- Taiwan

- /

- Trade Distributors

- /

- TWSE:6192

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate through a landscape marked by record-high U.S. indexes and geopolitical uncertainties, investors are keenly observing the Federal Reserve's upcoming decisions on interest rates and their potential impact on economic growth. Amid this backdrop, dividend stocks can offer a measure of stability and income, particularly appealing when market volatility is prevalent and interest rate movements remain uncertain.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.01% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.47% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.25% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.57% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.30% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.37% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.30% | ★★★★★★ |

Click here to see the full list of 1948 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

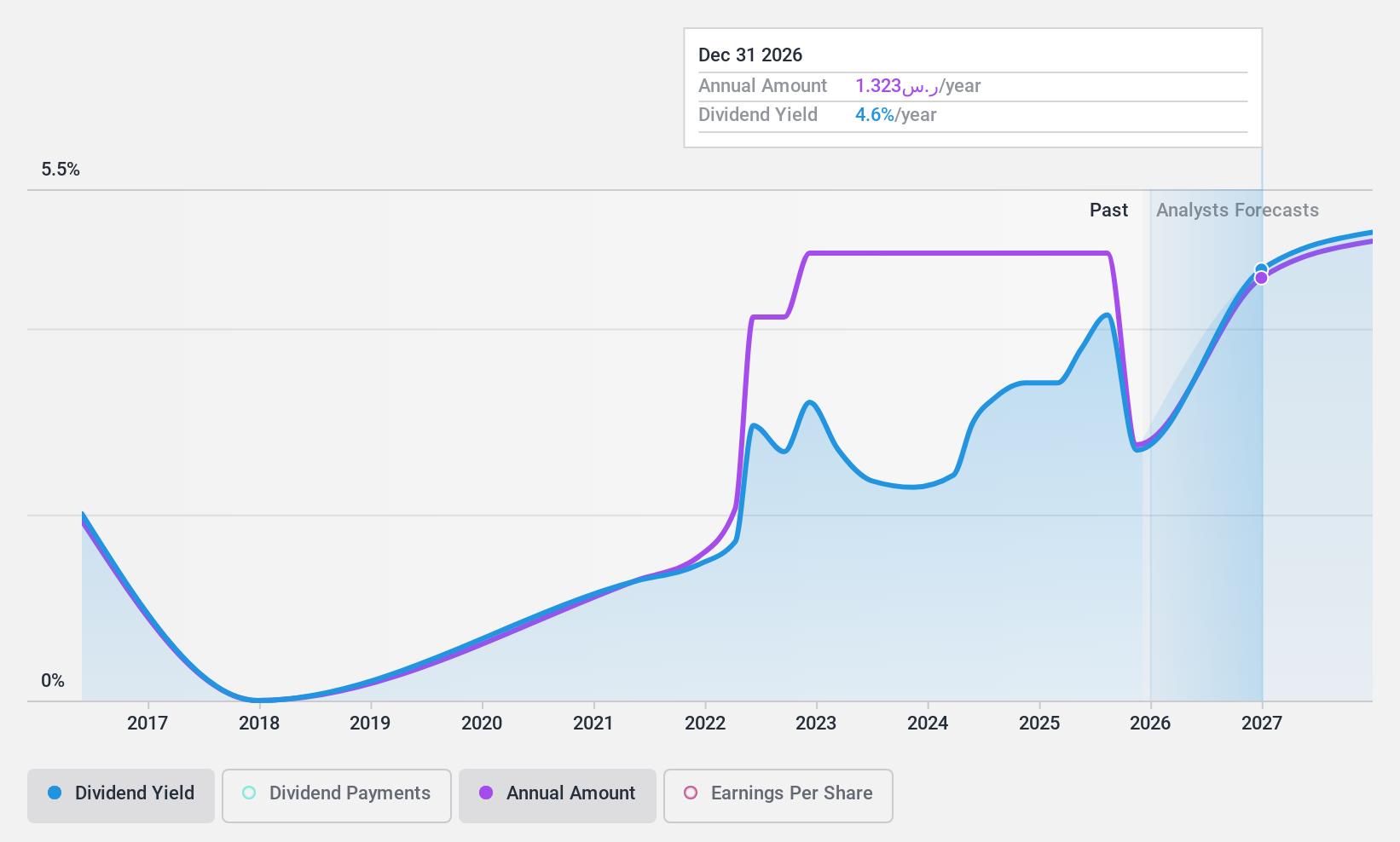

Al Hammadi Holding (SASE:4007)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al Hammadi Holding Company is a healthcare group offering a range of medical services in the Kingdom of Saudi Arabia, with a market cap of SAR6.45 billion.

Operations: Al Hammadi Holding Company's revenue is primarily derived from its medical services segment, which contributes SAR935.68 million, and its pharmaceutical products segment, which adds SAR199.10 million.

Dividend Yield: 3.5%

Al Hammadi Holding's dividends are covered by earnings and cash flows, with payout ratios of 68.7% and 60.1%, respectively. Despite a history of volatility, the company has increased its dividend payments over the past decade. The recent SAR 0.35 dividend aligns with sustainable practices but remains below top-tier yields in the Saudi market. Recent earnings growth supports potential future payouts, though past instability may concern some investors seeking consistent returns.

- Unlock comprehensive insights into our analysis of Al Hammadi Holding stock in this dividend report.

- In light of our recent valuation report, it seems possible that Al Hammadi Holding is trading behind its estimated value.

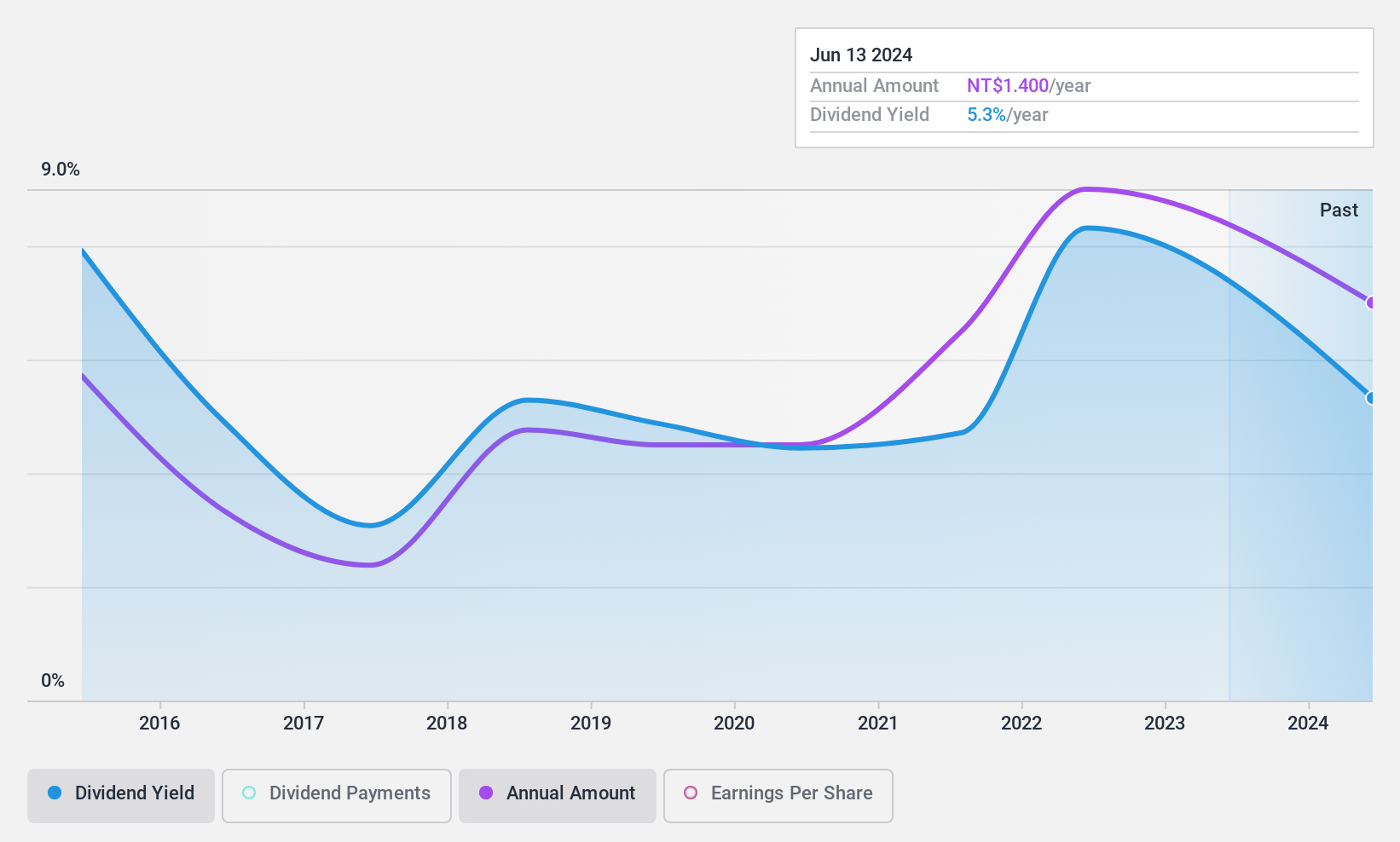

Central Reinsurance (TWSE:2851)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Central Reinsurance Corporation offers property and life inward and outward reinsurance services both in Taiwan and internationally, with a market cap of NT$21.13 billion.

Operations: Central Reinsurance Corporation generates revenue of NT$22.85 billion from its reinsurance services.

Dividend Yield: 5.3%

Central Reinsurance's dividend payments have been volatile over the past decade, but they have shown growth. Despite a low payout ratio of 42.1%, dividends are not covered by free cash flows, raising sustainability concerns. The company's recent earnings report showed increased nine-month revenue and net income compared to last year, yet third-quarter figures declined year-over-year. Governance changes include new appointments in risk management and audit committees, potentially impacting future strategic decisions.

- Click here to discover the nuances of Central Reinsurance with our detailed analytical dividend report.

- The analysis detailed in our Central Reinsurance valuation report hints at an deflated share price compared to its estimated value.

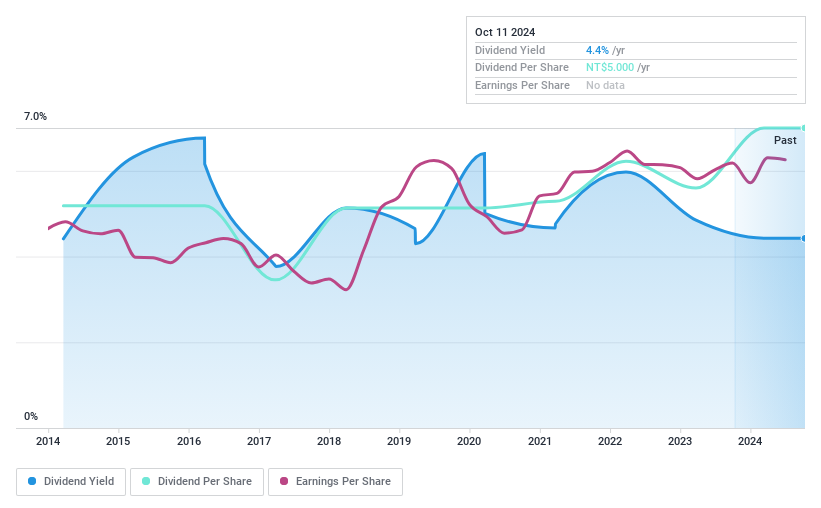

Lumax International (TWSE:6192)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lumax International Corp., Ltd. operates in Taiwan and China, offering electronic components and program-controlled instruments, with a market capitalization of NT$10.48 billion.

Operations: Lumax International Corp., Ltd. generates its revenue primarily from the provision of electronic components and program-controlled instruments in Taiwan and China.

Dividend Yield: 4.6%

Lumax International's dividend payments have been volatile over the past decade, despite an increase in payouts. The dividend yield of 4.59% is among the top quartile in Taiwan, supported by a payout ratio of 57.1% and a cash payout ratio of 60%. Recent earnings showed year-over-year growth in nine-month sales and net income, although third-quarter net income declined slightly. The stock trades at a significant discount to its estimated fair value.

- Take a closer look at Lumax International's potential here in our dividend report.

- Our valuation report unveils the possibility Lumax International's shares may be trading at a discount.

Where To Now?

- Click through to start exploring the rest of the 1945 Top Dividend Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6192

Lumax International

Provides electronic components and program-controlled instruments in Taiwan and China.

Flawless balance sheet established dividend payer.