As global markets navigate a cautious economic landscape marked by the Federal Reserve's recent rate cuts and political uncertainties, investors are increasingly seeking stability amidst volatility. With U.S. stocks experiencing fluctuations and concerns over interest rates affecting sentiment, dividend stocks can offer a reliable income stream, making them an attractive option for those looking to balance risk with steady returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.96% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.78% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.48% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.62% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.85% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.79% | ★★★★★☆ |

Click here to see the full list of 1968 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

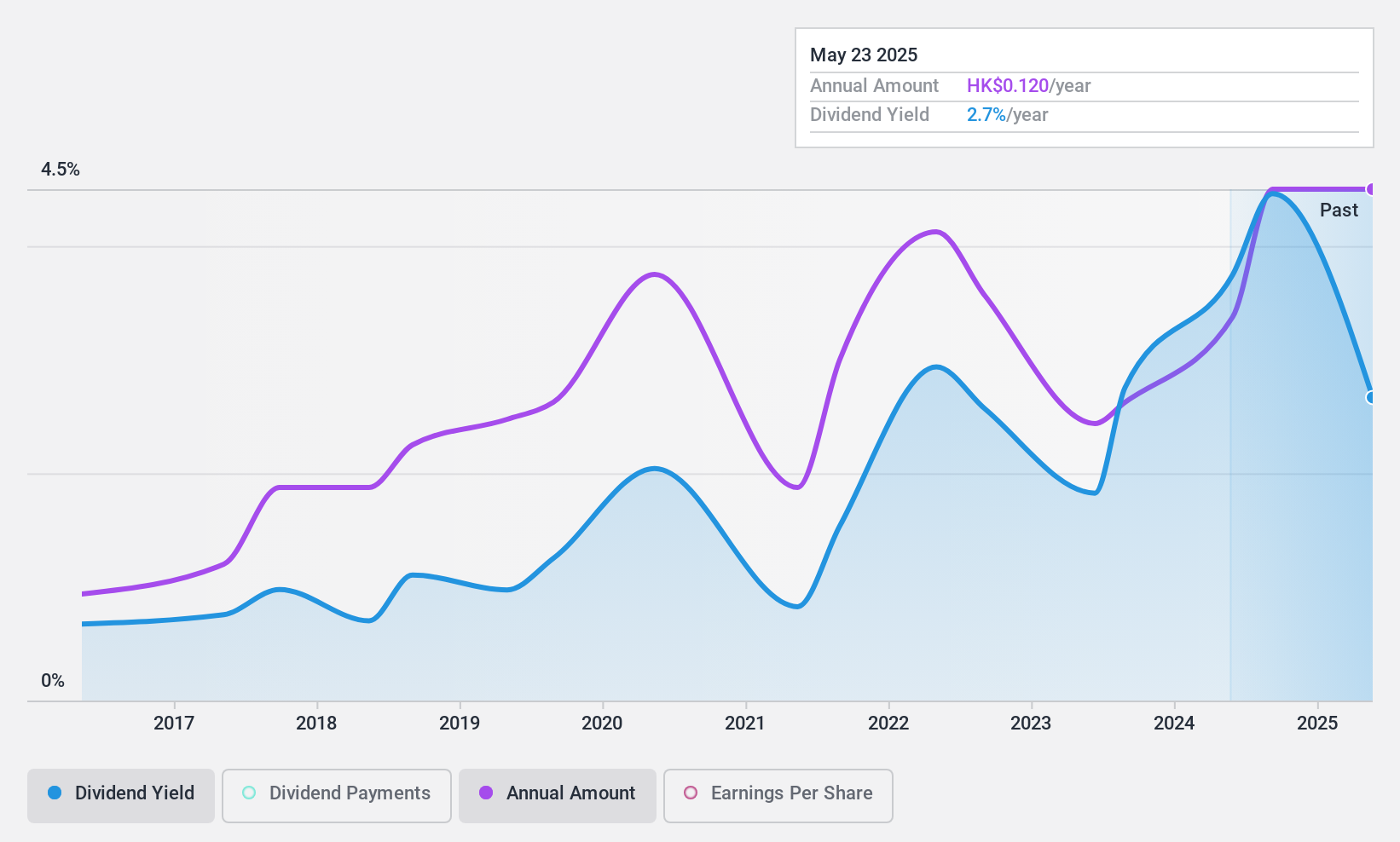

Essex Bio-Technology (SEHK:1061)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Essex Bio-Technology Limited is an investment holding company that develops, manufactures, distributes, and sells biopharmaceutical products in the People's Republic of China, Hong Kong, and internationally, with a market cap of HK$1.58 billion.

Operations: Essex Bio-Technology Limited generates its revenue primarily from two segments: Surgical, contributing HK$871.44 million, and Ophthalmology, with HK$747.39 million.

Dividend Yield: 4.1%

Essex Bio-Technology's dividend yield of 4.07% is below the top quartile in Hong Kong, but its low payout ratios—22.7% for earnings and 32.3% for cash flows—indicate strong coverage and sustainability. Despite growth in dividend payments over the past decade, they have been volatile with significant annual drops, making them unreliable. The stock's price-to-earnings ratio of 6.4x suggests it may be undervalued compared to the market average of 9.9x.

- Unlock comprehensive insights into our analysis of Essex Bio-Technology stock in this dividend report.

- The analysis detailed in our Essex Bio-Technology valuation report hints at an inflated share price compared to its estimated value.

PC Partner Group (SEHK:1263)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PC Partner Group Limited is an investment holding company that designs, develops, manufactures, and sells computer electronics with a market cap of HK$1.78 billion.

Operations: The primary revenue segment for PC Partner Group Limited is the design, manufacturing, and trading of electronics and PC parts and accessories, generating HK$9.94 billion.

Dividend Yield: 8.1%

PC Partner Group's dividend yield of 8.7% ranks in the top 25% in Hong Kong, though its history shows volatility and unreliability with past significant drops. Despite this, dividends are well-covered by both earnings and cash flows, with payout ratios of 66.1% and 7.8%, respectively. Recent changes include relocating headquarters to Singapore and board restructuring, potentially impacting future stability but not directly affecting current dividend sustainability or valuation attractiveness at present.

- Navigate through the intricacies of PC Partner Group with our comprehensive dividend report here.

- Our expertly prepared valuation report PC Partner Group implies its share price may be lower than expected.

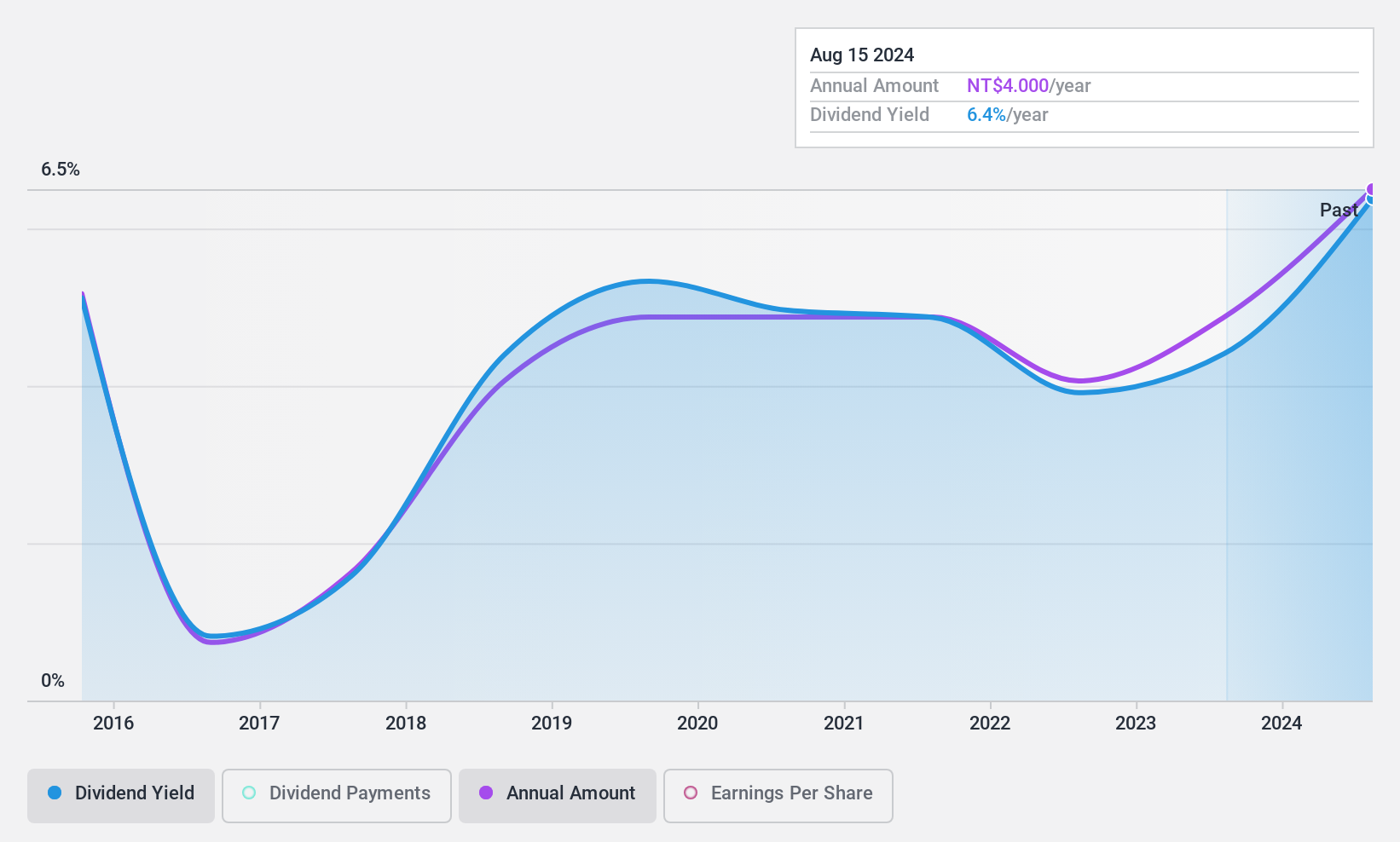

Goodway Machine (TWSE:1583)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Goodway Machine Corp. specializes in manufacturing and selling CNC lathes and processing machinery across Taiwan, Asia, the United States, Europe, and other international markets, with a market cap of NT$6.59 billion.

Operations: Goodway Machine Corp.'s revenue is derived from two main segments: CNC Lathes, which generated NT$2.51 billion, and the Processing Machine Department, contributing NT$2.54 billion.

Dividend Yield: 6.5%

Goodway Machine's dividend yield of 6.49% is among the top 25% in Taiwan, yet its history reflects volatility and unreliability. The recent earnings report showed a decline in both sales and net income, impacting dividend sustainability. With a high cash payout ratio of 941.8%, dividends are not well covered by free cash flows, though they are covered by earnings at a 76.3% payout ratio. Its P/E ratio of 11.7x suggests potential value relative to the market average.

- Get an in-depth perspective on Goodway Machine's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Goodway Machine's share price might be too optimistic.

Key Takeaways

- Dive into all 1968 of the Top Dividend Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1583

Goodway Machine

Manufactures and sells CNC lathes and processing machinery in Taiwan, Asia, the United States, Europe, and internationally.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives