Some Confidence Is Lacking In Shin Zu Shing Co., Ltd.'s (TWSE:3376) P/E

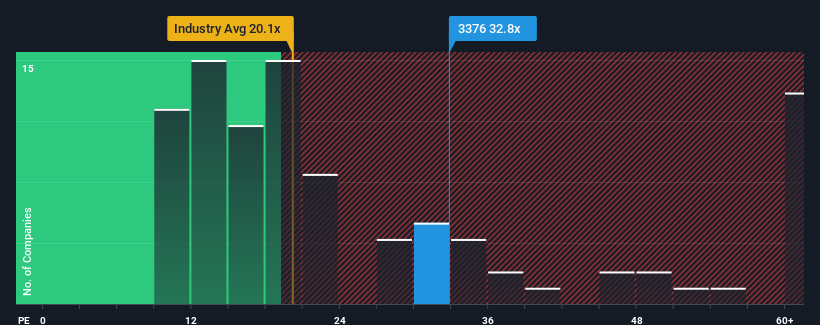

With a price-to-earnings (or "P/E") ratio of 32.8x Shin Zu Shing Co., Ltd. (TWSE:3376) may be sending very bearish signals at the moment, given that almost half of all companies in Taiwan have P/E ratios under 21x and even P/E's lower than 14x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Shin Zu Shing certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Shin Zu Shing

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Shin Zu Shing's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 58%. Still, incredibly EPS has fallen 12% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 24% over the next year. Meanwhile, the rest of the market is forecast to expand by 26%, which is not materially different.

With this information, we find it interesting that Shin Zu Shing is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Shin Zu Shing's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Shin Zu Shing's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 3 warning signs for Shin Zu Shing that you need to take into consideration.

You might be able to find a better investment than Shin Zu Shing. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3376

Shin Zu Shing

Engages in the research, design, development, production, assembly, testing, manufacturing, and trading of various precision springs, stamping parts, hinge components, CNC lathes, and metal injection molding in Taiwan, Singapore, and China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion