- Taiwan

- /

- Electrical

- /

- TWSE:1513

Chung-Hsin Electric and Machinery Manufacturing Corp. (TWSE:1513) Looks Just Right With A 25% Price Jump

Chung-Hsin Electric and Machinery Manufacturing Corp. (TWSE:1513) shares have continued their recent momentum with a 25% gain in the last month alone. The annual gain comes to 101% following the latest surge, making investors sit up and take notice.

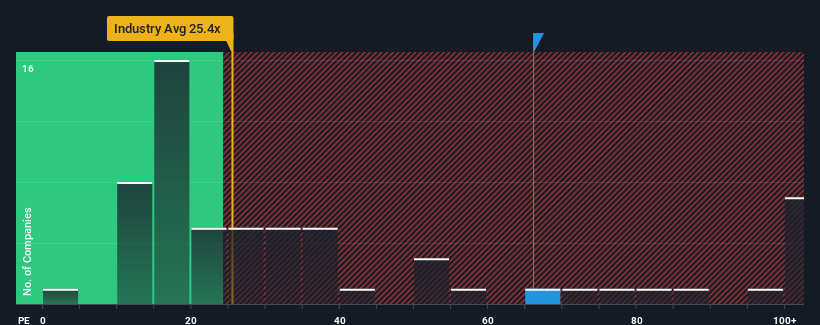

Since its price has surged higher, Chung-Hsin Electric and Machinery Manufacturing's price-to-earnings (or "P/E") ratio of 66.1x might make it look like a strong sell right now compared to the market in Taiwan, where around half of the companies have P/E ratios below 23x and even P/E's below 15x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Chung-Hsin Electric and Machinery Manufacturing has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Chung-Hsin Electric and Machinery Manufacturing

Does Growth Match The High P/E?

In order to justify its P/E ratio, Chung-Hsin Electric and Machinery Manufacturing would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 38%. The last three years don't look nice either as the company has shrunk EPS by 11% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 161% over the next year. Meanwhile, the rest of the market is forecast to only expand by 26%, which is noticeably less attractive.

With this information, we can see why Chung-Hsin Electric and Machinery Manufacturing is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Chung-Hsin Electric and Machinery Manufacturing's P/E is flying high just like its stock has during the last month. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Chung-Hsin Electric and Machinery Manufacturing's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 4 warning signs for Chung-Hsin Electric and Machinery Manufacturing that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1513

Chung-Hsin Electric and Machinery Manufacturing

Chung-Hsin Electric and Machinery Manufacturing Corp.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives