Stock Analysis

- Taiwan

- /

- Electrical

- /

- TWSE:2420

Exploring Dividend Potential With Turkiye Garanti Bankasi And Two Other Stocks

Reviewed by Simply Wall St

As global markets exhibit a mix of cautious optimism and strategic adjustments in response to recent economic data, investors are keenly observing the performance of various sectors and indices. Amid these dynamics, dividend stocks like Turkiye Garanti Bankasi continue to attract attention due to their potential for providing steady income streams in a fluctuating economic environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Mitsubishi Shokuhin (TSE:7451) | 3.52% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 8.42% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.60% | ★★★★★★ |

| Globeride (TSE:7990) | 3.52% | ★★★★★★ |

| Allianz (XTRA:ALV) | 5.18% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.49% | ★★★★★★ |

| Ryoyu Systems (TSE:4685) | 3.42% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.40% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.15% | ★★★★★★ |

| Innotech (TSE:9880) | 4.00% | ★★★★★★ |

Click here to see the full list of 1900 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

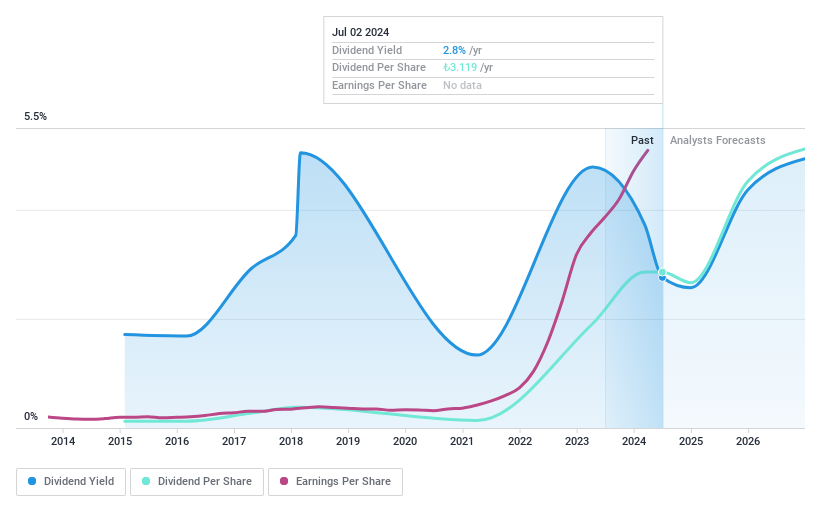

Turkiye Garanti Bankasi (IBSE:GARAN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Turkiye Garanti Bankasi A.S. offers a range of banking products and services across Turkey, with a market capitalization of approximately TRY 422.94 billion.

Operations: Turkiye Garanti Bankasi A.S. generates revenue primarily through its Retail Banking segment at TRY 75.02 billion and its Corporate and Commercial Banking segment at TRY 95.05 billion.

Dividend Yield: 3.1%

Turkiye Garanti Bankasi's recent financial performance shows a significant increase in net income to TRY 22.29 billion, up from TRY 15.37 billion year-over-year, with earnings per share also rising. Despite this growth, the bank's dividend history is marked by instability and volatility over its nine-year dividend-paying period. The dividends are well-covered by earnings with a low payout ratio of 14%, suggesting sustainability from an earnings perspective. However, the track record of fluctuating payouts may concern dividend stability-focused investors. Additionally, plans to issue bonds up to US$6 billion could impact future financial strategies and dividend policies.

- Unlock comprehensive insights into our analysis of Turkiye Garanti Bankasi stock in this dividend report.

- Upon reviewing our latest valuation report, Turkiye Garanti Bankasi's share price might be too pessimistic.

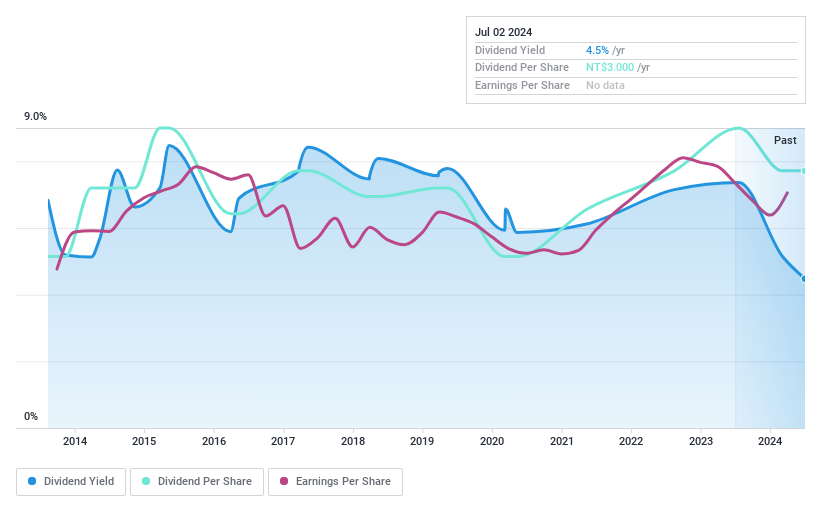

Zippy Technology (TWSE:2420)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zippy Technology Corp. operates in the design, manufacture, and trade of micro switches and power supplies across Taiwan, the United States, China, Germany, Italy, and other international markets with a market capitalization of approximately NT$9.85 billion.

Operations: Zippy Technology Corp. generates its revenue primarily from the design, production, and sale of micro switches and power supplies across various global markets.

Dividend Yield: 4.4%

Zippy Technology, with a dividend yield of 4.43%, ranks in the upper quartile for its market, yet its history of dividend payments has been inconsistent over the last decade, showing significant volatility. The company maintains a payout ratio of 76.5% and a cash payout ratio of 56.1%, suggesting that dividends are well-supported by earnings and cash flows. Recent financials from Q1 2024 show an improvement in net income to TWD 188.38 million from TWD 131.69 million year-over-year, potentially bolstering its dividend-paying capability despite past fluctuations and recent management changes in the finance department.

- Click here to discover the nuances of Zippy Technology with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Zippy Technology shares in the market.

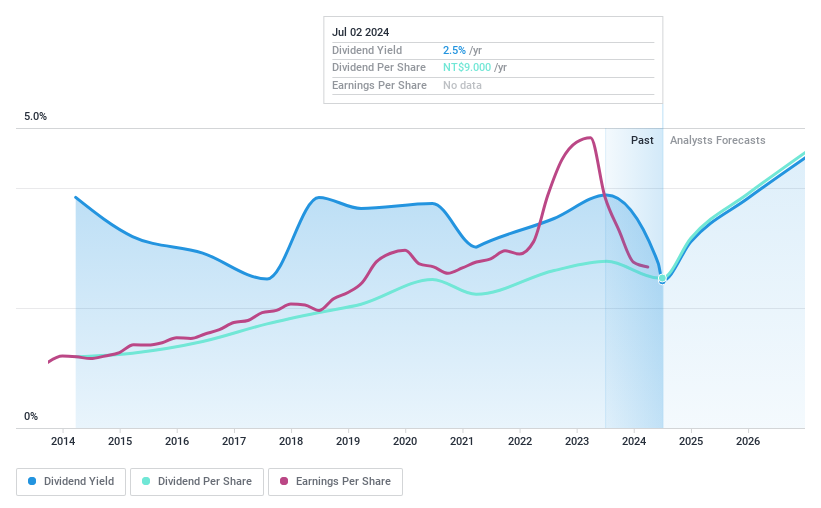

Bizlink Holding (TWSE:3665)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bizlink Holding Inc. is a company that specializes in researching, designing, developing, manufacturing, and selling products and components for various technology industries globally, with a market capitalization of approximately NT$42.50 billion.

Operations: Bizlink Holding Inc. generates revenue by researching, designing, developing, manufacturing, and selling products and components for technology industries across multiple countries.

Dividend Yield: 3.5%

Bizlink Holding maintains a stable dividend with a yield of 3.49%, supported by a payout ratio of 66.5% and cash payout ratio of 39%, indicating dividends are well-covered by both earnings and cash flows. Despite this, the company's recent financial performance shows challenges, with year-over-year sales declines in early 2024 and profit margins dropping from 7.2% to 4.5%. The firm recently raised US$3 million through a private placement, potentially for strategic initiatives amid these financial pressures.

- Get an in-depth perspective on Bizlink Holding's performance by reading our dividend report here.

- Our valuation report unveils the possibility Bizlink Holding's shares may be trading at a discount.

Turning Ideas Into Actions

- Discover the full array of 1900 Top Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Zippy Technology is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2420

Zippy Technology

Engages in the designing, manufacturing, and trading of micro switches and power supplies in Taiwan, the United States, China, Germany, Italy and internationally.

Flawless balance sheet established dividend payer.