- Taiwan

- /

- Electrical

- /

- TWSE:4545

With A 29% Price Drop For Min Aik Precision Industrial Co., Ltd. (TWSE:4545) You'll Still Get What You Pay For

Min Aik Precision Industrial Co., Ltd. (TWSE:4545) shares have retraced a considerable 29% in the last month, reversing a fair amount of their solid recent performance. Looking at the bigger picture, even after this poor month the stock is up 54% in the last year.

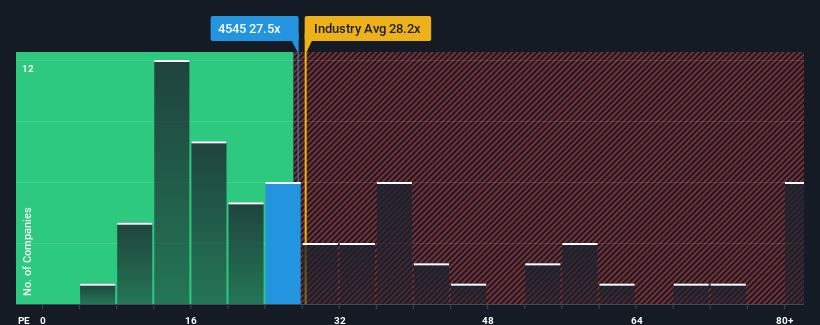

In spite of the heavy fall in price, Min Aik Precision Industrial's price-to-earnings (or "P/E") ratio of 27.5x might still make it look like a sell right now compared to the market in Taiwan, where around half of the companies have P/E ratios below 22x and even P/E's below 15x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Min Aik Precision Industrial has been doing a decent job lately as it's been growing earnings at a reasonable pace. It might be that many expect the reasonable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Min Aik Precision Industrial

Does Growth Match The High P/E?

In order to justify its P/E ratio, Min Aik Precision Industrial would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a decent 3.4% gain to the company's bottom line. Pleasingly, EPS has also lifted 130% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 23% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Min Aik Precision Industrial is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

What We Can Learn From Min Aik Precision Industrial's P/E?

Min Aik Precision Industrial's P/E hasn't come down all the way after its stock plunged. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Min Aik Precision Industrial maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Min Aik Precision Industrial is showing 2 warning signs in our investment analysis, and 1 of those is potentially serious.

Of course, you might also be able to find a better stock than Min Aik Precision Industrial. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4545

Min Aik Precision Industrial

Engages in processes and manufactures electroplating of aluminum and copper products, precision stamping components, and electroless nickel plating products.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success