- Hong Kong

- /

- Specialty Stores

- /

- SEHK:2519

Undiscovered Gems With Strong Fundamentals To Explore November 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by mixed economic signals and cautious investor sentiment, small-cap stocks have shown resilience, outperforming their larger counterparts amid a busy earnings season. With the S&P MidCap 400 and Russell 2000 indices reflecting this trend, there is growing interest in identifying lesser-known companies with robust fundamentals that may offer potential opportunities for investors. In the current environment, a good stock is often characterized by strong financial health and stability, which can provide a buffer against broader market volatility and position it well for future growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 44.92% | 51.98% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

AuGroup (SHENZHEN) Cross-Border Business (SEHK:2519)

Simply Wall St Value Rating: ★★★★★★

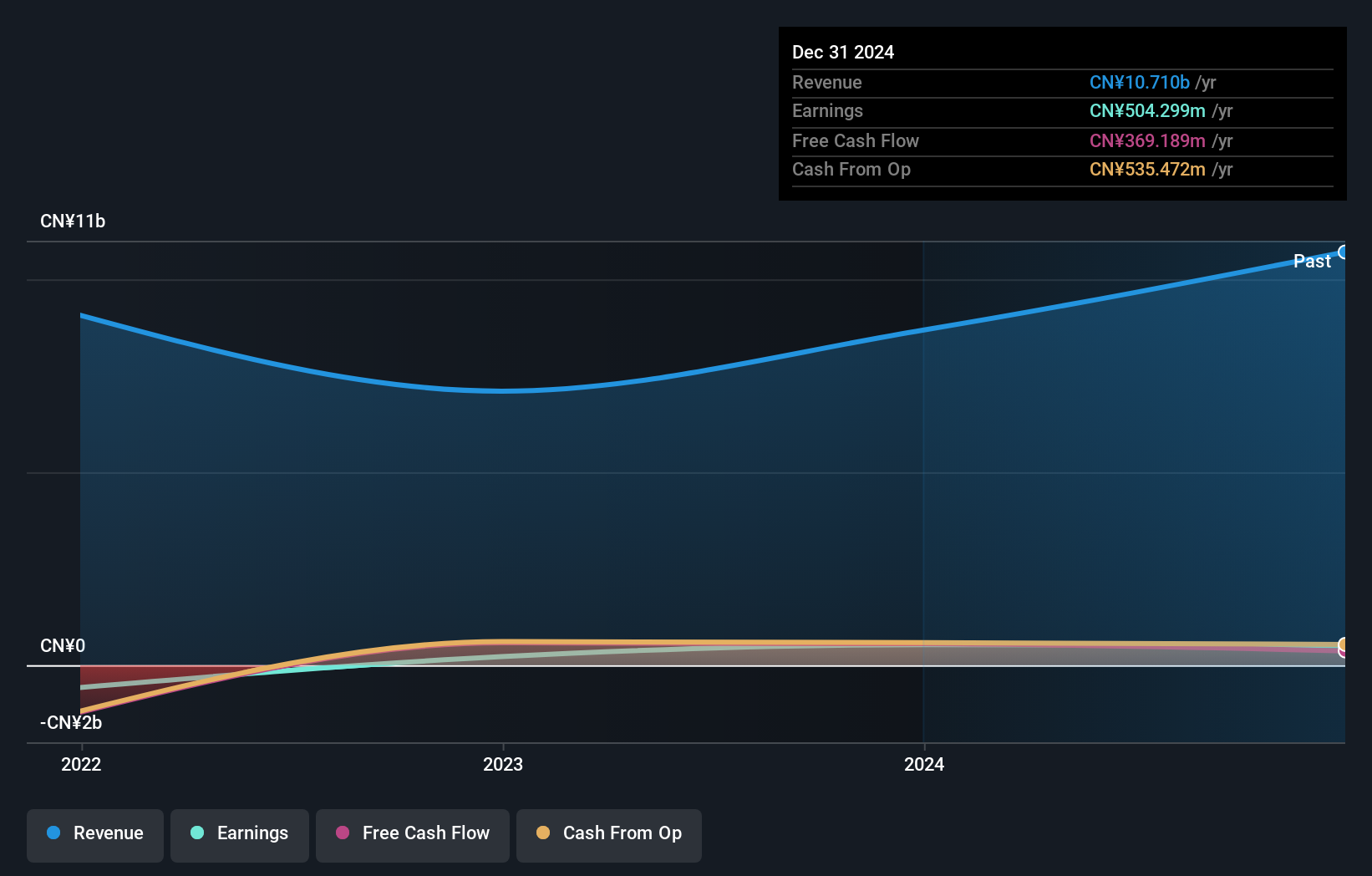

Overview: AuGroup (SHENZHEN) Cross-Border Business Co., Ltd. operates in the cross-border trade sector, providing goods and logistics services, with a market capitalization of CN¥5.76 billion.

Operations: AuGroup generates revenue primarily from the sales of goods, amounting to CN¥7.03 billion, and logistic services contributing CN¥2.42 billion.

AuGroup (SHENZHEN) Cross-Border Business has shown impressive growth, with earnings skyrocketing by 142.9% over the past year, outpacing the Specialty Retail industry average of -13.7%. The company's net income surged to CNY 532 million from CNY 219 million in the previous year, reflecting robust financial health. Additionally, its debt-to-equity ratio improved significantly from 54.3% to 29.2% over five years, suggesting better financial management and stability. With shares trading at a discount of about 27% below fair value estimates, AuGroup appears well-positioned within its sector despite liquidity challenges in its share price dynamics.

- Take a closer look at AuGroup (SHENZHEN) Cross-Border Business' potential here in our health report.

L&K Engineering (TWSE:6139)

Simply Wall St Value Rating: ★★★★★★

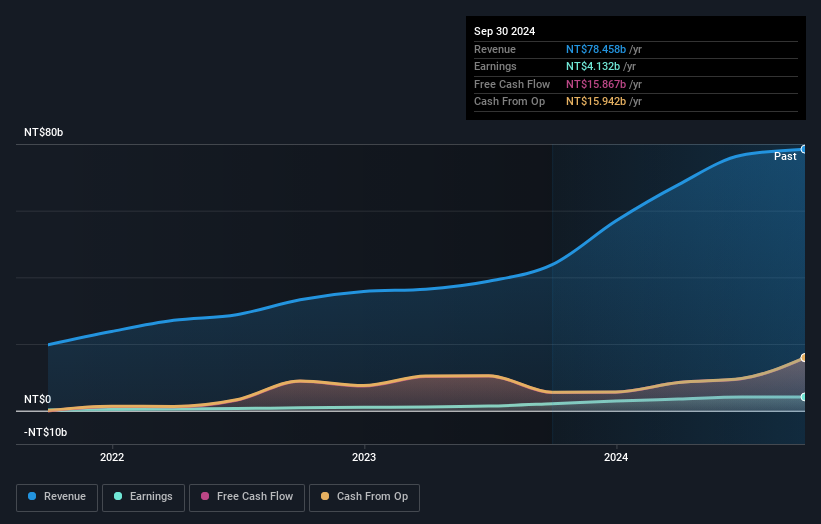

Overview: L&K Engineering Co., Ltd. offers turnkey engineering services across Taiwan, Hong Kong, and internationally, with a market cap of NT$54.63 billion.

Operations: L&K Engineering Co., Ltd. generates revenue primarily from its L1 Company and L2 Company segments, contributing NT$22.42 billion and NT$15.59 billion respectively, to a total of NT$40.44 billion in revenue.

L&K Engineering, a relatively smaller player in its field, has shown impressive financial performance recently. Its earnings for the second quarter jumped to TWD 1.07 billion from TWD 467 million last year, while sales surged to TWD 18.8 billion from TWD 10 billion. This growth is reflected in basic earnings per share rising to TWD 4.61 from TWD 2.07 previously. The company also formed a strategic partnership with Takenaka in Singapore, indicating proactive expansion efforts within the region's VSMC projects sector without any initial capital requirement for the joint venture, potentially enhancing its market footprint and operational scale further.

- Click here to discover the nuances of L&K Engineering with our detailed analytical health report.

Explore historical data to track L&K Engineering's performance over time in our Past section.

Skytech (TWSE:6937)

Simply Wall St Value Rating: ★★★★★☆

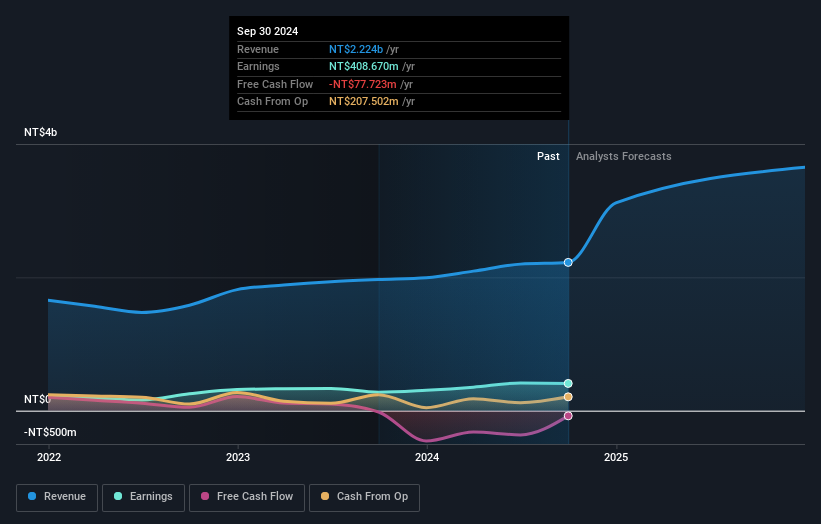

Overview: Skytech Inc. operates within the semiconductor and related technology industries, with a market capitalization of approximately NT$24.36 billion.

Operations: Skytech generates revenue primarily from its Machinery & Industrial Equipment segment, amounting to NT$2.20 billion.

Skytech, a nimble player in the semiconductor industry, has seen its earnings grow by 24.6% over the past year, outpacing industry averages. The company reported TWD 495.57 million in sales for Q2 2024, up from TWD 390.45 million a year ago, with net income jumping to TWD 94.01 million from TWD 31.01 million previously. Despite recent shareholder dilution and a volatile share price, Skytech's profitability ensures cash runway is not an issue. Recent inclusion in the S&P Global BMI Index and new sustainability initiatives reflect strategic positioning for future growth amidst industry challenges.

- Click to explore a detailed breakdown of our findings in Skytech's health report.

Gain insights into Skytech's historical performance by reviewing our past performance report.

Make It Happen

- Explore the 4705 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2519

AuGroup (SHENZHEN) Cross-Border Business

AuGroup (SHENZHEN) Cross-Border Business Co., Ltd.

Flawless balance sheet and fair value.

Market Insights

Community Narratives