Does Easy Field's (GTSM:6425) Share Price Gain of 35% Match Its Business Performance?

On average, over time, stock markets tend to rise higher. This makes investing attractive. But if you choose that path, you're going to buy some stocks that fall short of the market. Unfortunately for shareholders, while the Easy Field Corporation (GTSM:6425) share price is up 35% in the last year, that falls short of the market return. Zooming out, the stock is actually down 27% in the last three years.

See our latest analysis for Easy Field

Easy Field isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Easy Field saw its revenue shrink by 30%. Given the revenue reduction the modest 35% share price rise over the year seems pretty decent. Generally we're pretty unenthusiastic about loss making stocks that are not growing revenue.

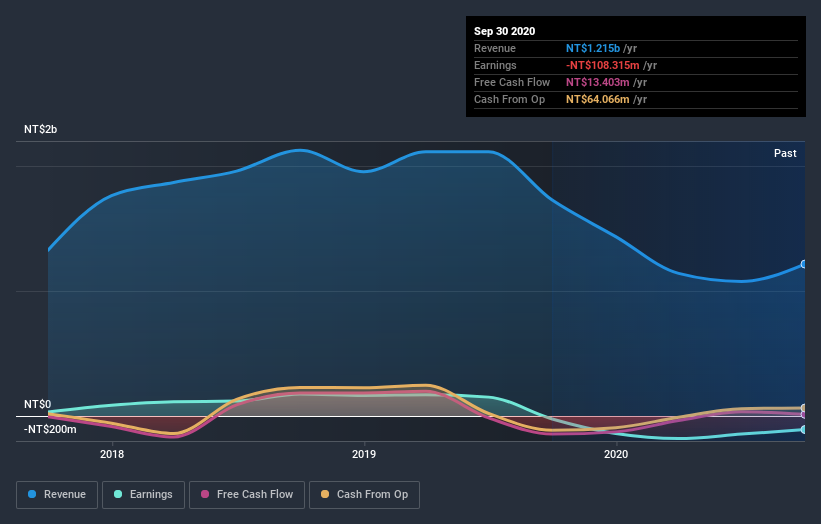

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Easy Field's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered Easy Field's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Easy Field's TSR of 38% for the year exceeded its share price return, because it has paid dividends.

A Different Perspective

Easy Field shareholders are up 38% for the year. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 2% over half a decade This could indicate that the company is winning over new investors, as it pursues its strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Easy Field has 4 warning signs (and 2 which are a bit unpleasant) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade Easy Field, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Easy Field might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6425

Easy Field

Researches, develops, manufactures, and sells machinery and equipment in Taiwan.

Mediocre balance sheet with minimal risk.

Market Insights

Community Narratives