- Taiwan

- /

- Electrical

- /

- TWSE:1618

Hold-Key Electric Wire & Cable (TPE:1618) Has Compensated Shareholders With A Respectable 56% Return On Their Investment

If you buy and hold a stock for many years, you'd hope to be making a profit. Better yet, you'd like to see the share price move up more than the market average. But Hold-Key Electric Wire & Cable Co., Ltd (TPE:1618) has fallen short of that second goal, with a share price rise of 30% over five years, which is below the market return. Looking at the last year alone, the stock is up 14%.

Check out our latest analysis for Hold-Key Electric Wire & Cable

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

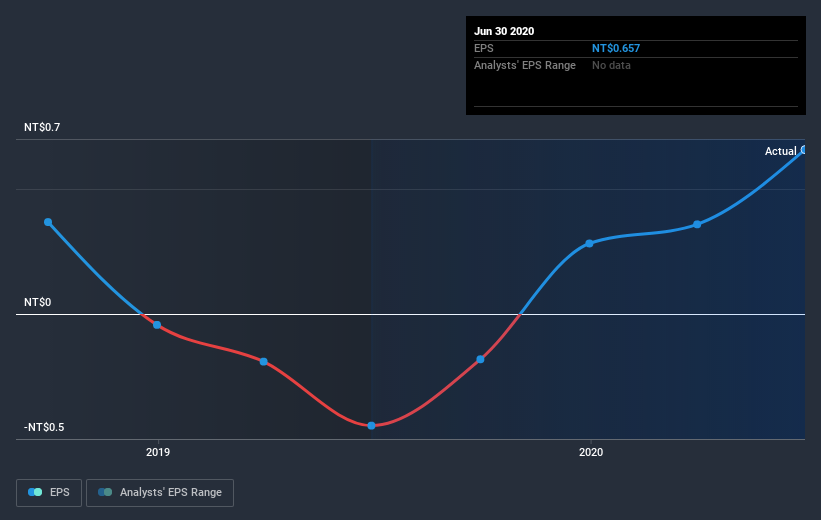

During the five years of share price growth, Hold-Key Electric Wire & Cable moved from a loss to profitability. That's generally thought to be a genuine positive, so we would expect to see an increasing share price. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. Indeed, the Hold-Key Electric Wire & Cable share price has gained 4.2% in three years. During the same period, EPS grew by 31% each year. This EPS growth is higher than the 1.4% average annual increase in the share price over the same three years. Therefore, it seems the market has moderated its expectations for growth, somewhat.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on Hold-Key Electric Wire & Cable's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Hold-Key Electric Wire & Cable's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Hold-Key Electric Wire & Cable's TSR of 56% over the last 5 years is better than the share price return.

A Different Perspective

Hold-Key Electric Wire & Cable's TSR for the year was broadly in line with the market average, at 18%. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 9%. It is possible that management foresight will bring growth well into the future, even if the share price slows down. It's always interesting to track share price performance over the longer term. But to understand Hold-Key Electric Wire & Cable better, we need to consider many other factors. Even so, be aware that Hold-Key Electric Wire & Cable is showing 1 warning sign in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade Hold-Key Electric Wire & Cable, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hold-Key Electric Wire & Cable might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:1618

Hold-Key Electric Wire & Cable

Manufactures, imports, and sells cable products in Taiwan.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives