- Taiwan

- /

- Construction

- /

- TPEX:5511

February 2025's Best Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating corporate earnings, AI competition concerns, and central bank rate decisions, investors are seeking stability in dividend stocks. These stocks can offer a reliable income stream and potential for capital appreciation, making them an attractive option amid the current economic uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.80% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.78% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.99% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.93% | ★★★★★★ |

Click here to see the full list of 1956 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

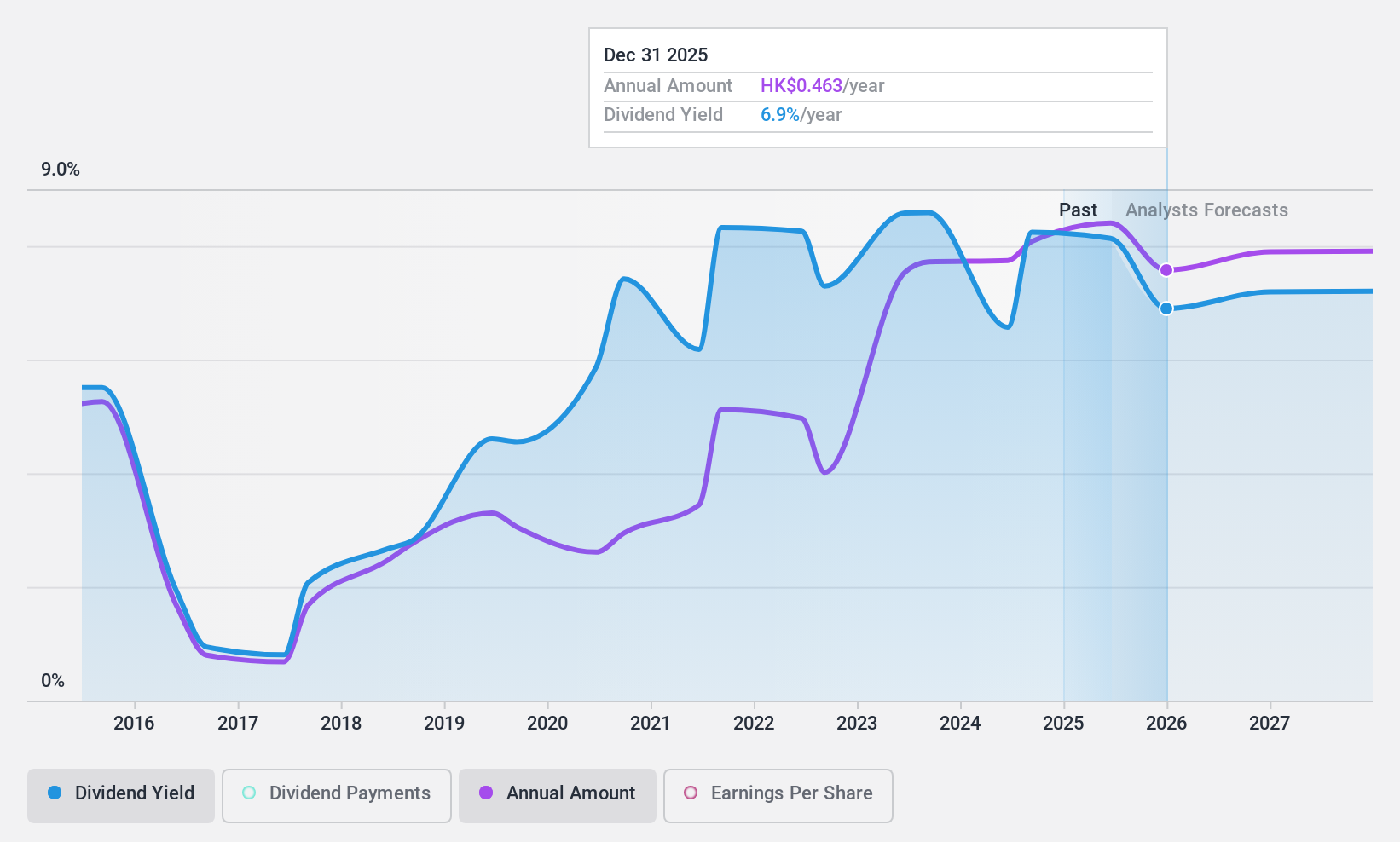

PetroChina (SEHK:857)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PetroChina Company Limited, along with its subsidiaries, is involved in various petroleum-related products, services, and activities both in Mainland China and internationally, with a market cap of approximately HK$1.54 trillion.

Operations: PetroChina's revenue segments include Marketing (CN¥2.47 billion), Natural Gas Sales (CN¥593.33 million), Oil, Gas and New Energy (CN¥923.02 million), and Refining and Chemicals and New Materials (CN¥1.24 billion).

Dividend Yield: 7.8%

PetroChina's dividend payments have been volatile over the past decade, despite being covered by earnings and cash flows with payout ratios around 51%. The company's recent renewal of a refined oil agreement may stabilize revenue, but its dividends remain unreliable. Trading at a significant discount to estimated fair value, PetroChina offers good relative value compared to peers. However, its dividend yield is slightly below top-tier levels in Hong Kong and future earnings are forecasted to decline.

- Dive into the specifics of PetroChina here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of PetroChina shares in the market.

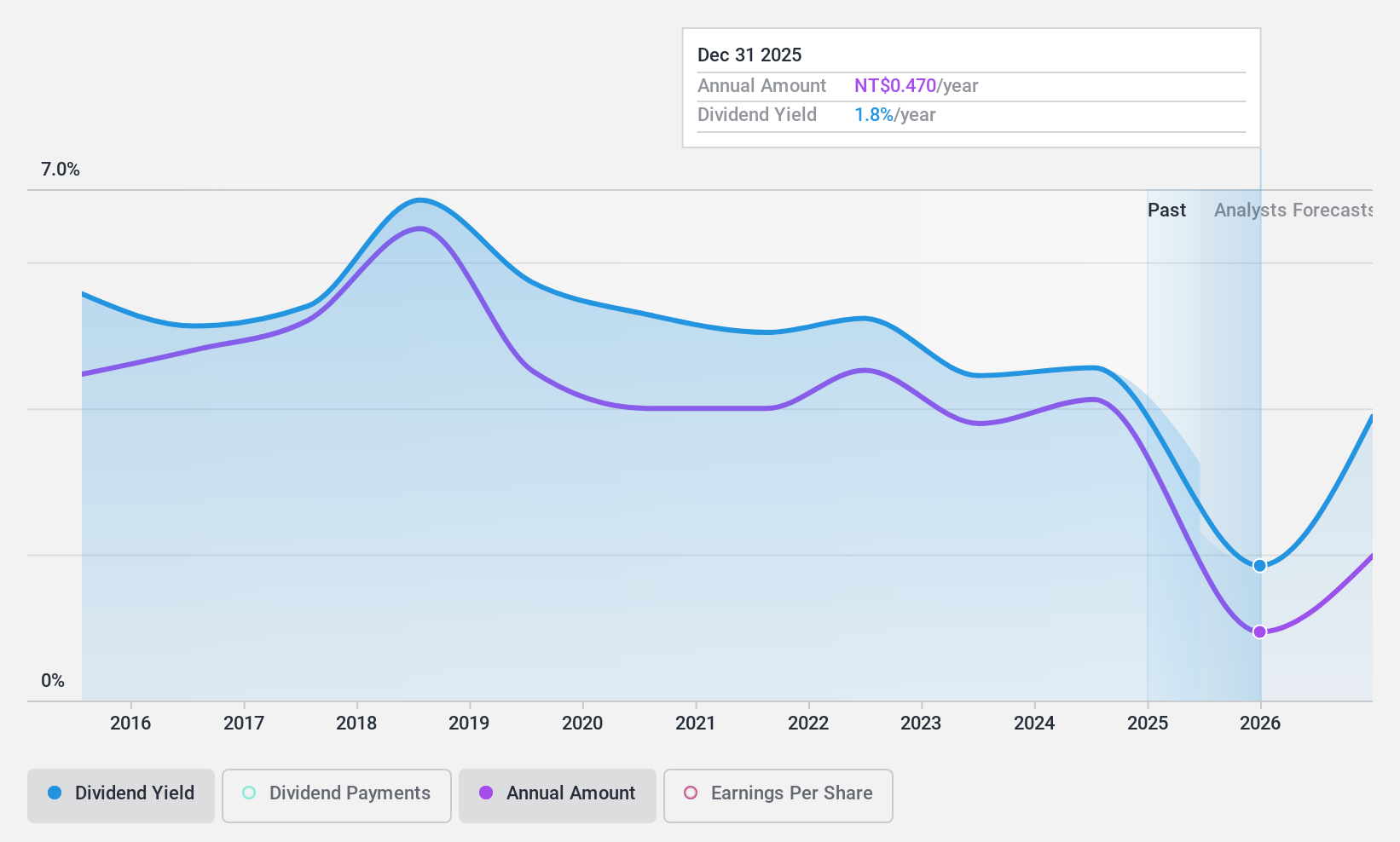

Te Chang Construction (TPEX:5511)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Te Chang Construction Co., Ltd. operates in the construction contracting and civil engineering sectors in Taiwan and Thailand, with a market cap of NT$7.02 billion.

Operations: Te Chang Construction Co., Ltd. generates revenue of NT$10.11 billion from its construction, real estate leasing, and other business activities.

Dividend Yield: 7.9%

Te Chang Construction's dividend yield of 7.91% ranks among the top 25% in Taiwan, yet it's not well covered by free cash flows, with a high cash payout ratio of 266.1%. Despite a reasonable earnings payout ratio of 65.7%, dividends have been volatile over the past decade. The recent TWD 505 million contract for STARLUX Airlines' headquarters could bolster future revenues, though sales and net income recently declined year-over-year for nine months ending September 2024.

- Take a closer look at Te Chang Construction's potential here in our dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Te Chang Construction shares in the market.

CTCI (TWSE:9933)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CTCI Corporation specializes in the design, surveying, construction, and inspection of engineering and construction plants, machinery and equipment, as well as environmental protection projects across Taiwan, the United States, and internationally with a market cap of NT$32.09 billion.

Operations: CTCI Corporation's revenue is primarily derived from its Construction Engineering Department, which contributes NT$119.09 billion, followed by the Environmental Resources Service at NT$8.65 billion, and the General Sales Department with NT$880.36 million.

Dividend Yield: 5.1%

CTCI's dividend yield of 5.12% places it in the top 25% of Taiwan's market, but the payments are not supported by free cash flows, indicating potential sustainability issues. Although dividends have been volatile over the past decade, they remain covered by earnings at an 80.3% payout ratio. The stock trades at a favorable P/E ratio of 15.9x compared to the market average, suggesting good value despite analysts' consensus on potential price appreciation.

- Click here and access our complete dividend analysis report to understand the dynamics of CTCI.

- Our comprehensive valuation report raises the possibility that CTCI is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Dive into all 1956 of the Top Dividend Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Te Chang Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5511

Te Chang Construction

Engages in the construction contracting and civil engineering business in Taiwan and Thailand.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives