- Austria

- /

- Construction

- /

- WBAG:POS

3 Dividend Stocks Offering Yields Up To 7.2

Reviewed by Simply Wall St

As global markets react to political developments and economic indicators, U.S. stocks have been marching toward record highs, buoyed by optimism over potential trade deals and AI investment enthusiasm. In this dynamic environment, investors often turn their attention to dividend stocks as a way to potentially generate income while participating in market growth. A good dividend stock typically offers a stable yield and the potential for capital appreciation, making it an attractive option amid current market conditions where interest rates and inflation expectations are key considerations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.04% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.66% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.04% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.52% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.54% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

L&K Engineering (TWSE:6139)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: L&K Engineering Co., Ltd. offers turnkey engineering services in Taiwan, Hong Kong, and internationally, with a market cap of NT$58.25 billion.

Operations: The revenue segments for L&K Engineering Co., Ltd. are as follows: L1 Company with NT$25.53 billion, L2 Company with NT$17.10 billion, and L&K Engineering Co., Ltd. itself contributing NT$37.77 billion.

Dividend Yield: 3.6%

L&K Engineering's dividends are well-covered by earnings with a payout ratio of 50% and a cash payout ratio of 13.2%, indicating strong coverage by cash flows. Despite this, the dividend yield at 3.6% is below the top quartile in Taiwan's market and has been historically volatile, though there has been growth over the past decade. Recent earnings show substantial revenue and profit growth, suggesting potential for future dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of L&K Engineering.

- According our valuation report, there's an indication that L&K Engineering's share price might be on the cheaper side.

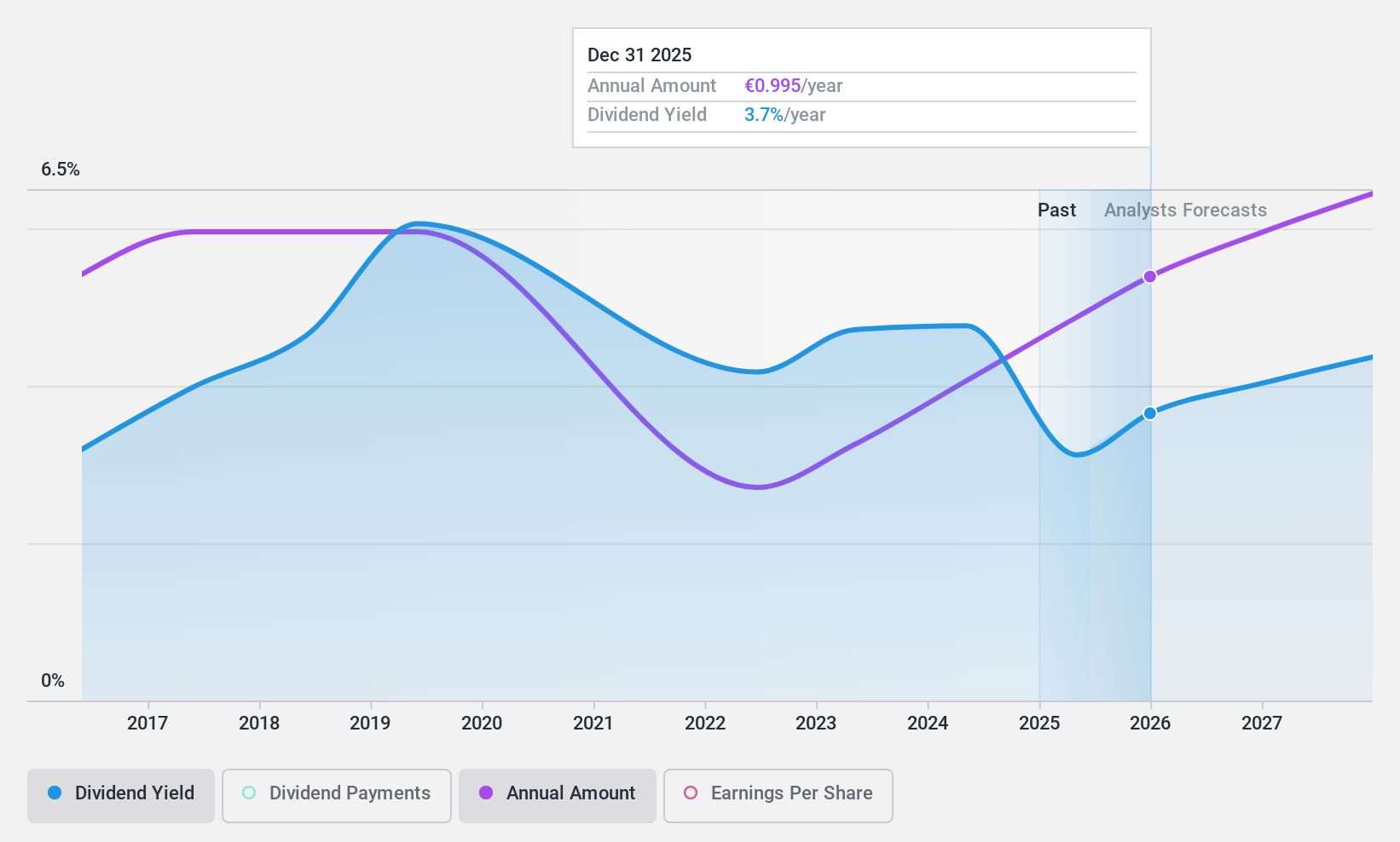

PORR (WBAG:POS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PORR AG is a construction company operating in Austria, Germany, and several other countries internationally, with a market cap of €775.09 million.

Operations: PORR AG generates its revenue from various regions, including €1.02 billion from Poland, €962.46 million from Germany, €3.07 billion from Austria and Switzerland combined, and €425.83 million from Infrastructure International projects.

Dividend Yield: 3.7%

PORR AG's dividend payments are well-supported by a payout ratio of 32% and a cash payout ratio of 45.9%, indicating solid earnings and cash flow coverage. However, the dividend history has been volatile over the past decade, lacking reliability despite recent growth. The current yield is lower than Austria's top quartile at 3.7%. Recent earnings show modest revenue growth but stable net income, suggesting potential for future stability in dividends amidst past fluctuations.

- Dive into the specifics of PORR here with our thorough dividend report.

- According our valuation report, there's an indication that PORR's share price might be on the expensive side.

Wacker Neuson (XTRA:WAC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wacker Neuson SE is a company that manufactures and distributes light and compact equipment in Germany, Austria, the United States, and internationally, with a market cap of approximately €1.08 billion.

Operations: Wacker Neuson SE generates revenue from its segments as follows: Services (€506.20 million), Light Equipment (€459.80 million), and Compact Equipment (€1.41 billion).

Dividend Yield: 7.3%

Wacker Neuson's dividend yield of 7.25% ranks in the top quartile of German dividend payers, yet its high payout ratio of 95.8% raises sustainability concerns as it is not fully covered by earnings. Recent financial results show a decline in sales and net income, with third-quarter sales at €517.6 million and net income at €9.7 million, down from last year’s figures. The company's dividends have been volatile over the past decade despite some growth.

- Click here and access our complete dividend analysis report to understand the dynamics of Wacker Neuson.

- Our expertly prepared valuation report Wacker Neuson implies its share price may be lower than expected.

Summing It All Up

- Access the full spectrum of 1981 Top Dividend Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:POS

PORR

Operates as a construction company in Austria, Germany, Poland, the Czech Republic, Italy, Romania, Switzerland, Serbia, Great Britain, Slovakia, Norway, Belgium, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives