- Taiwan

- /

- Trade Distributors

- /

- TWSE:8374

Undiscovered Gems Featuring 3 Promising Stocks with Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by climbing U.S. stock indexes and heightened inflation expectations, small-cap stocks have recently lagged behind their larger counterparts, with the Russell 2000 Index trailing the S&P 500. In this environment of cautious optimism and selective growth, identifying promising stocks involves looking for companies that demonstrate resilience and potential for growth despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

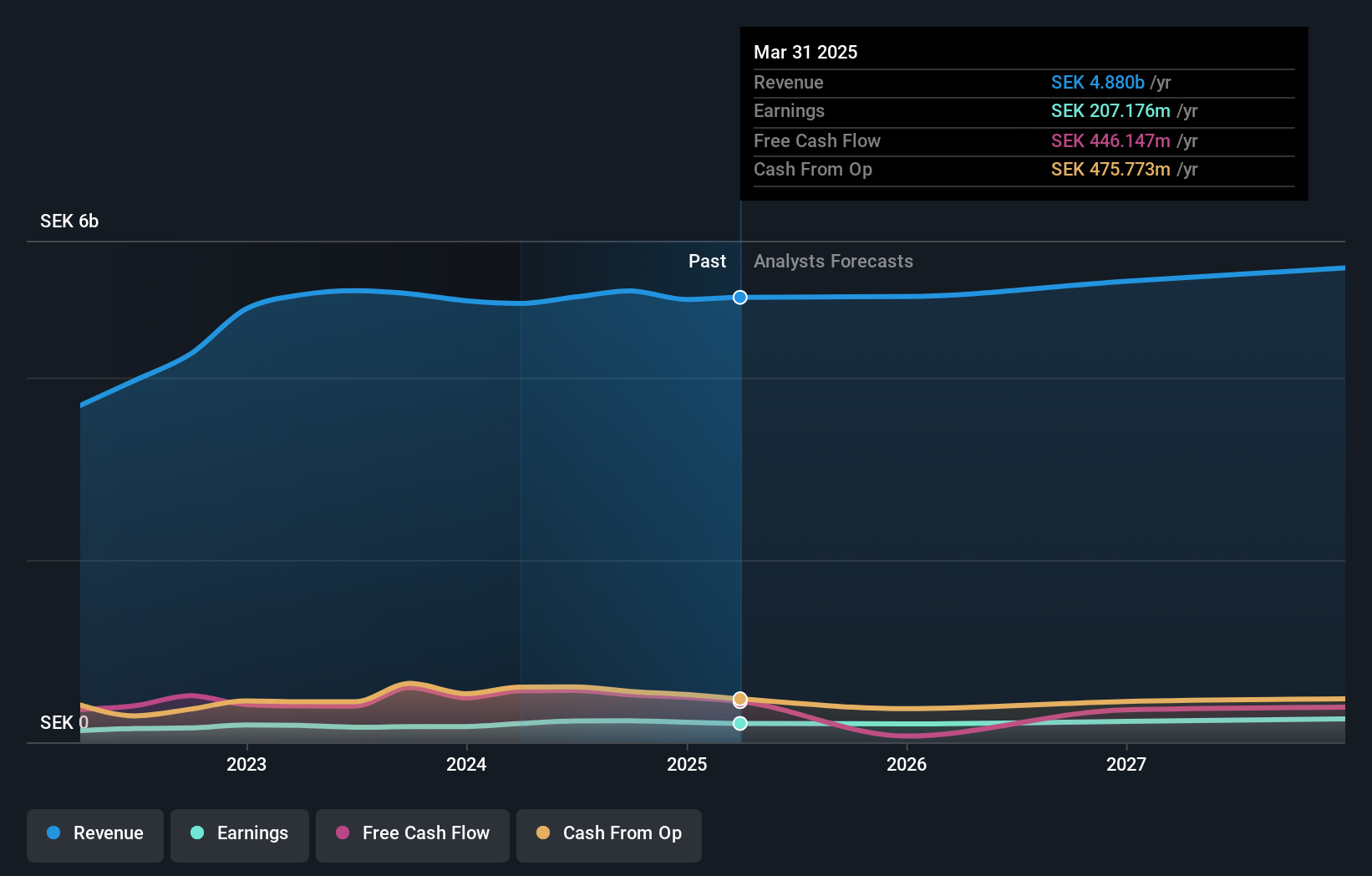

Proact IT Group (OM:PACT)

Simply Wall St Value Rating: ★★★★★★

Overview: Proact IT Group AB (publ) is a company that offers data and information management services, focusing on cloud services and data center solutions across Sweden, the United Kingdom, the Netherlands, Germany, and other international markets, with a market capitalization of SEK3.49 billion.

Operations: Proact IT Group generates revenue primarily from its regional segments, with the Nordics & Baltics contributing SEK2.53 billion and Central Europe (Czech Republic and Germany) adding SEK887.9 million. The UK segment accounts for SEK707.7 million, while the West region (Belgium and Netherlands) brings in SEK848.3 million.

Proact IT Group, a nimble player in the IT sector, has been making waves with its focus on cloud services and AI-driven solutions. Despite a slight revenue dip to SEK 1.27 billion in Q4 2024 from SEK 1.36 billion the previous year, the company remains profitable with net income at SEK 50.3 million. The recent dividend proposal of SEK 2.40 per share aligns well with their policy of distributing profits to shareholders. Leadership changes are underway as CEO Jonas Hasselberg steps down after significantly boosting revenues and profits during his tenure, leaving Proact poised for continued growth under new leadership by mid-2025.

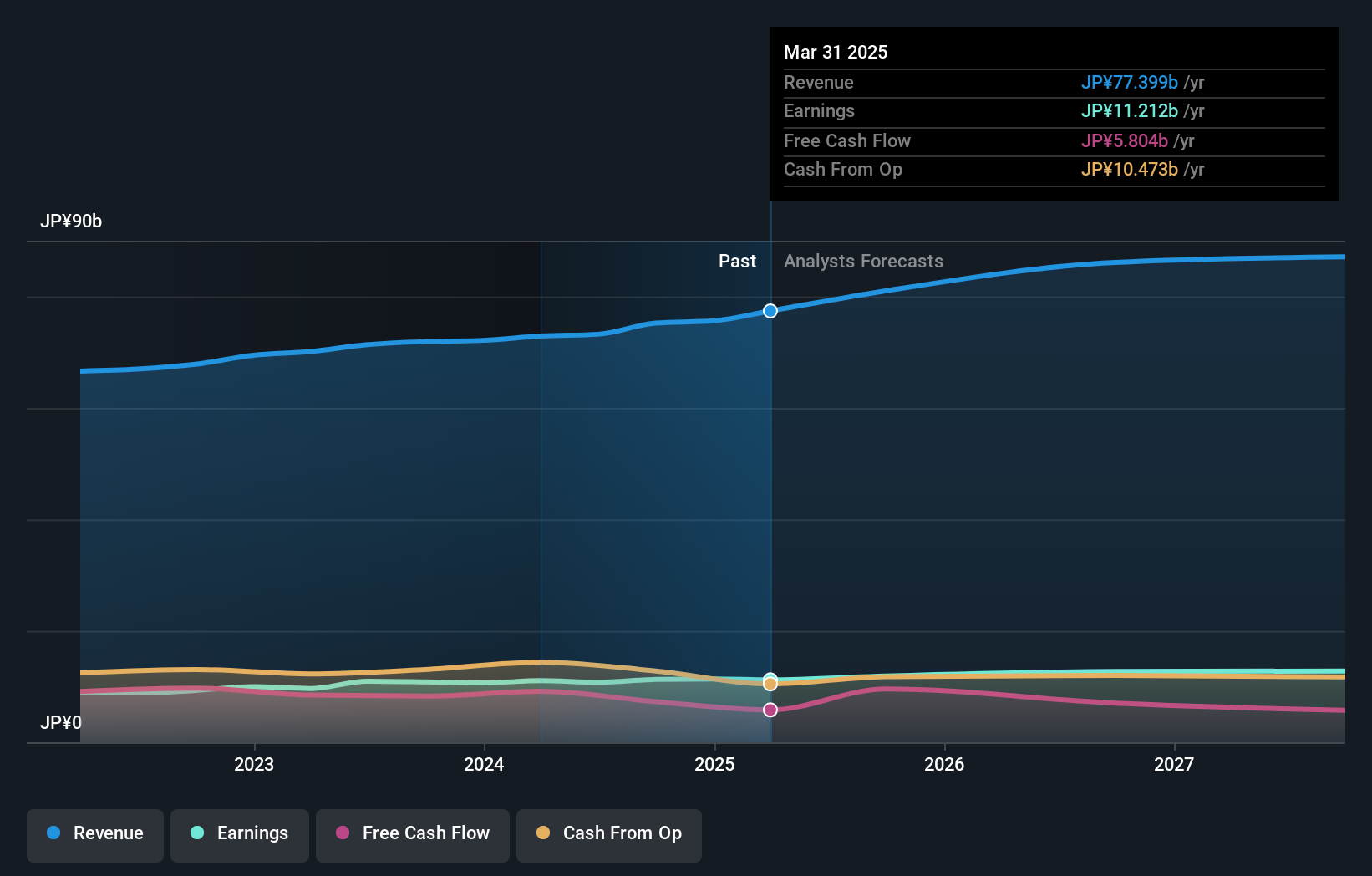

TKC (TSE:9746)

Simply Wall St Value Rating: ★★★★★★

Overview: TKC Corporation functions as a specialized electronic data processing center catering to accounting firms and local governments in Japan, with a market cap of ¥199.73 billion.

Operations: TKC Corporation generates revenue through its electronic data processing services, primarily targeting accounting firms and local governments in Japan. The company has a market cap of ¥199.73 billion.

TKC, a small company with high-quality earnings, has seen its profits grow 8.4% annually over the past five years. The firm maintains a healthy financial structure with more cash than total debt and has successfully reduced its debt to equity ratio from 0.9 to 0.07 in the same period. Recently, TKC completed a share buyback of 865,000 shares for ¥3.30 billion, aiming to boost capital efficiency and shareholder returns by cancelling repurchased shares. Despite not outperforming industry growth last year, earnings are forecasted to increase by 4.46% annually moving forward.

- Dive into the specifics of TKC here with our thorough health report.

Examine TKC's past performance report to understand how it has performed in the past.

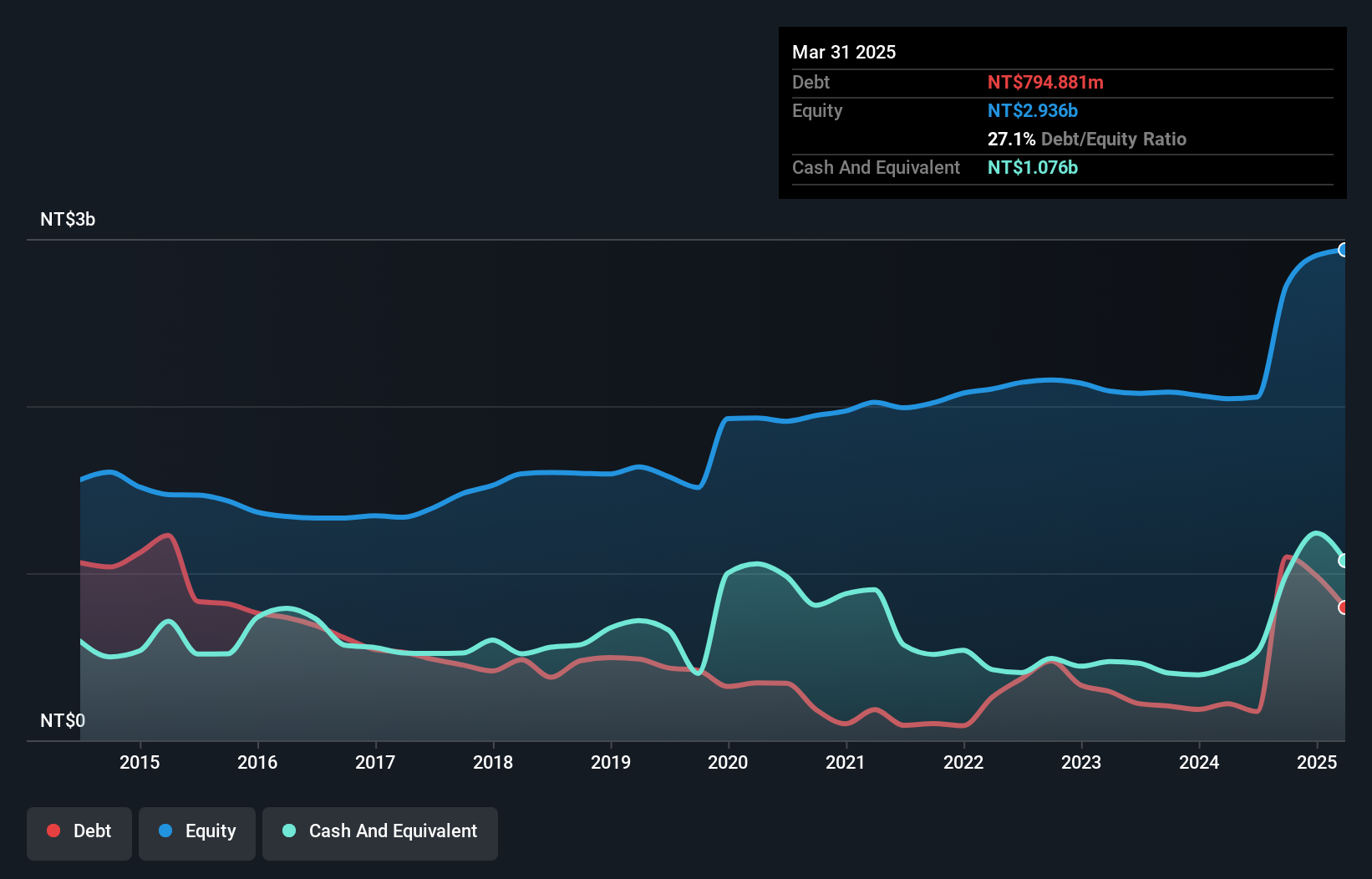

Ace Pillar (TWSE:8374)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ace Pillar Co., Ltd. is an industrial automation company that distributes automatic mechatronics components both in Taiwan and internationally, with a market capitalization of NT$14.20 billion.

Operations: Ace Pillar generates revenue primarily from its Taiwan Operations Department (NT$950.44 million), Mainland Operations Department (NT$1.07 billion), and Energy Saving/Storage Department (NT$451.09 million). The Semiconductor Equipment Sales and Service Division also contributes NT$528.54 million to the total revenue.

Ace Pillar, a promising name in the trade distributors sector, has recently turned profitable, contrasting with the industry's -0.9% earnings growth. Over the past five years, its debt to equity ratio rose from 27.7% to 40.3%, yet remains satisfactory with a net debt to equity of 3.7%. The company's interest payments are comfortably covered by EBIT at 9.9 times coverage, suggesting robust financial health despite recent share price volatility. Its high-quality earnings and positive free cash flow position it well for future stability and potential growth within its niche market segment.

- Click here and access our complete health analysis report to understand the dynamics of Ace Pillar.

Gain insights into Ace Pillar's past trends and performance with our Past report.

Seize The Opportunity

- Click through to start exploring the rest of the 4721 Undiscovered Gems With Strong Fundamentals now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8374

Ace Pillar

Engages in the testing, processing, selling, repairment, electromechanical integration of automation control and mechanical transmission system; and intelligent technology service.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives