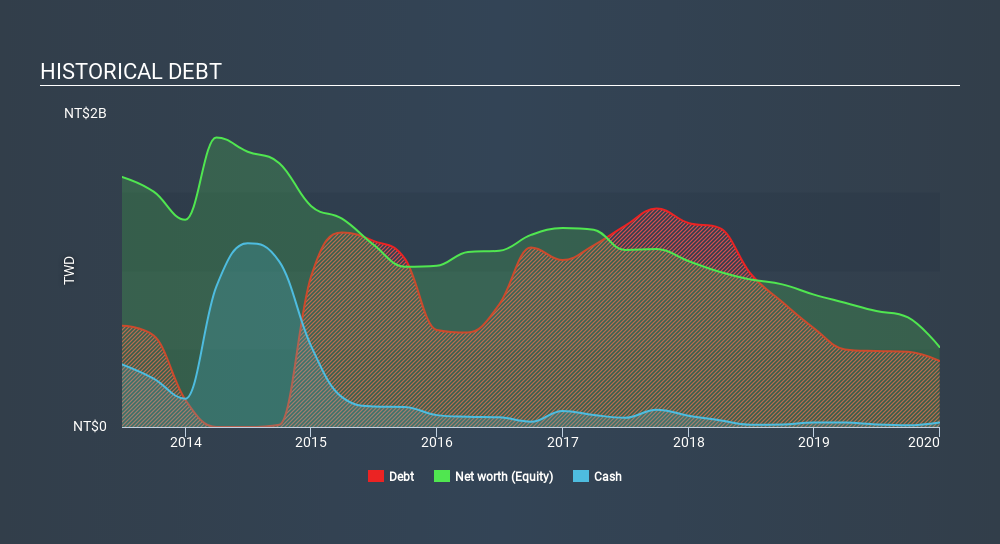

The image below, which you can click on for greater detail, shows that Mutto Optronics had debt of NT$422.0m at the end of December 2019, a reduction from NT$631.1m over a year. On the flip side, it has NT$29.2m in cash leading to net debt of about NT$392.8m.

How Healthy Is Mutto Optronics's Balance Sheet?

According to the last reported balance sheet, Mutto Optronics had liabilities of NT$482.0m due within 12 months, and liabilities of NT$16.1m due beyond 12 months. On the other hand, it had cash of NT$29.2m and NT$59.5m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by NT$409.5m.

Given this deficit is actually higher than the company's market capitalization of NT$298.9m, we think shareholders really should watch Mutto Optronics's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. When analysing debt levels, the balance sheet is the obvious place to start. But it is Mutto Optronics's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Mutto Optronics reported revenue of NT$178m, which is a gain of 4.6%, although it did not report any earnings before interest and tax. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Over the last twelve months Mutto Optronics produced an earnings before interest and tax (EBIT) loss. Its EBIT loss was a whopping NT$232m. When we look at that alongside the significant liabilities, we're not particularly confident about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it had negative free cash flow of NT$74m over the last twelve months. So suffice it to say we consider the stock to be risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Take risks, for example - Mutto Optronics has 5 warning signs (and 3 which shouldn't be ignored) we think you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TPEX:4950

Golden Win International

Manufactures and sells stainless steel kitchen cutlery in Taiwan, the United States, China, Europe, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives