- Taiwan

- /

- Commercial Services

- /

- TPEX:8401

Bai Sha Technology Co., Ltd.'s (GTSM:8401) Has Been On A Rise But Financial Prospects Look Weak: Is The Stock Overpriced?

Bai Sha Technology (GTSM:8401) has had a great run on the share market with its stock up by a significant 17% over the last three months. We, however wanted to have a closer look at its key financial indicators as the markets usually pay for long-term fundamentals, and in this case, they don't look very promising. Particularly, we will be paying attention to Bai Sha Technology's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for Bai Sha Technology

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Bai Sha Technology is:

4.4% = NT$38m ÷ NT$861m (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. Another way to think of that is that for every NT$1 worth of equity, the company was able to earn NT$0.04 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Bai Sha Technology's Earnings Growth And 4.4% ROE

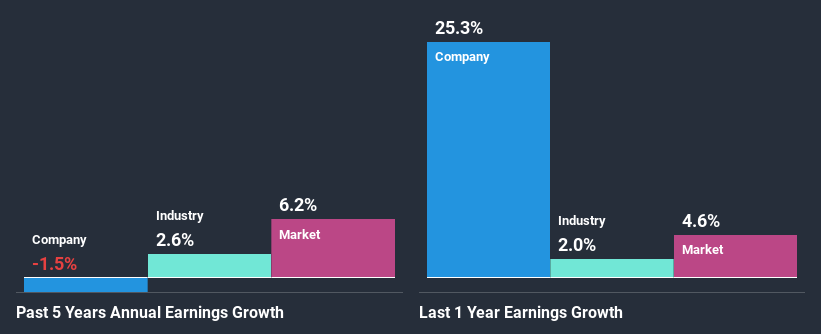

When you first look at it, Bai Sha Technology's ROE doesn't look that attractive. We then compared the company's ROE to the broader industry and were disappointed to see that the ROE is lower than the industry average of 5.6%. Therefore, Bai Sha Technology's flat earnings over the past five years can possibly be explained by the low ROE amongst other factors.

We then compared Bai Sha Technology's net income growth with the industry and found that the average industry growth rate was 2.6% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. Is Bai Sha Technology fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Bai Sha Technology Efficiently Re-investing Its Profits?

With a high three-year median payout ratio of 99% (implying that the company keeps only 1.2% of its income) of its business to reinvest into its business), most of Bai Sha Technology's profits are being paid to shareholders, which explains the absence of growth in earnings.

Moreover, Bai Sha Technology has been paying dividends for nine years, which is a considerable amount of time, suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Summary

In total, we would have a hard think before deciding on any investment action concerning Bai Sha Technology. Particularly, its ROE is a huge disappointment, not to mention its lack of proper reinvestment into the business. As a result its earnings growth has also been quite disappointing. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of Bai Sha Technology's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

If you decide to trade Bai Sha Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bai Sha Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:8401

Bai Sha Technology

Provides printing products and services in Taiwan and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives