- China

- /

- Electronic Equipment and Components

- /

- SZSE:300782

Three High Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

In a week marked by heightened economic activity and mixed signals from the labor market, global stock indices experienced volatility with growth stocks underperforming their value counterparts. Amid this backdrop, investors are increasingly focused on companies with strong insider ownership as they often signal confidence in the firm's long-term potential and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.1% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Pharma Mar (BME:PHM) | 11.8% | 55.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Underneath we present a selection of stocks filtered out by our screen.

Ninebot (SHSE:689009)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ninebot Limited is involved in the design, research and development, production, sale, and servicing of transportation and robot products globally, with a market cap of CN¥32.66 billion.

Operations: Ninebot Limited's revenue primarily comes from its global operations in designing, developing, producing, selling, and servicing transportation and robot products.

Insider Ownership: 16%

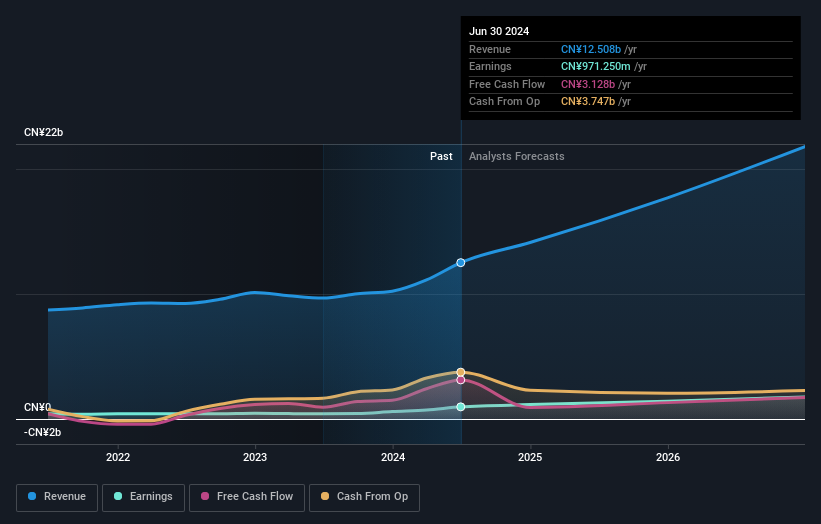

Ninebot's earnings grew significantly by 172.3% over the past year, with revenue expected to increase at a robust 23.3% annually, outpacing the Chinese market's growth rate. The company's price-to-earnings ratio of 27.5x suggests it is valued attractively compared to the broader market at 33.6x. Recent financial results show strong performance, with sales reaching CNY 10.91 billion and net income rising to CNY 969.67 million for the nine months ended September 2024, indicating solid growth potential despite high one-off items impacting results.

- Delve into the full analysis future growth report here for a deeper understanding of Ninebot.

- Insights from our recent valuation report point to the potential overvaluation of Ninebot shares in the market.

Straumann Holding (SWX:STMN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Straumann Holding AG is a global provider of tooth replacement and orthodontic solutions with a market cap of CHF18.54 billion.

Operations: Straumann Holding AG's revenue segments include Sales NAM at CHF800.14 million, Operations at CHF1.26 billion, Sales APAC at CHF540.74 million, Sales EMEA at CHF1.20 billion, and Sales LATAM at CHF282.34 million.

Insider Ownership: 32.7%

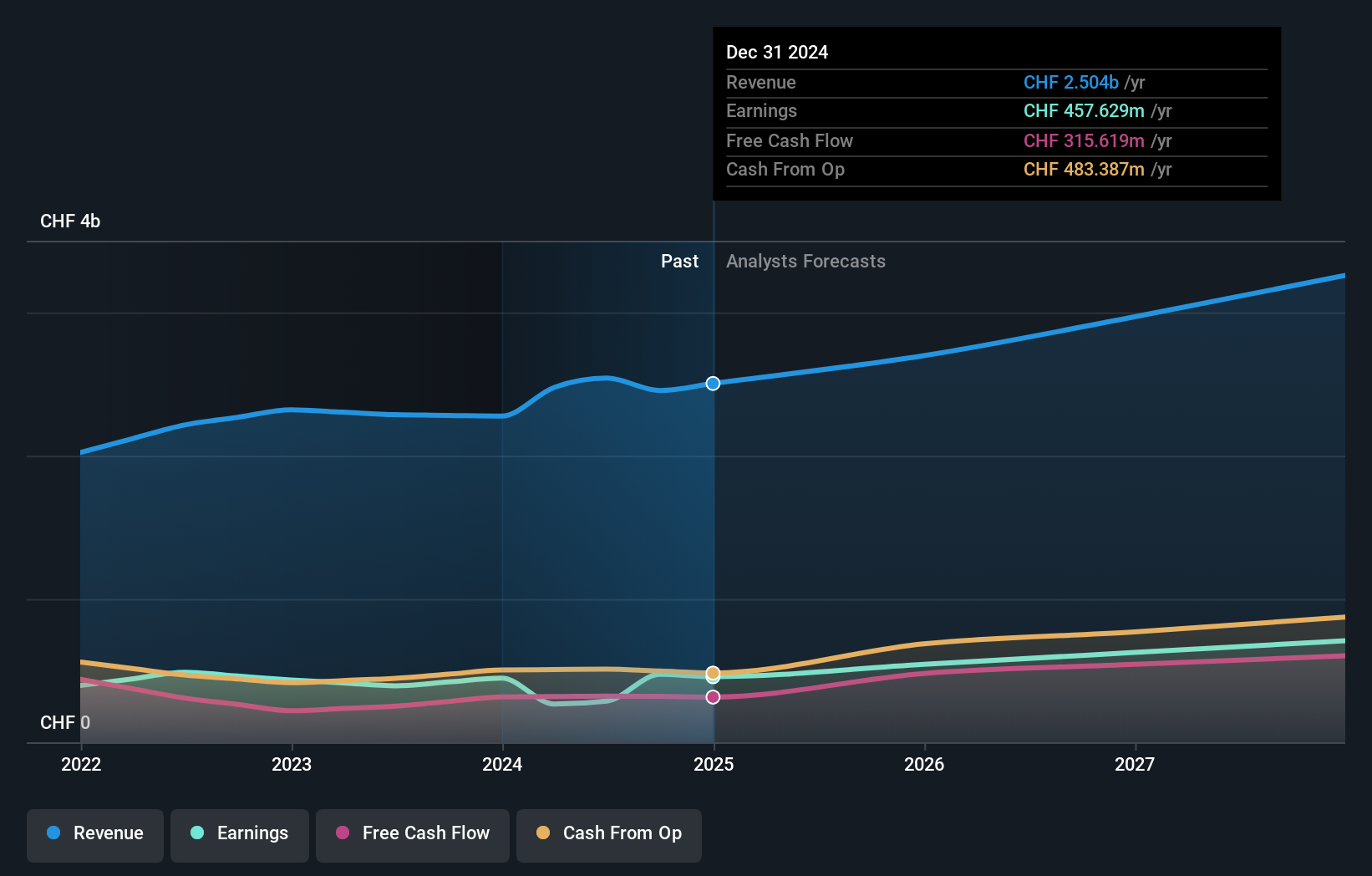

Straumann Holding's earnings are projected to grow at 21.2% annually, surpassing the Swiss market average of 11%. Despite recent volatility in its share price, the company remains a good value, trading below estimated fair value. Recent half-year results show sales of CHF 1.27 billion and net income of CHF 230.37 million, with profitability expected in the 27%-28% range for 2024. However, profit margins have decreased from last year due to large one-off items impacting financial results.

- Take a closer look at Straumann Holding's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Straumann Holding's current price could be inflated.

Maxscend Microelectronics (SZSE:300782)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Maxscend Microelectronics Company Limited focuses on the research, development, production, and sale of radio frequency integrated circuits in China with a market cap of CN¥48.78 billion.

Operations: Maxscend Microelectronics Company Limited generates revenue from its core activities in the research, development, production, and sale of radio frequency integrated circuits within China.

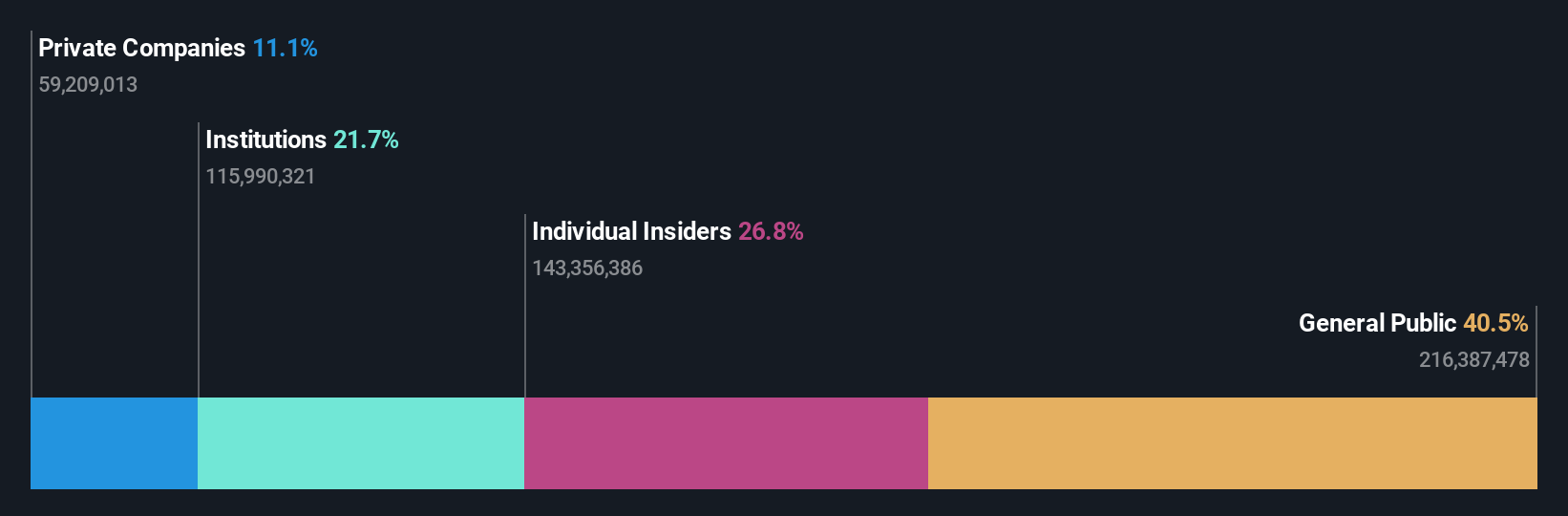

Insider Ownership: 27.8%

Maxscend Microelectronics is experiencing significant expected earnings growth of 30.7% annually, outpacing the Chinese market's average. Despite recent volatility, its revenue increased to CNY 3.37 billion for the nine months ending September 2024 from CNY 3.07 billion a year ago, although net income declined to CNY 425.42 million from CNY 818.95 million due to lower profit margins and high non-cash earnings levels impacting overall profitability.

- Click here to discover the nuances of Maxscend Microelectronics with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Maxscend Microelectronics' share price might be too optimistic.

Summing It All Up

- Explore the 1537 names from our Fast Growing Companies With High Insider Ownership screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300782

Maxscend Microelectronics

Engages in the research, development, production, and sale of radio frequency integrated circuits in the People’s Republic of China.

Reasonable growth potential with adequate balance sheet.