- China

- /

- Semiconductors

- /

- SHSE:688525

Unveiling 3 Growth Companies With Insider Ownership As High As 31%

Reviewed by Simply Wall St

As global markets navigate through a period of relative calm with anticipation for upcoming earnings reports and key economic indicators, investors continue to seek opportunities that align with both growth prospects and stable governance. Companies with high insider ownership often signal strong confidence in the business’s future, making them particularly compelling in the current environment where strategic stability is prized.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

| Medley (TSE:4480) | 34% | 28.7% |

| Gaming Innovation Group (OB:GIG) | 25.7% | 36.9% |

| SiteMinder (ASX:SDR) | 11.3% | 75.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| Vow (OB:VOW) | 31.8% | 97.6% |

| Adocia (ENXTPA:ADOC) | 12.1% | 104.5% |

Let's dive into some prime choices out of from the screener.

BIWIN Storage Technology (SHSE:688525)

Simply Wall St Growth Rating: ★★★★★☆

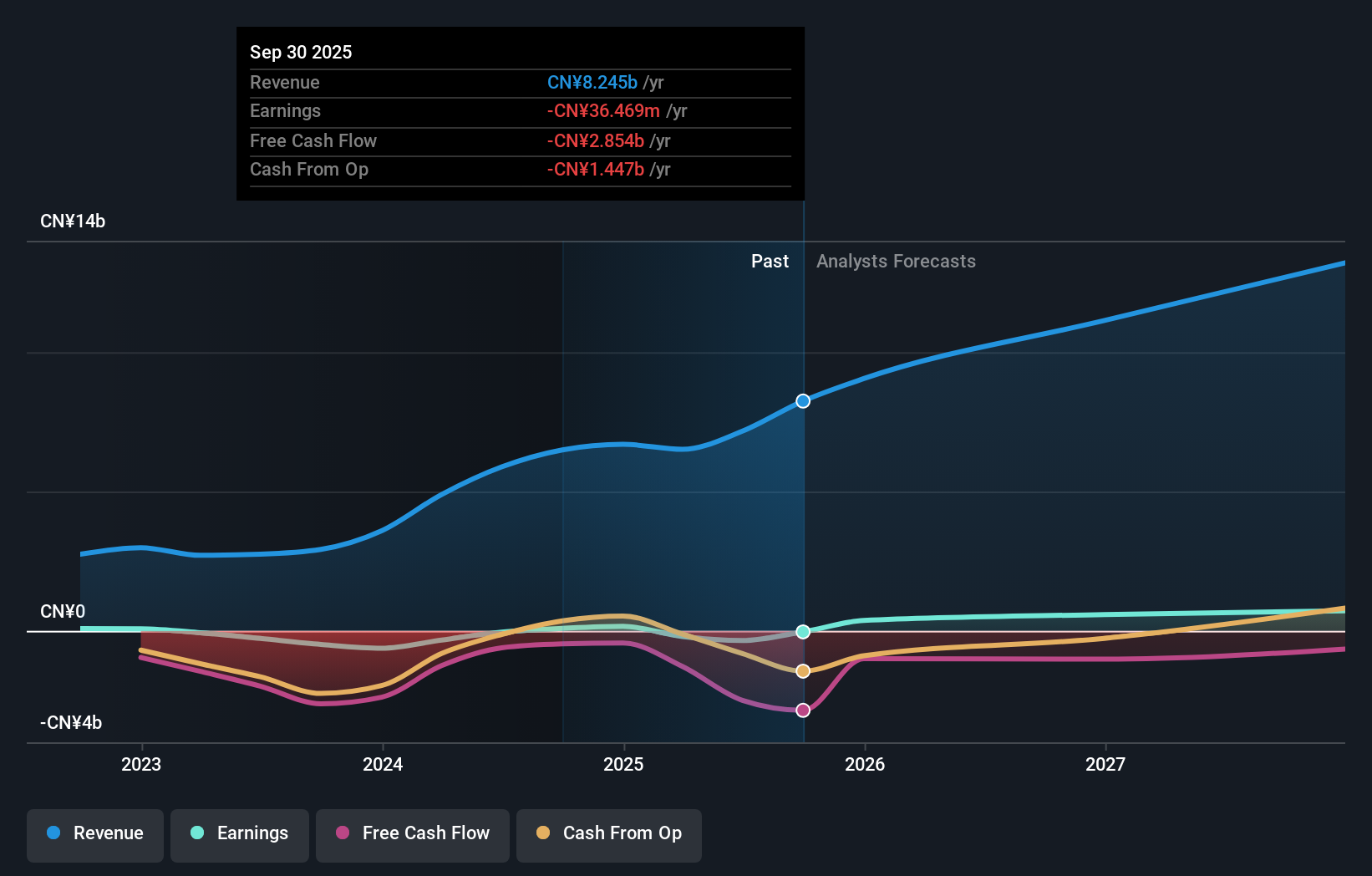

Overview: BIWIN Storage Technology Co., Ltd. specializes in the research, development, design, packaging, testing, production, and sale of semiconductor memories with a market capitalization of CN¥27.56 billion.

Operations: The company generates its revenue primarily from the semiconductor segment, totaling CN¥4.89 billion.

Insider Ownership: 18.8%

BIWIN Storage Technology has demonstrated substantial growth, with a notable increase in first quarter revenue to CNY 1.73 billion from CNY 425.49 million year-over-year and a shift to a net income of CNY 167.56 million from a previous loss. This performance aligns with forecasts predicting revenue growth at 25.6% annually, outpacing the Chinese market's average. The company's recent product launches and strategic share buybacks further underscore its proactive market stance, despite its highly volatile share price and low forecasted Return on Equity (19.7%).

- Dive into the specifics of BIWIN Storage Technology here with our thorough growth forecast report.

- The valuation report we've compiled suggests that BIWIN Storage Technology's current price could be inflated.

M31 Technology (TPEX:6643)

Simply Wall St Growth Rating: ★★★★★★

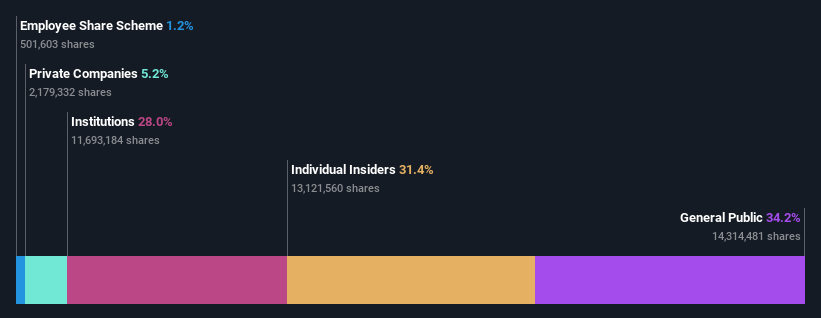

Overview: M31 Technology Corporation specializes in providing silicon intellectual property (IP) design services within the integrated circuit industry, with a market capitalization of approximately NT$47.45 billion.

Operations: The firm generates NT$1.64 billion from its semiconductor equipment and services segment.

Insider Ownership: 31.4%

M31 Technology is poised for significant growth with forecasted earnings and revenue increases of 36% and 25.5% per year, respectively, outpacing the Taiwanese market. High insider ownership aligns leadership with shareholder interests, enhancing trust in management's commitment to long-term value creation. Recent launches of advanced memory IP solutions cater to burgeoning AI and HPC markets, promising robust business opportunities despite a recent dip in quarterly net income to TWD 42.31 million from TWD 70.07 million year-over-year.

- Click here and access our complete growth analysis report to understand the dynamics of M31 Technology.

- According our valuation report, there's an indication that M31 Technology's share price might be on the expensive side.

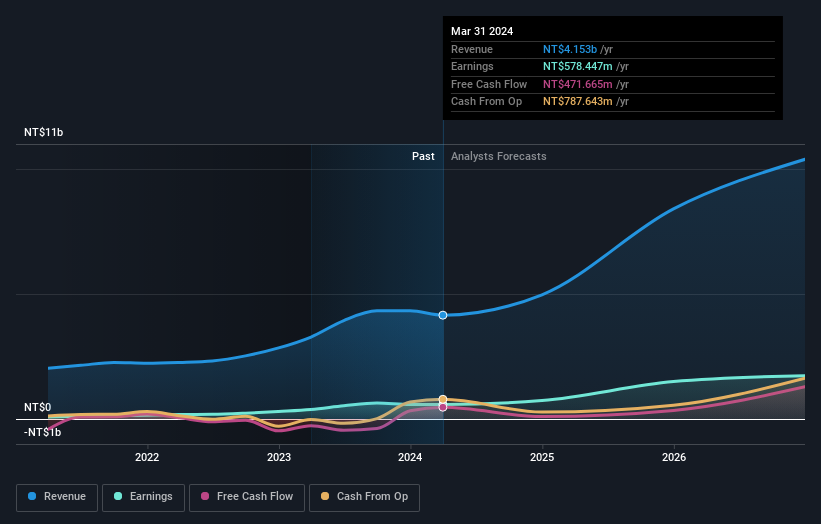

Kaori Heat Treatment (TWSE:8996)

Simply Wall St Growth Rating: ★★★★★★

Overview: Kaori Heat Treatment Co., Ltd. is a company based in Taiwan that develops, manufactures, and sells heat exchanger solutions globally, with a market capitalization of NT$43.28 billion.

Operations: The company generates revenue primarily through two segments: Plate Heat Exchangers, which brought in NT$2.23 billion, and its Energy Conservation Product Segment, including Metal Products and Processing, contributing NT$1.92 billion.

Insider Ownership: 13.9%

Kaori Heat Treatment Co. has shown resilience with a slight increase in net income to TWD 128.58 million from TWD 126.66 million year-over-year, despite a drop in sales. The company's earnings are expected to grow by 41.19% annually, outstripping the Taiwanese market's growth, with revenue also forecasted to expand significantly at 34.8% per year. Additionally, the establishment of a Sustainable Development Committee highlights its commitment to long-term strategic goals amidst high insider ownership which aligns interests and fosters stability.

- Delve into the full analysis future growth report here for a deeper understanding of Kaori Heat Treatment.

- Our comprehensive valuation report raises the possibility that Kaori Heat Treatment is priced higher than what may be justified by its financials.

Next Steps

- Access the full spectrum of 1453 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if BIWIN Storage Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688525

BIWIN Storage Technology

Research, develops, designs, packs, tests, produces, and sells semiconductor memories.

Exceptional growth potential and fair value.