- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6524

Undiscovered Gems And 2 Other Small Caps With Potential

Reviewed by Simply Wall St

As global markets respond to easing inflation and strong earnings reports, small-cap stocks are gaining renewed attention, with the S&P MidCap 400 and Russell 2000 indices showing notable weekly gains. In this environment, identifying promising small-cap companies requires a keen eye for those that can leverage current economic conditions to enhance their growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Macnica Galaxy | 52.99% | 8.23% | 18.45% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 35.98% | -1.56% | 50.16% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tait Marketing & Distribution | 0.75% | 7.36% | 18.40% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

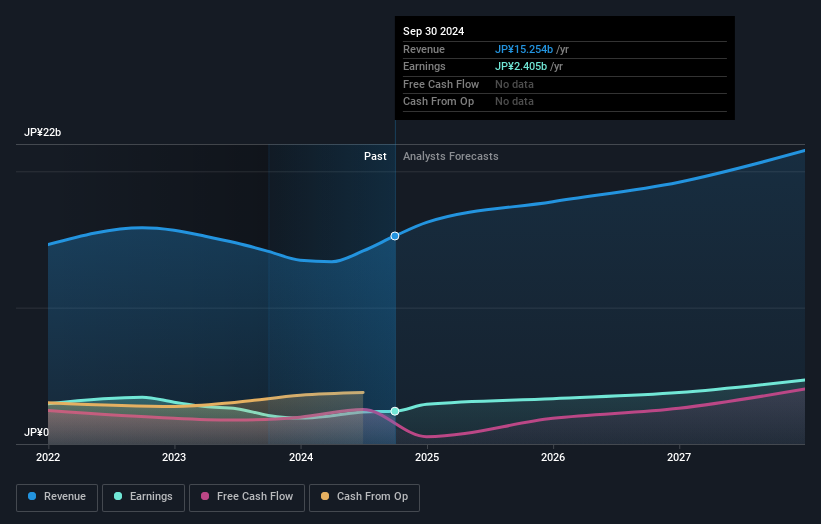

Kohoku KogyoLTD (TSE:6524)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kohoku Kogyo CO., LTD. is engaged in the manufacturing and sale of lead terminals for aluminum electrolytic capacitors, optical components and devices for optical fiber communication networks, and precision components using quartz glass materials in Japan, with a market capitalization of ¥73.21 billion.

Operations: Kohoku Kogyo generates revenue primarily from its Lead Terminal Business, contributing ¥8.11 billion, and its Optical Components and Devices Business, which adds ¥7.15 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability trends over time.

Kohoku Kogyo, a small cap player in optical components, is making waves with its strategic alliance with WARPSPACE Inc., investing approximately ¥300 million for an 8.9% stake. This partnership focuses on developing advanced optical systems for space communications, leveraging Kohoku's expertise in reliable optical devices used in submarine cables. The company has been growing earnings at 14.7%, surpassing the electronic industry's -0.2%. Trading at 27% below fair value estimates and boasting high-quality past earnings, Kohoku is poised to enhance its market share through innovations and collaborations in satellite communication technologies.

- Unlock comprehensive insights into our analysis of Kohoku KogyoLTD stock in this health report.

Evaluate Kohoku KogyoLTD's historical performance by accessing our past performance report.

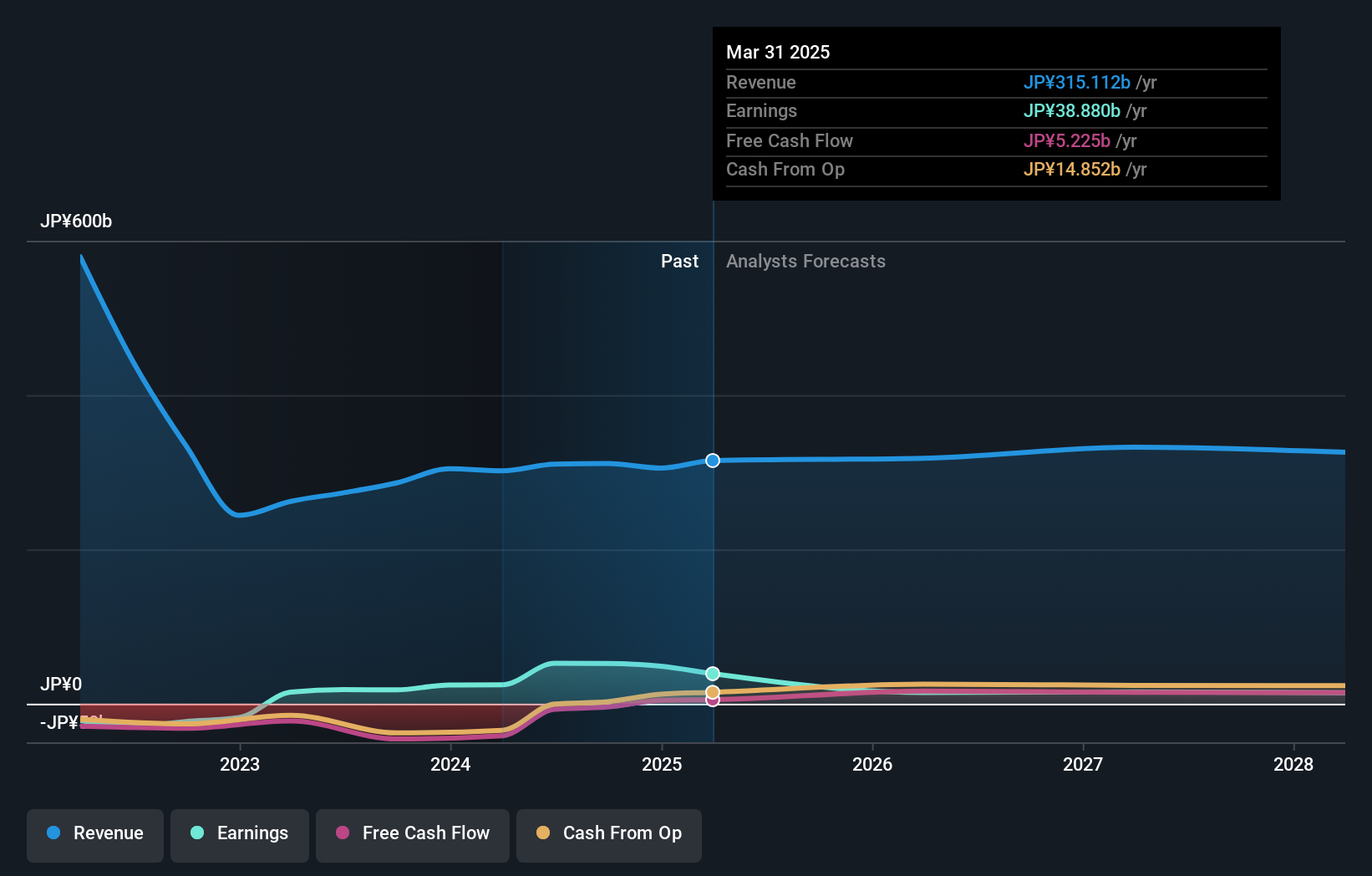

MITSUI E&S (TSE:7003)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MITSUI E&S Co., Ltd. is a company that, along with its subsidiaries, offers marine propulsion systems across various regions including Japan, Asia, Europe, and North America; it has a market capitalization of approximately ¥148.91 billion.

Operations: The primary revenue stream for MITSUI E&S Co., Ltd. comes from Marine Propulsion Systems, generating ¥138.19 billion, followed by Peripheral Businesses at ¥89.67 billion and Logistics Systems contributing ¥57.34 billion. New Business Development adds another ¥39.13 billion to the revenue mix.

Mitsui E&S, a notable player in the machinery sector, has demonstrated impressive earnings growth of 191.5% over the past year, outpacing its industry peers. Despite this growth, the firm faces challenges with a high net debt to equity ratio of 40.9%, which remains above comfortable levels despite reducing from 101.7% to 65.1% over five years. The company's interest payments are well covered by EBIT at 7.9 times coverage, indicating solid operational profitability amidst volatile share prices recently observed in the market. Trading at a value below fair estimates suggests potential for investors seeking undervalued opportunities within this space.

- Take a closer look at MITSUI E&S' potential here in our health report.

Assess MITSUI E&S' past performance with our detailed historical performance reports.

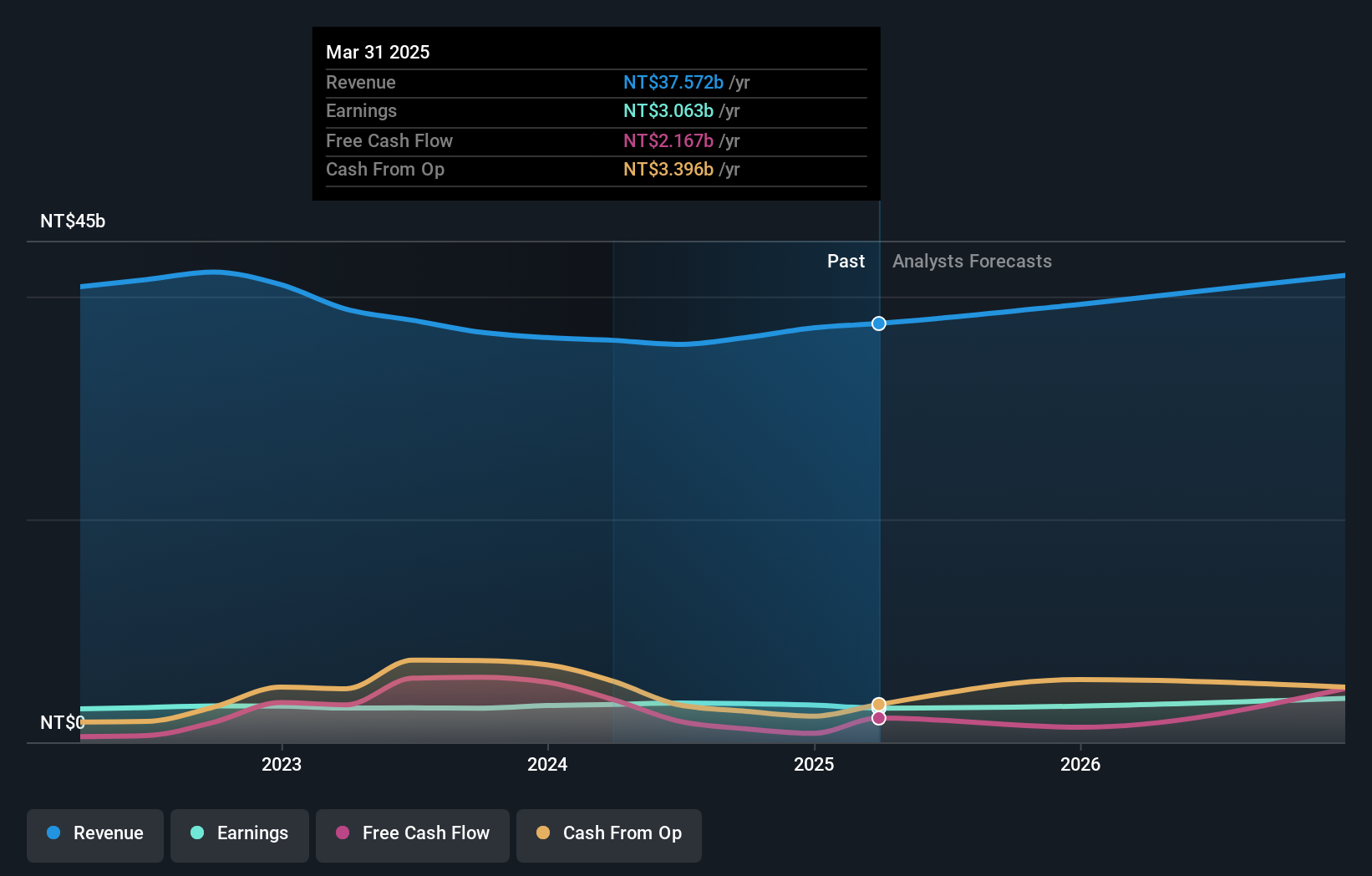

Chicony Power Technology (TWSE:6412)

Simply Wall St Value Rating: ★★★★★★

Overview: Chicony Power Technology Co., Ltd. is a Taiwanese company that develops, manufactures, and sells switching power supplies, electronic components, LED lighting modules, and smart building solutions with a market cap of NT$49.90 billion.

Operations: Chicony Power Technology generates revenue primarily from its operations in Asia and domestic markets, with NT$31.32 billion and NT$35.12 billion, respectively. The company's revenue model is heavily reliant on these regions, while the American market contributes significantly less at NT$1.05 billion.

Chicony Power Technology, a promising player in the electrical industry, has shown robust earnings growth of 13% over the past year, outpacing the sector's average. The company's price-to-earnings ratio stands at a competitive 14.6x against the Taiwan market average of 20.5x, suggesting good relative value. Despite a slight dip in quarterly net income to TWD 886 million from TWD 942 million last year, Chicony reported increased sales and improved basic earnings per share for nine months ending September 2024 at TWD 6.19 compared to TWD 5.81 previously, indicating solid financial health and potential for future growth.

- Delve into the full analysis health report here for a deeper understanding of Chicony Power Technology.

Understand Chicony Power Technology's track record by examining our Past report.

Key Takeaways

- Explore the 4663 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kohoku KogyoLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6524

Kohoku KogyoLTD

Manufactures and sells lead terminals for aluminum electrolytic capacitors, optical components and devices for optical fiber communication network, and precision components using quartz glass materials in Japan, China, rest of Asia, England, the United States, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives