- Taiwan

- /

- Commercial Services

- /

- TWSE:9917

Taiwan Secom Co., Ltd.'s (TWSE:9917) Business Is Yet to Catch Up With Its Share Price

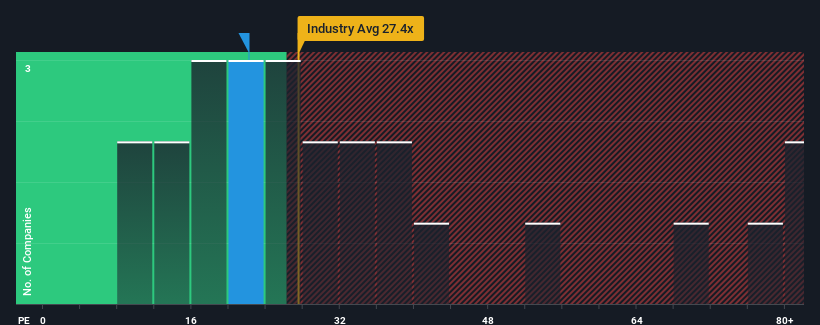

There wouldn't be many who think Taiwan Secom Co., Ltd.'s (TWSE:9917) price-to-earnings (or "P/E") ratio of 22.2x is worth a mention when the median P/E in Taiwan is similar at about 23x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

It looks like earnings growth has deserted Taiwan Secom recently, which is not something to boast about. One possibility is that the P/E is moderate because investors think this benign earnings growth rate might not be enough to outperform the broader market in the near future. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

View our latest analysis for Taiwan Secom

How Is Taiwan Secom's Growth Trending?

Taiwan Secom's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Still, the latest three year period was better as it's delivered a decent 7.9% overall rise in EPS. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

This is in contrast to the rest of the market, which is expected to grow by 26% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Taiwan Secom's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Bottom Line On Taiwan Secom's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Taiwan Secom currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

You always need to take note of risks, for example - Taiwan Secom has 1 warning sign we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Secom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:9917

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026